Will AVAX crash further? What these metrics tell you…

- Smart contracts deployed on the Avalanche network declined significantly over the last few weeks.

- Activity and DEX volumes on the network also fell, however, TVL remained high.

Avalanche [AVAX] has been moving sideways over the last few weeks and hasn’t responded much to market volatility. However, despite the AVAX token not succumbing to any volatility, the Avalanche network has faced some challenges.

Problems for Avalanche

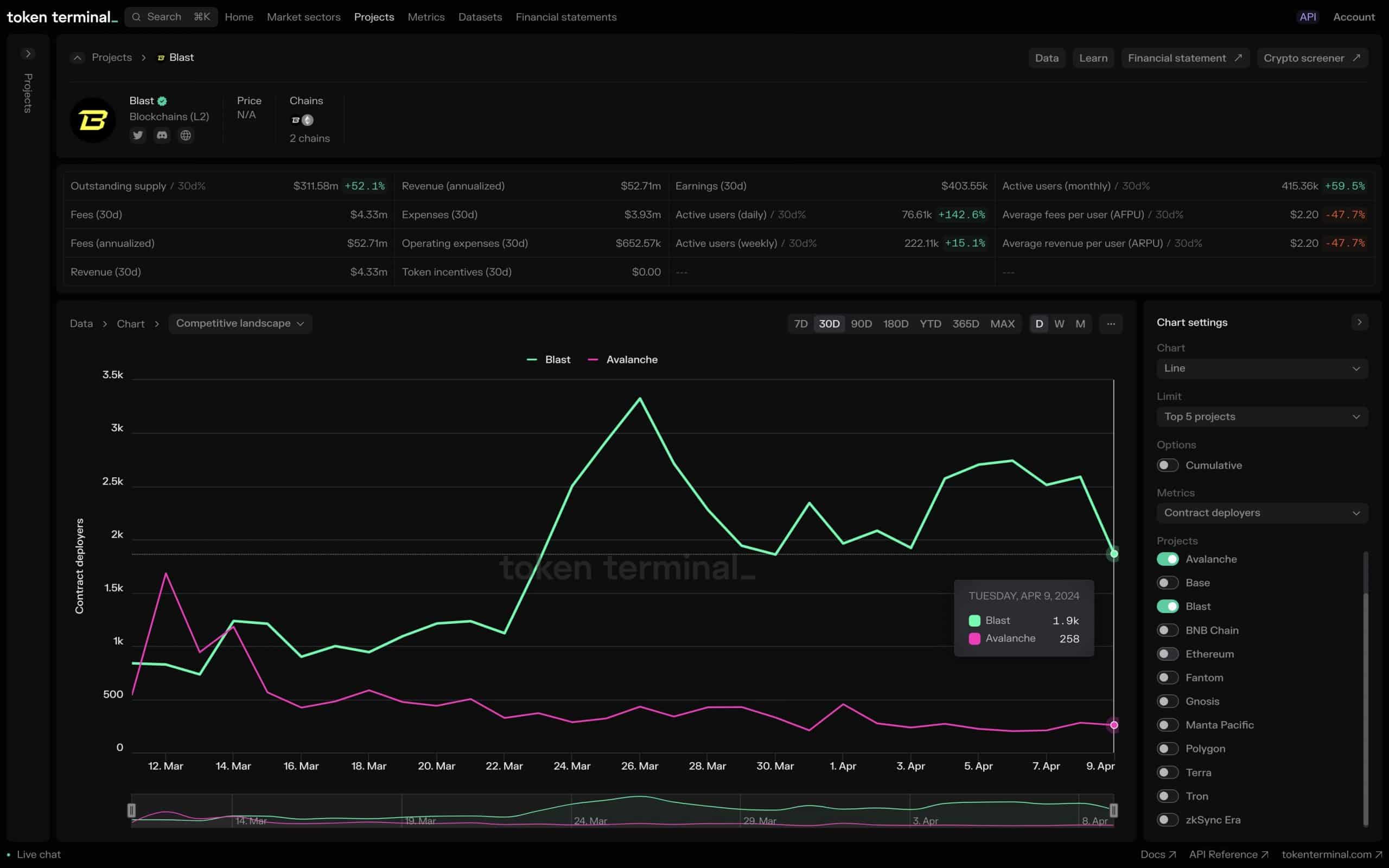

According to recent data from token terminal, the number of smart contracts deployers on the Avalanche network has declined significantly. This could be a sign of a slowdown in innovation.

