Increased Bitcoin whale accumulation could have this impact on BTC in Q1 2023

- BTC whales intensified accumulation in the last eight weeks.

- Open Interest and Funding Rates revealed that investors harbored bullish sentiments.

Increased whale activity since the commencement of the new trading year has led to a 26% growth in the price of Bitcoin [BTC], as per a 14 January tweet from Santiment.

? Amongst many of the foreshadowing metrics for this 2023 breakout was the rapidly growing amount of addresses holding 100 to 1,000 $BTC. Price pumps generally occur marketwide when whales accumulate #Bitcoin. The #1 asset in #crypto is +26% in two weeks. https://t.co/JMh83m3mIu pic.twitter.com/FiRTLIc3LB

— Santiment (@santimentfeed) January 14, 2023

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin whales show their strength

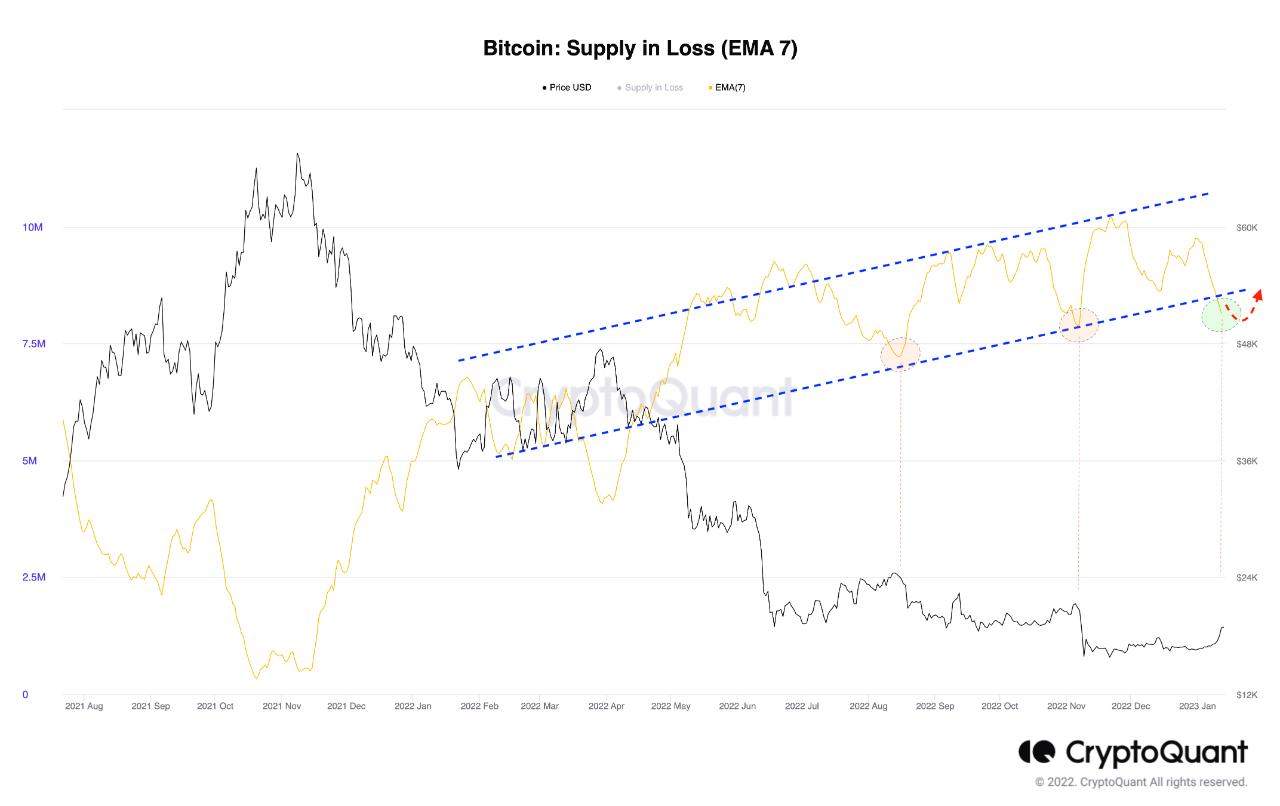

According to the on-chain data provider, the count of BTC whales holding 100 – 1,000 BTCs rallied by over 3% in the last two months. At press time, the count of this cohort stood at 14,110 whale addresses.

When whales intensified the accumulation of a crypto asset, it often created a positive sentiment among other investors. This leads to an increase in demand for the asset, which can, in turn, drive up its prices.

