Investor sentiment dips as Bitcoin products witness first outflows in a month

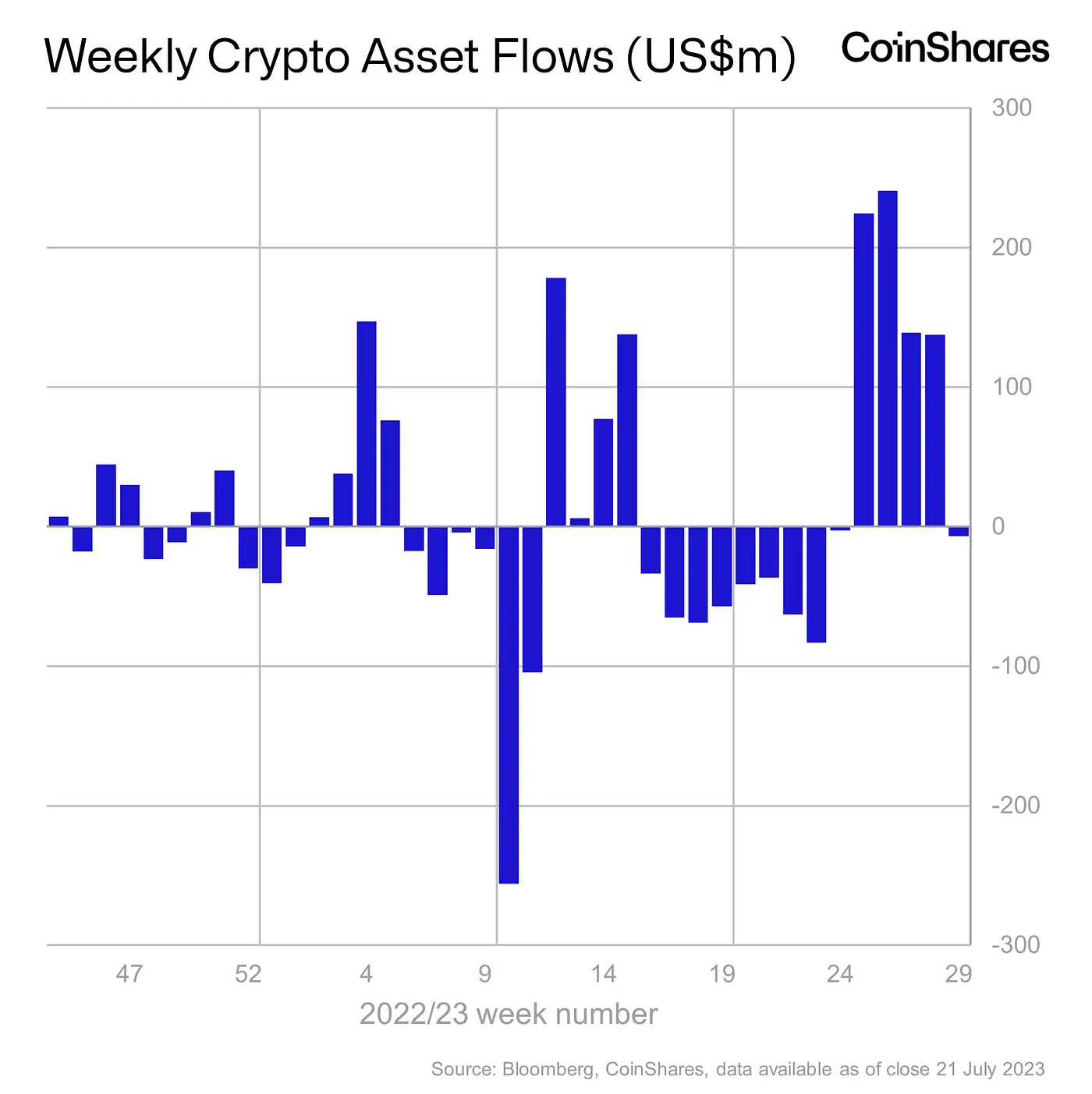

- For the first time in the last four weeks, investment products suffered outflows.

- Investors shied away from Bitcoin, with altcoins pulling all the inflows.

For the first time in the last month, digital asset investment products experienced outflows that totaled $6.5 million, ending four weeks of cumulative $742 million inflows, CoinShares found in a new report.

According to the digital assets investment firm, last week trading volumes of $1.2 billion for investment products were lower than the average weekly volume for the year. This represented a 39% decline from the previous week’s volume of $2.4 billion.

The outflows recorded last week and the accompanying decrease in trading volumes signaled a negative shift in investor behavior and sentiment toward this asset class. The drop in trading volumes specifically indicated a temporary slowdown in market activity or a cautious approach from investors due to various factors that may influence the market dynamics.

