Is Bitcoin the driving force behind Aave’s gains in October

- AAVE’s ratio of daily transaction volume in profit to loss climbs to its highest level since May.

- The token’s supply on exchanges has increased in the past few days due to the uptick in profit-taking activity.

Due to its statistically significant positive correlation with Bitcoin [BTC], the ratio of AAVE’s daily transaction volume in profit to loss rallied to its highest level in six months during the intraday trading session on 2 October, data from Santiment showed.

The surge in the volume of AAVE transactions in profit came after BTC’s price broke the key resistance of $27,800 to exchange hands briefly above the $28,000 price mark.

Is your portfolio green? Check out the AAVE Profit Calculator

AAVE also experienced a brief price growth within this period, data from CoinMarketCap showed. On 2 October, the altcoin logged an intraday price rally of over 15%.

However, AAVE’s price peaked at $72.13 and initiated a decline. At $69.46 at press time, the governance taken recorded a 2% price drop in the past 24 hours.

A look at AAVE’s on-chain performance

Due to the surge in the daily volume of profitable AAVE transactions, whale investors have increased their holdings.

Information sourced from on-chain data provider Santiment revealed that the count of whales that hold between 100 and 100,000 AAVE tokens has increased by almost 1% since 1 October. At press time, their count stood at 2767.

The increase in whale interest in the past few days is also attributable to the positive ratio of AAVE’s daily on-chain transaction volume in profit to loss. In fact, on 1 October, this ratio rallied to 4.42, marking its highest daily level in the past three months.

This meant that for every transaction that returned losses, 4.42 transactions ended in profit.

At 3.33 at press time, the ratio of AAVE transactions that ended in profit still exceeded those that returned losses.

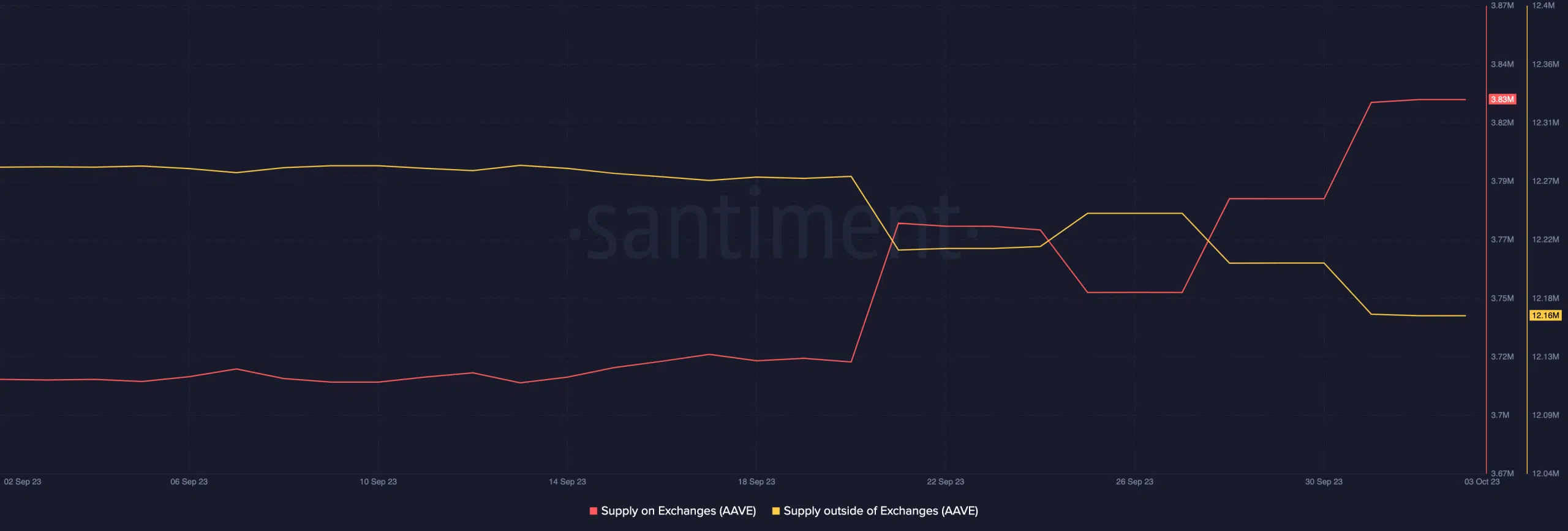

However, with investors taking advantage of the current profitable state, the token’s supply on exchanges has increased. According to data from Santiment, the supply on exchanges has gone up by 2% in the past five days.

How much are 1,10,100 AAVEs worth today?

This suggested that token holders have increasingly sent tokens to exchanges for onward sales to book profits.

Conversely, within the same period, the token’s supply outside of exchanges has dropped. At 12.16 million at press time, AAVE’s supply outside exchanges has fallen by 1% in the last five days.