India’s central bank shares concept note on CBDC; will begin pilot soon

India’s central bank, the Reserve Bank of India (RBI), has released a concept note on the country’s proposed central bank digital currency (CBDC).

The concept note discussed key issues such as technology and design choices, possible uses of Digital Rupee (e₹), and issuance mechanisms, among other things. The RBI will soon begin work on the pilot project.

The note has been prepared by the Fintech Department, a department created by the RBI to devise a CBDC and formulate regulations related to cryptocurrencies.

The note also informed that the body aims to work step by step for different stages of pilots before the digital currency is finally launched. It also underlined the need to identify “innovative methods and compelling use cases that will make CBDC as attractive as cash if not more.”

Proposed design structures

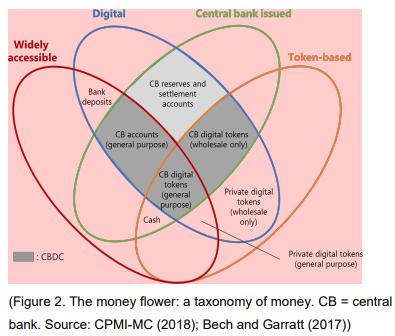

A CBDC, as a sovereign currency, holds unique advantages of central bank money viz. trust, safety, liquidity, settlement finality and integrity. Simply put, a CBDC is not a cryptocurrency in the strictest sense.

The note also discussed a number of motivations behind the idea of CBDC in India such as reduction in operational costs involved in physical cash management and fostering financial inclusion. The move is also aimed at bringing resilience, efficiency, and innovation to the existing payments system. In addition, it is also expected to boost innovation in the cross-border payments space.

Most importantly, the note claimed that the CBDC would offer the same services as any private virtual currencies, without the associated risks.

Here, it’s worth pointing out that the note was critical of the design of cryptocurrencies as being more geared to bypass the established and regulated intermediation and control arrangements. It is for this reason that the RBI is planning to introduce a CBDC that will be similar to any private cryptocurrency, minus the risks.

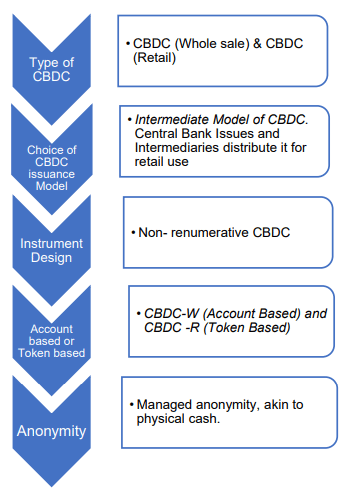

There will be two types of CBDCs in India – Retail (CBDC-R) and Wholesale (CBDC-W). While the former will cater to the private sector, non-financial consumers and businesses, the latter will cater to select financial institutions.

The RBI is considering both token-based and account-based structures for its CBDC.

A centralized response to cryptocurrencies

Regarding the anonymous nature of cryptocurrency, the note mentioned that it remains a challenge as all digital transactions would leave some trail. However, it would remain a key design decision for the project.

Finally, it also underlined the need to create CBDCs that conform to Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) requirements.

RBI’s aversion to the presence of a ‘private’ cryptocurrency in the Indian economy is well known. Like most countries, it also arrived at the conclusion that there is a need to create a CBDC. However, its opposition to ‘private’ cryptocurrencies still remains, as is evident by its frequent calls to ban the asset class.