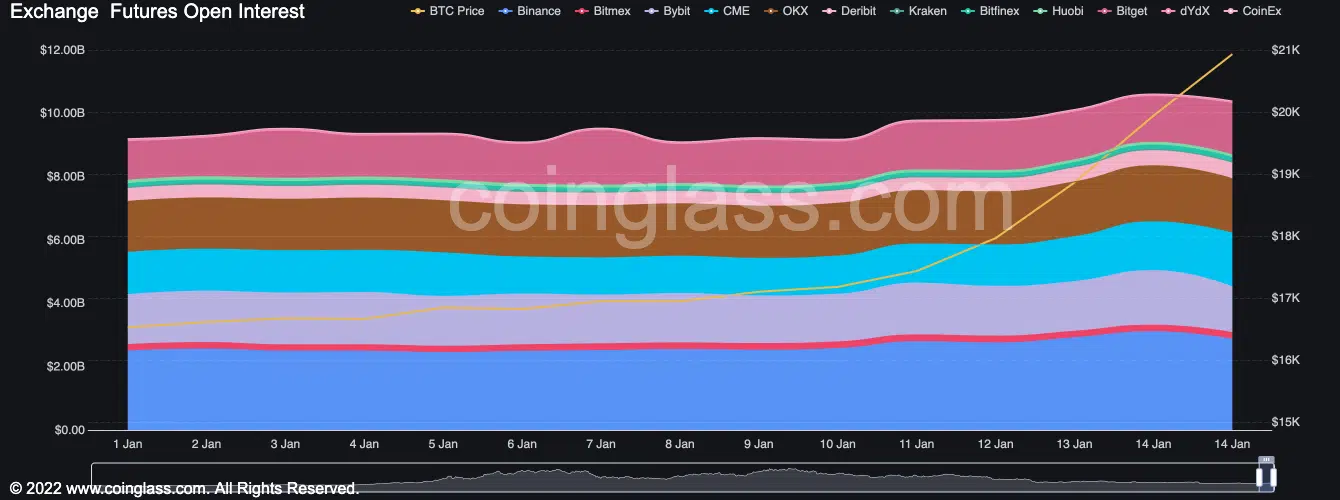

Further, BTC’s Open Interest has been rallying since the year started. Per data from Coinglass, the king coin’s Open Interest has grown by 13% since 1 January 2023.

Open interest refers to the number of outstanding contracts, or positions, that have not yet been settled. An increase in open interest suggested that more traders and investors were entering trading positions on the asset. This is often regarded as a sign of increased demand for the asset, which precedes a price rally.