Fewer new projects could mean Avalanche struggles to keep pace with the breakneck speed of the blockchain industry. Furthermore, the decline might be symptomatic of underlying issues.

Perhaps developers are not invested in the Avalanche ecosystem or lack the necessary support. Whatever the cause, this trend could erode developer confidence, a crucial element for any blockchain platform’s success.

Unless Avalanche addresses these potential issues, it risks losing its momentum and falling behind the competition.

Looking at the DeFi space

Coming to the DeFi sector, it was seen that the total value of crypto assets deposited in on the Avalanche network had grown, signifying user investment, other metrics painted a concerning picture.

There was a decline in network activity, evident from both the number of transactions and the volume traded on Avalanche’s Decentralized Exchanges (DEXes). This suggested a slowdown in user adoption and overall network usage.

This inconsistency between rising TVL and declining activity is particularly troubling. It raises concerns about the sustainability of the current TVL growth.

If the increase in TVL isn’t accompanied by a corresponding rise in new users and network activity, it might simply reflect existing users locking in more value. This could lead to a stagnant ecosystem with limited growth potential.

Furthermore, the decline in DEX volume specifically indicated a potential drop in trading activity, a core function of any blockchain platform.

Realistic or not, here’s AVAX market cap in BTC’s terms

This could discourage new users from entering the Avalanche ecosystem, further hindering its growth and adoption.

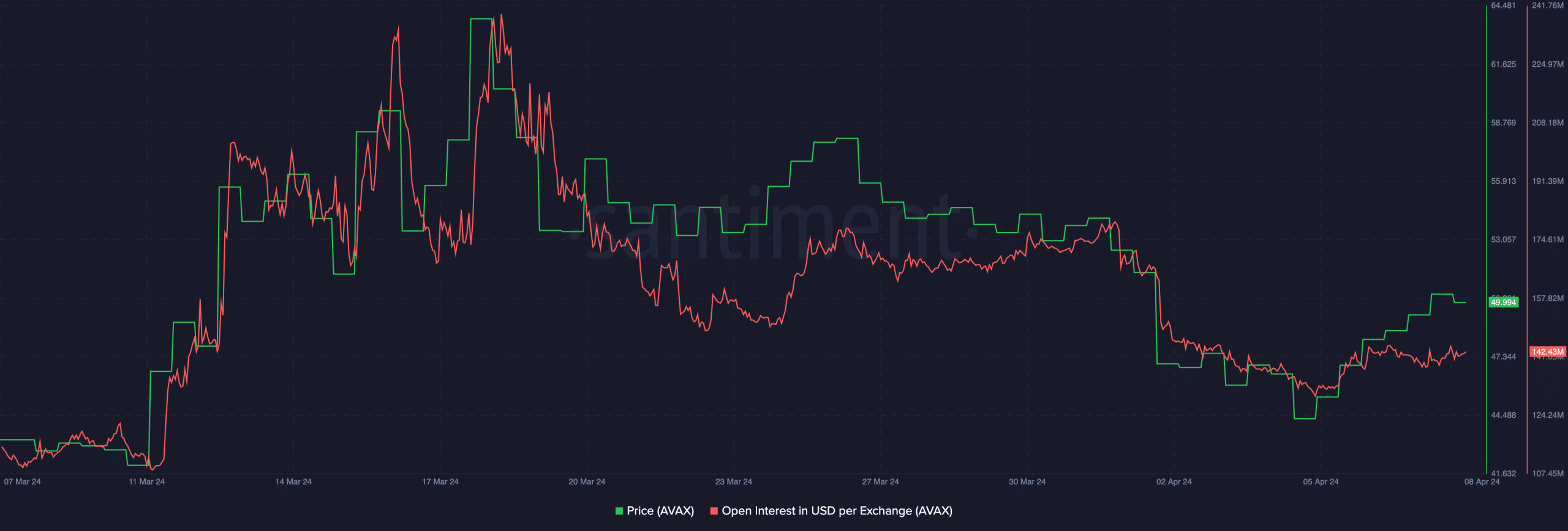

At press time, AVAX was trading at $46.73 and its price had fallen by 0.81% in the last 24 hours. Along with that, the Open Interest in AVAX had also declined suggesting that traders were losing interest in the token.