Investing beyond Bitcoin: Which alts are ‘very important’ for high returns?

Ever since altcoins started gaining traction, they’ve been compared to the market’s leader – Bitcoin. With market dynamics altering at a noteworthy pace, the Bitcoin v. altcoins debate will, perhaps, never come to a conclusion.

Pantera Capital’s CEO Dan Morehead, in a recent interview with Bloomberg, revealed that he is looking beyond BTC for big returns from the crypto-market. He said,

“A really important way to think about it is if you’re just long Bitcoin, it’s kinda like in the 90s just being long Yahoo. There were 30 other really important companies to invest in in the 90s, and the same here. There are a lot of different products to be invested in.”

Altcoins like Ethereum and Polkadot have evidently out-performed Bitcoin in the recent past. In fact, at the time of writing, according to Messari’s data, BTC’s YTD returns stood at merely 12.64% while the same for ETH and DOT was 164.25% and 88.09%, respectively.

Source: Twitter

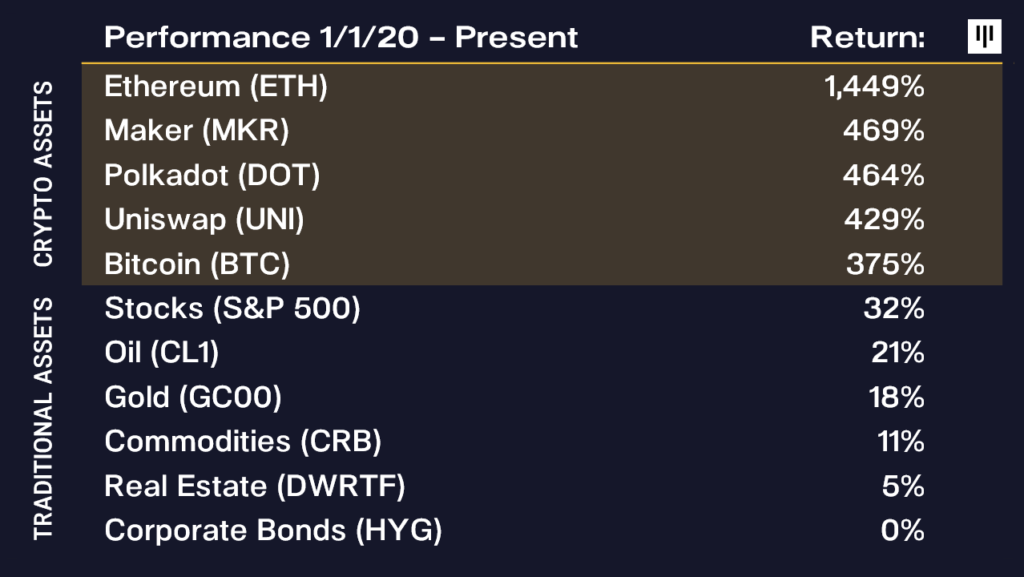

Even when zoomed out, Ethereum and Polkadot have fairly been able to outperform the market’s king coin over the past year. At press time, ETH and DOT boasted returns of 1449% and 464%, respectively, while the same for BTC stood at 375%. Despite recording diminishing returns, however, it should be noted that Bitcoin fared considerably well when compared to the traditional asset class.

Highlighting the same, Morehead said,

“Cryptocurrencies are still out-performing other asset classes by an order of magnitude (or two) throughout this period of unprecedented fiscal and monetary expansion.”

In the interview, the exec further asserted that Pantera’s hedge fund, which typically trades liquid tokens, is up by 240% this year, a figure far greater than what BTC solitarily fetched it.

Apart from Bitcoin holdings, Morehead also revealed that his asset management company remains invested in Ethereum and Polkadot. He added,

“So obviously, Ethereum is the second biggest. It is very important… We’re big investors in Polkadot, which is kind of a newer version for Ethereum.”

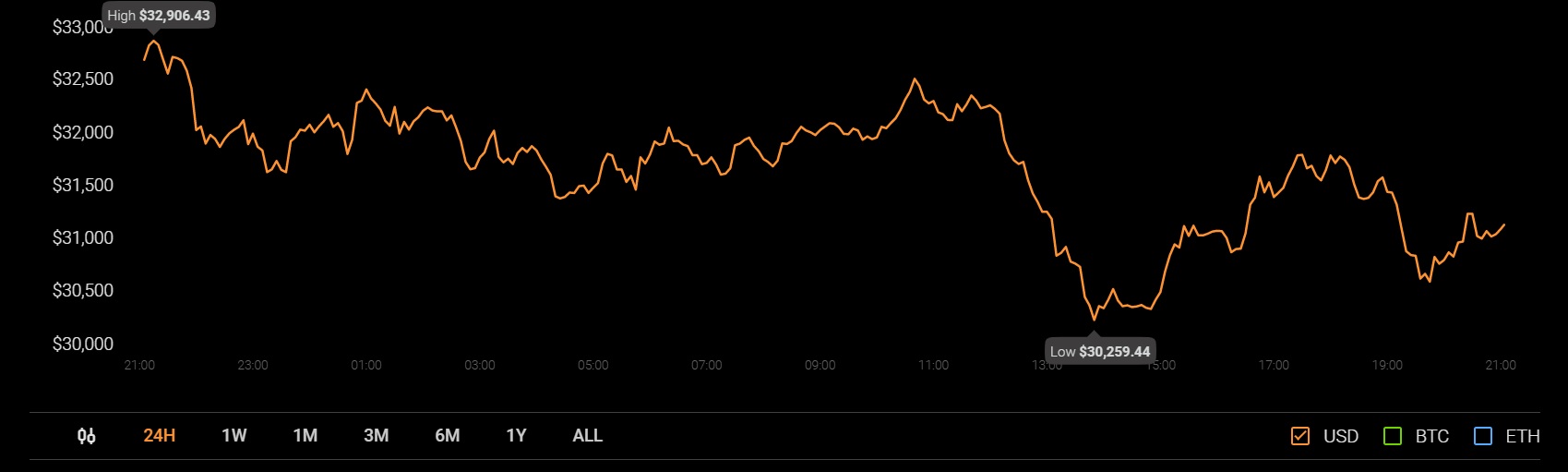

However, at the time of writing, Bitcoin’s social volume (1173) quite evidently managed to outnumber Ethereum (474) and Polkadot (43) by a huge degree. Ultimately, BTC is here to stay, with the exec also asserting that the ongoing correction phase is the “best time” to buy the largest crypto because of its relative cheapness.

What’s more, Morehead also stated that BTC’s price would be 213% high within a year’s time and by 2031, the largest crypto would constitute 20% of the global purchasing power. That essentially implies that Bitcoin’s market cap would be about $250 trillion and would be trading above $12.5 million dollars per BTC by 2031.

Source: Coinstats