Source: Coinglass

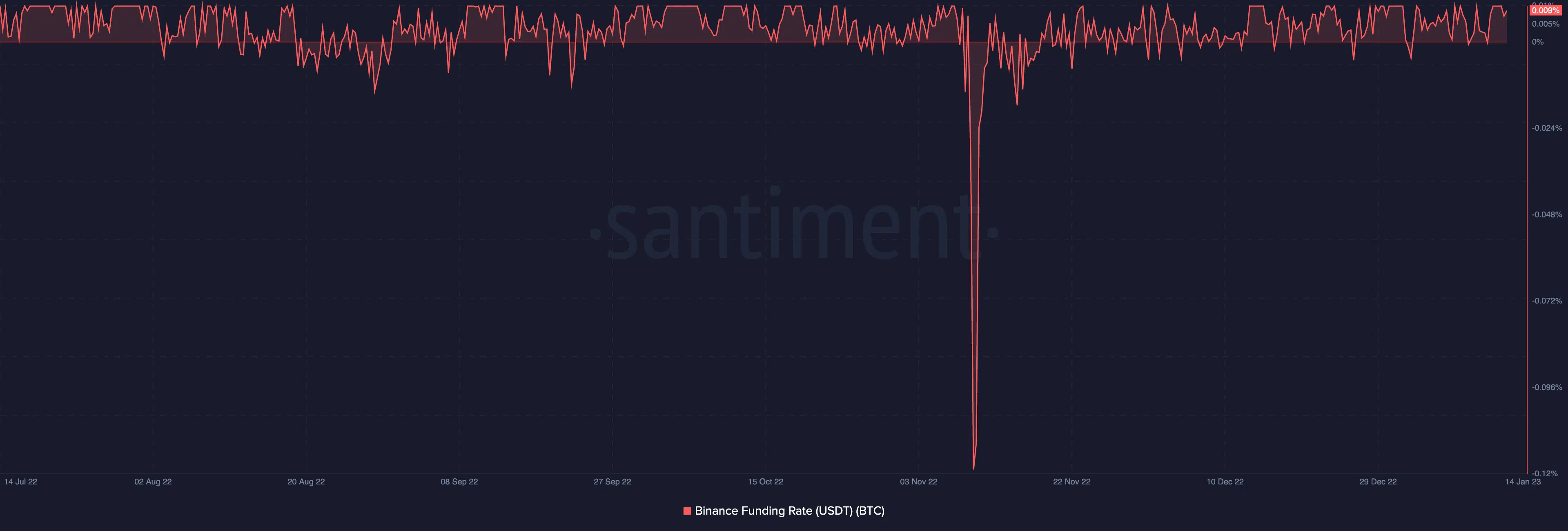

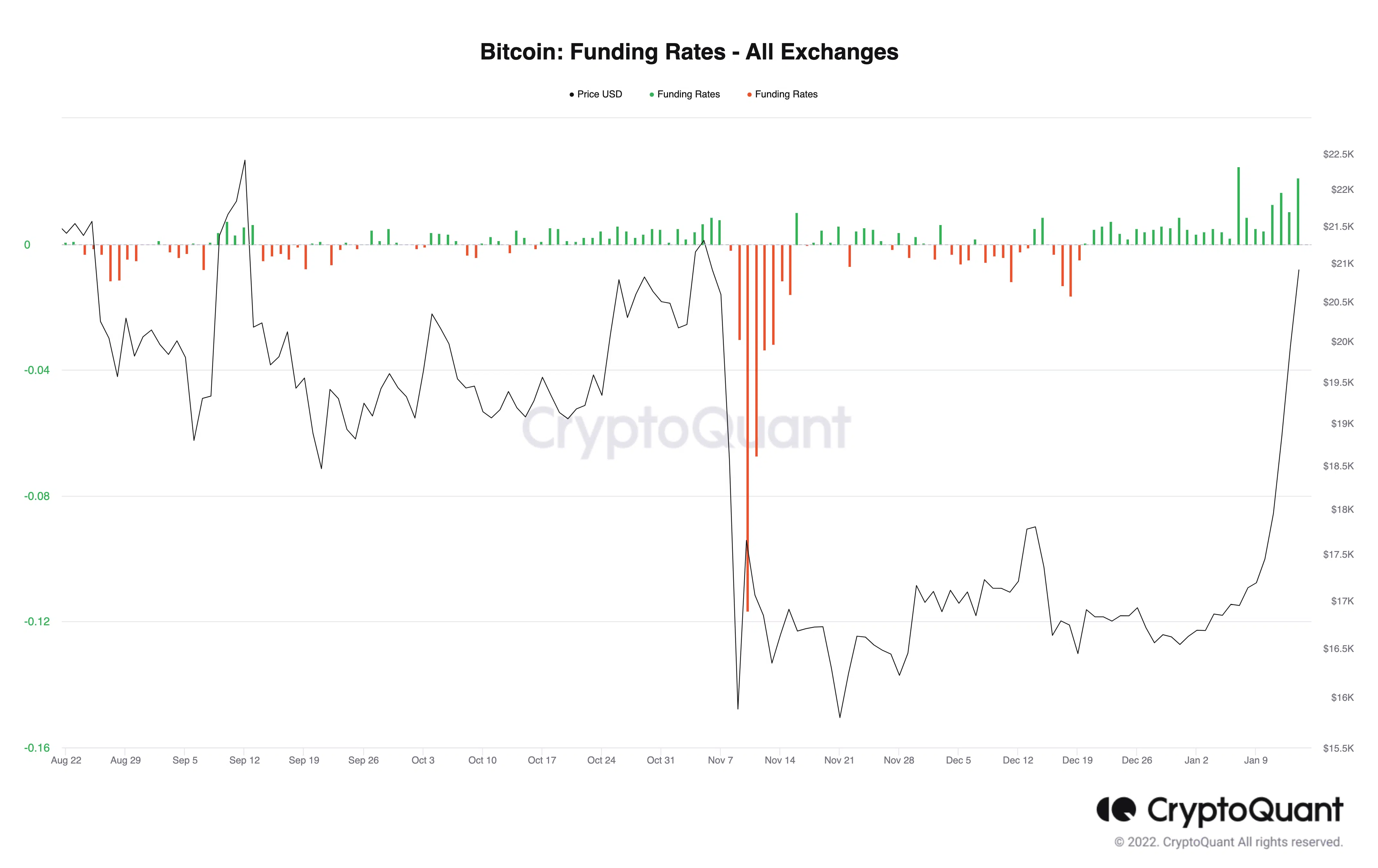

Likewise, funding rates on the BTC network since 2023 have been positive, data from CryptoQuant showed.

Source: CryptoQuant

For example, despite the FTX debacle in November 2022 and the consequential decline in BTC’s value, traders were undeterred and continued to take long positions.

Keep this at the back of your mind

CryptoQuant analyst Inspocrypto found that BTC logged the highest spot inflow on 13 January, which showed that holders of 1000 to 10,000 BTC had resumed sending their holdings to exchanges.

Realistic or not, here’s BTC market cap in ETH’s terms

While the increase in an asset’s exchange inflow is often regarded as a bearish sign, it could also mean that the asset is becoming more liquid and easier to trade, which can be positive for the market.

On where BTC’s price might go next, Inspocrypto opined,

“For bulls, the range between 19k – 19.2k is key. If they break that range and maintain above, we can go further, heading 23k – 24k. Otherwise, we will retest 15.6k and trade lower levels below 15k.”

Further, on what BTC holders should expect, another CryptoQuant analyst, TariqDabil, while assessing BTC’s Adjusted Spent Output Profit Ratio (aSOPR) said,

“To be sure about the price movement ahead of us, we should see a retest to the aSOPR rising trend, then a (fall down) and transition to a downtrend….”