Is Arbitrum’s token unlock a ‘sell the news’ event?

- An algorithmic trading firm bought 17.08 million ARB tokens.

- The sentiment around the market indicated that the unlock might not trigger a price crash.

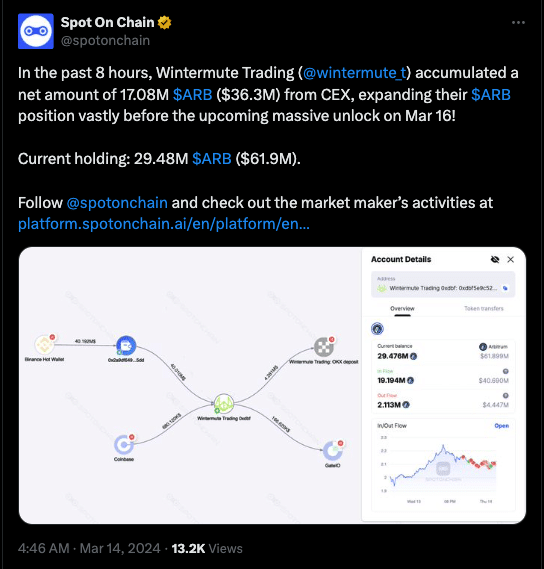

Market maker Wintermute Trading has added an incredible $36.3 million worth of Arbitrum [ARB] tokens. This happened ahead of the token unlock scheduled for the 16th of March.

AMBCrypto, through data from Spot On Chain, observed that this was not the first of tokens the market purchased. At press time, the recent buy meant that Wintermute Trading now holds a total number of 29.48 million ARB.

Freedom may not be bad for ARB

Token unlocks refers to the release of previously-locked tokens into circulation. This mechanism implies increased supply. Therefore, if demand does not match the circulating supply, the price of the cryptocurrency involved might decline.

Arbitrum’s token unlock is one of the biggest this year. On the scheduled date, the Ethereum [ETH] Layer 2 project plans to release 1.45 billion tokens. This represent 15.7% of its total supply, and valued at $2.93 billion.

Should we go by the market maker’s sentiment, then Arbitrum’s token unlock might not cause a price collapse. If it does, then the potential decline might not last long as there is conviction that it would rebound.

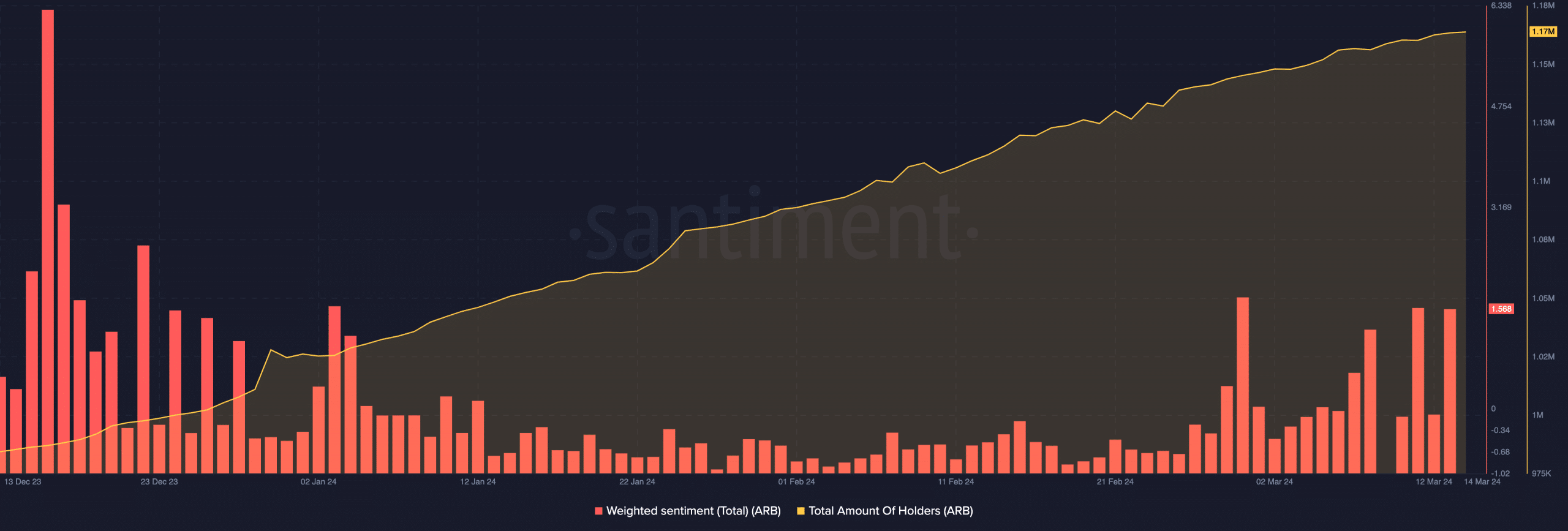

As of this writing, ARB’s price was $2.01. This value represents a 6.50% decrease over the last 24 hours. Despite the recent drawdown, the sentiment around the project has changed. Previously, the Weighted Sentiment of ARB was negative.

