Investing in Ethereum should be correlated with positions in BNB, LINK, LTC; Why?

Crypto-market corrections can be nasty and Ethereum suffered one of its worst drawdowns over the past couple of weeks. While the market decline was collective, the sentiment noted by Bitcoin and Ethereum was poles apart. The community’s beloved Bitcoin was identified as an opportunity, while ETH’s social sentiment touched a new low.

According to Santiment, Ethereum seemed to be losing steam with respect to market optimism on Social weighted charts. However, historically, these positions have been considered opportunities for ETH as well. When identifying other fundamentals, a certain degree of validation can be attached to the aforementioned statement as well.

Derivatives played a role in corrections, time for role-reversal?

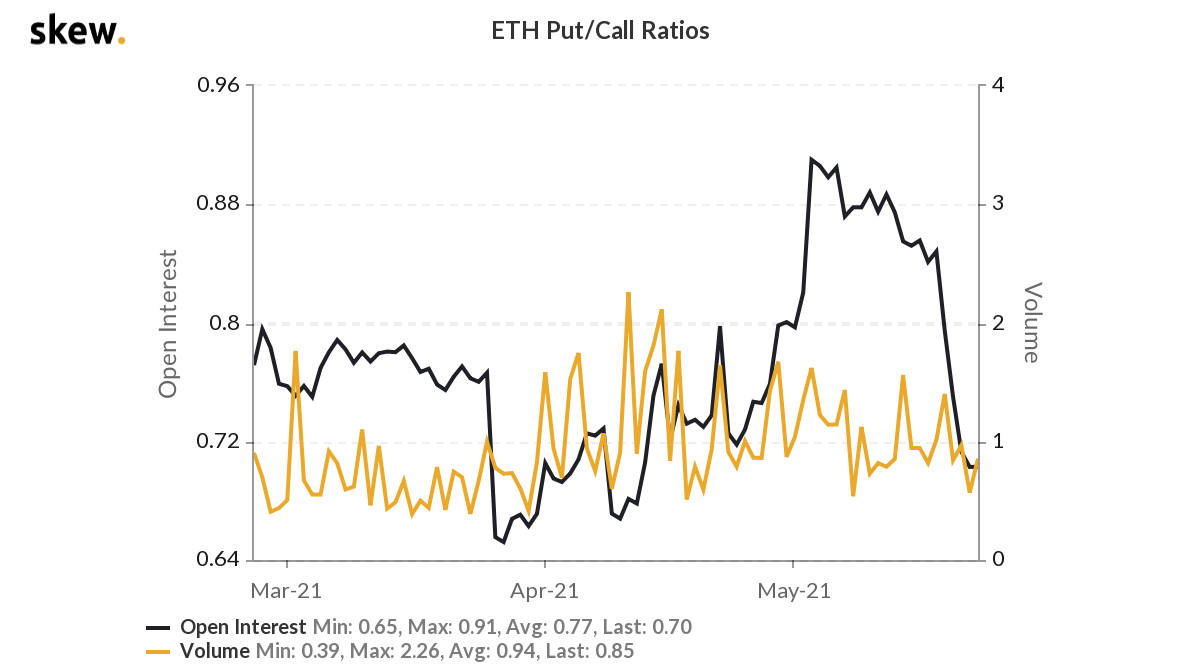

An overleveraged market dragged down ETH’s value. At press time, however, data from Skew seemed to point to a recovery by the same derivatives traders. According to statistics, the May 21st contract expiries have registered a reset, and Open Interest is now expected to move upwards.

One interesting development can be observed with the ETH Put/Call Ratios. At press time, a reset had taken place, one where call-buys had taken precedence over put-sells. It indicated that traders are now expecting a recovery over the coming weeks. A similar reset was observed back towards the end of April, one which led to ETH climbing to its ATH of $4,375.

On a larger scale, selling pressure was minute

What’s more, Ethereum’s selling pressure over the past week seemed to be significant on a larger scale. According to the chart above, exchange inflows for Ethereum remain relatively low. Hence, it can be inferred that only a minor group of people may have sold during the corrections. Additionally, the amount of ETH staked on ETH 2.0 continuous to rise, hence, panic selling in the short-term hasn’t really affected that sentiment.

Will Ethereum push the rally for these altcoins?

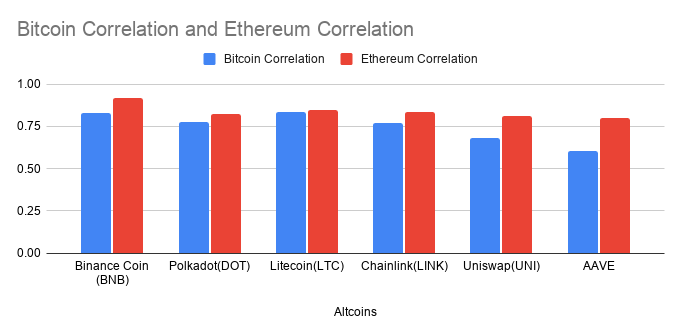

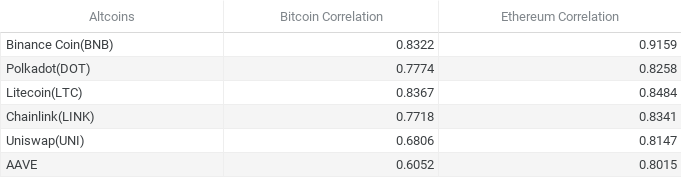

While Bitcoin does facilitate some control over each asset in the space, correlation charts suggest that Ethereum has a greater pull on the following assets.

The illustrations above highlight that some assets seem to exhibit a higher correlation with Ethereum, than with Bitcoin. The highest correlation can be seen with Binance Coin, but there is a conflict of interest. Ethereum has seen a rise in competition from Binance Smart Chain over the past few weeks as many projects are moving their tokens to the BSC to facilitate lower gas fees.

However, according to data, the users tend to keep their assets on the ETH blockchain, since it is considered more decentralized. Ethereum also has the advantage of 77,800 active validators, whereas BSC has a measly 21 validators.

The case for other assets can be drawn from a perspective of implementation. AAVE is a DeFi lending protocol, one that is primarily based on Ethereum. Uniswap is a rising Decentralized Exchange, operating from ETH blockchain, and Chainlink is primarily an ERC-20 token.

However, Litecoin is a strange inclusion, especially considering it is the silver counterpart of Bitcoin. However, in a recent article, we explained how Litecoin has been following ETH more than BTC since mid-2020, so the trend can be expected to continue. And yet, it is important to note here that the correlation between BTC-LTC and ETH-LTC is only divided by a fine margin.