Bitcoin: A tale of how the mighty coin fell

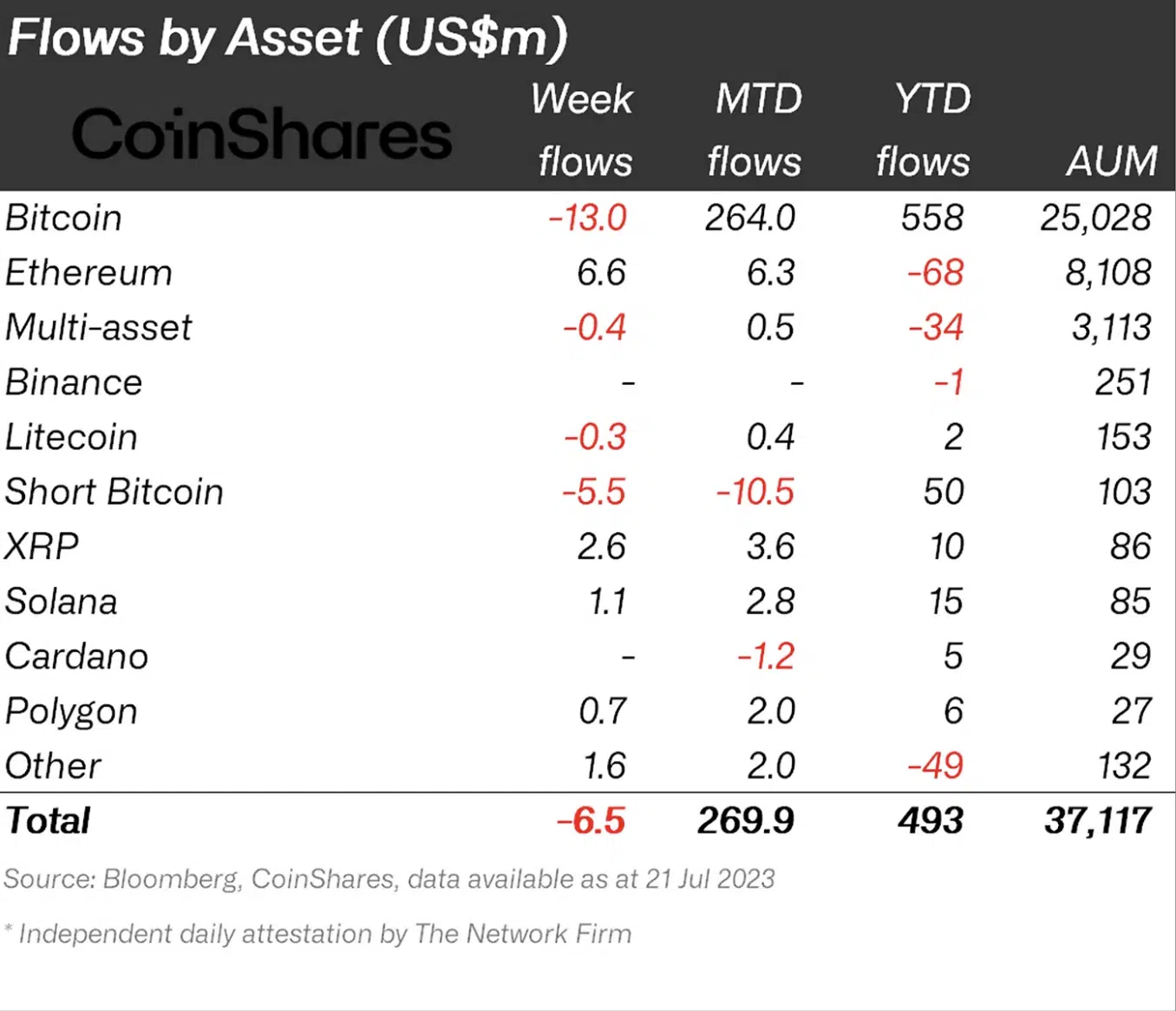

After several weeks of being investors’ most preferred investment asset, Bitcoin [BTC] suffered outflows that totaled $13 million last week.

Last week’s BTC outflows beset the market following several weeks of inflows due to investors’ positive sentiments caused by the influx of exchange-traded fund (ETF) applications in June.

BlackRock applied for a coveted spot in the BTC exchange-traded fund (ETF) on 15 June. This action triggered a flurry of competitors to follow suit and renew their own ETF applications.

Consequently, investors responded enthusiastically, leading to a rapid flow of funds into BTC-focused investment funds throughout the following month. Notably, this surge in investments marked the fastest pace seen since October 2021.

Not faring any better, Short-Bitcoin investment products recorded their 13th week of consecutive outflows. According to CoinShares:

“Short bitcoin total assets under management (AuM) at its peak represented 1.3% of total bitcoin investment products. This has now fallen to just 0.4%, the lowest level since June 2022.”

Altcoins are last week’s winners

Negative investors’ sentiments have mostly trailed leading altcoin Ethereum [ETH], since the year began. However, while BTC and Short-BTC suffered liquidity exit:

“Ethereum topped the leaderboard last week, seeing US$6.6m inflows, suggesting sentiment, which has been poor this year, is slowly beginning to turn around,” CoinShares found.

Further, Ripple’s “controversial” token XRP recorded inflows of $2.6 million, bringing its 11 weeks of inflows to $6.8 million or 8% of all assets under management inflows. According to the report, “this implies investors are increasingly confident in the outlook for XRP.”

Other alts, including Solana [SOL], Uniswap [UNI], and Polygon [MATIC], registered minor inflows of $1.1 million, $700,000, and $700,000, respectively.