But by the 13th of March, the reading had risen into negative territory. Weighted Sentiment tracks the positive/negative commentary about the Arbitrum project. Therefore, the press time reading of the metric suggest that discussion around ARB was bullish.

As such, it is possible for traders to place big bets on long positions. Apart from the broader market sentiment, AMBCrypto spotted a significant change in the number of ARB holders.

Up only after the event?

Three months ago, the number of holders was 985,000. But at the time of writing, the number has increased to 1.17 million. A surge like this implied that buyers are confident in the long-term potential of the token.

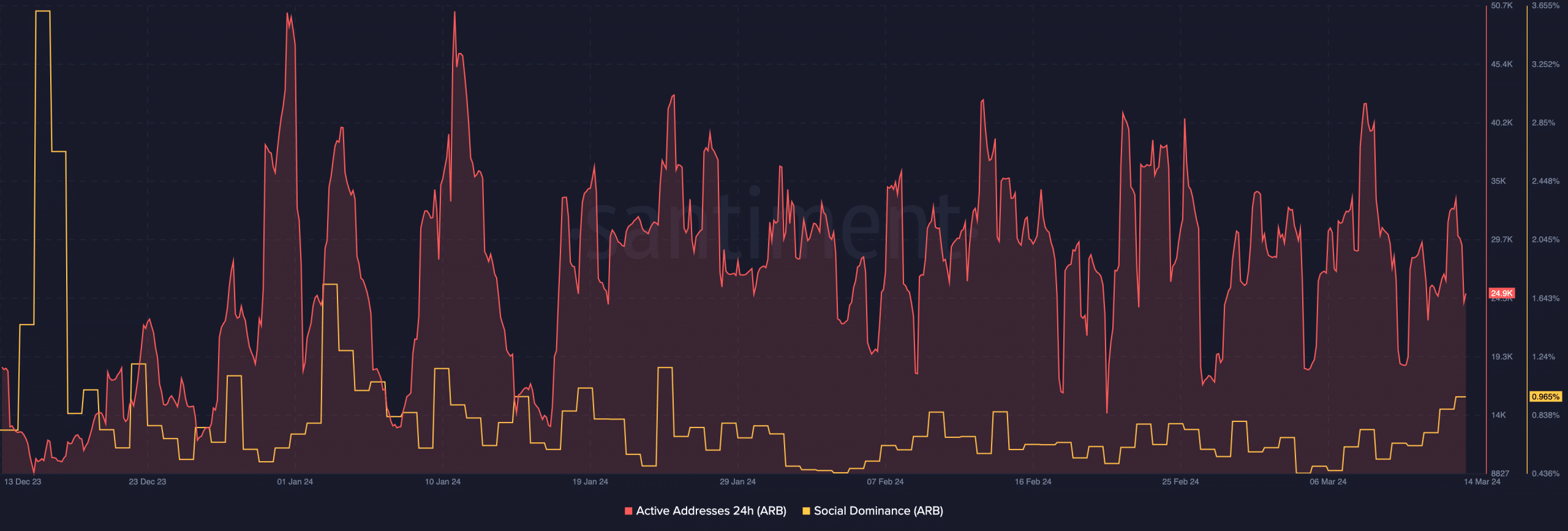

On the social end of the market, on-chain data showed that Arbitrum’s dominance has been increasing. When compared with other assets in the market, the rise in social dominance means that discussions about the project has increased.

Though an exponential increase in social dominance could spell a local top, Arbitrum’s case was different as it was not unusually high. Thus, the token might have a good upside potential post-token unlock.

How much are 1,10,100 ARBs worth today?

In the meantime, active addresses on the network had decreased. At 24,900, the active addresses indicated that speculation around ARB had reduced. If speculation decreases, then the chances of selling has also fallen.

However, this does not mean that ARB’s price might not drop below $2 toward the unlock. While it can, metrics agree that a rally could be in the works after the supply increases.

![Solana's [SOL] high fee generation figures are misleading - Here's why!](https://ambcrypto.com/wp-content/uploads/2025/05/B6ACB721-6173-4255-91A4-FEE8D9DE21D1-400x240.webp)