Is Ethereum’s ‘Merge’ a threat to L2 solutions like Polygon

He who reigns within himself and rules his passions, desires, and fears is more than a king.

Does this quote from ‘Paradise Regained’ connote Ethereum’s ‘Merge’ in any way? Well, yes, only if ‘passion, desire, and fears’ are taken for scalability. As Ethereum awaits its transition to Proof-of-Stake (PoS), investors are wondering if the ‘Merge’ will invalidate Polygon’s use cases.

It may be noted that Ethereum’s switch to PoS might give a boost to layer-2 scaling solutions like Polygon. Many believe, the ‘Merge’ might not have a great effect on Ethereum’s scalability. Consider this- After the ‘Merge,’ the demand for Ethereum will see a sharp spike.

Now, because of the traffic, users might find it harder to use Ethereum. In which case, layer-2 platforms might witness a lot of traction which will eventually translate into demand. Keeping this factor in mind, it seems that Polygon is perfectly positioned to profit. In fact, it seems MATIC holders would benefit massively from Ethereum’s transition to PoS.

Would MATIC go up?

On 19 January 2022, EIP 1559 upgrade was introduced to Polygon’s PoS which has seen over 600k MATIC being burned so far. Furthermore, in early February, the network raised $450 million from various crypto venture capitalists. And, on 24 March, Polygon announced that two massive product releases were coming up shortly. All this goes on to assert that the macro outlook for the token can’t be bearish, to say the least.

Buckle up #Polygon fam! Two MASSIVE product releases coming up shortly ?

Hint: #Polygon's multi-chain #Ethereum ecosystem is about to EXPLODE ?

RT to show love ? pic.twitter.com/SmCzQ8C9Bs

— Polygon | $MATIC ? (@0xPolygon) March 24, 2022

To assess that narrative, a look at the Total Value Locked (TVL) wouldn’t be a bad idea. At the time of writing, the TVL locked on the Polygon network stood at $4.1 billion. AAVE held 29.34% of dominance on the network.

It’s also to be noted that there are hundreds of decentralized applications running on the network. As it were, it proves that Polygon is Ethereum’s most popular layer-2 scaling solution. Well, despite the upgrades’ fervor, MATIC hasn’t shown a remarkable performance of late.

Why so?

At press time, the token was trading at $1.635, down by about 6.02% over the last day. Even though MATIC is still in an uptrend, it hasn’t registered a significant hike in percentage terms over the last year. Apparently, supply seems to be suppressing the price of MATIC.

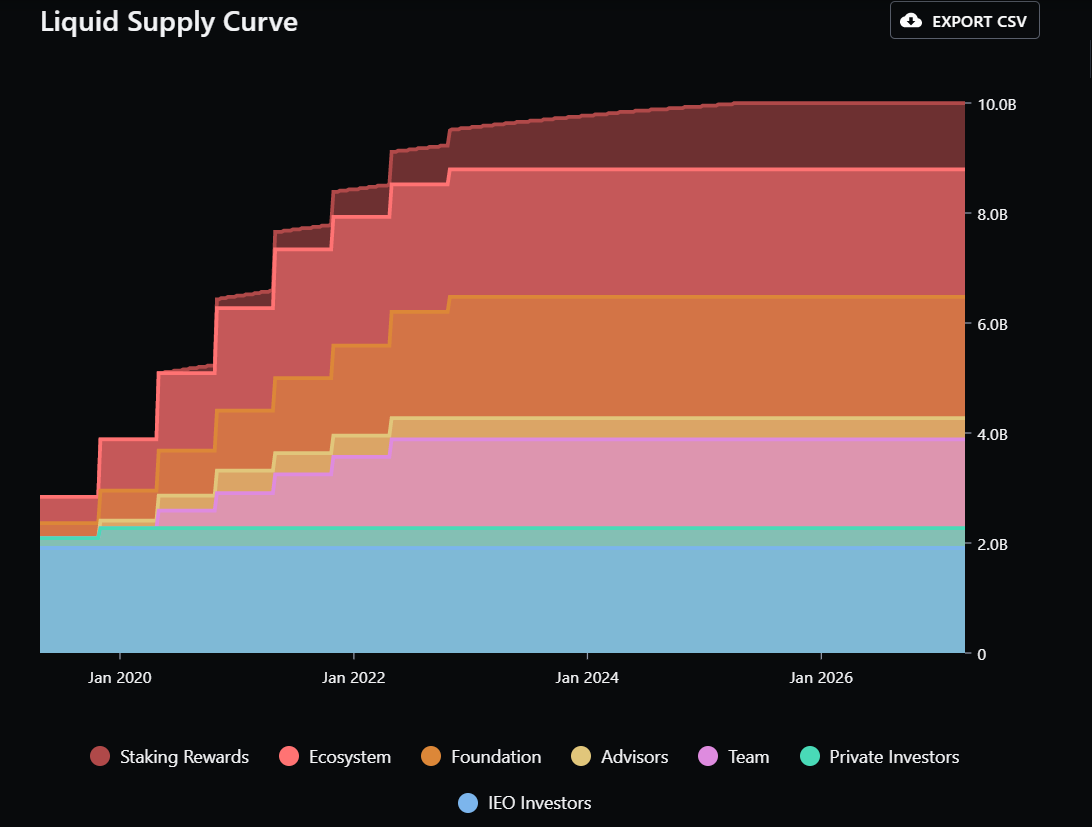

The token has a comparatively aggressive vesting schedule. In fact, with the very minimal ICO price, early token holders seem to be sitting with substantial gains. This hints that some of them are selling, as expected. Thus, affecting the price of the token.

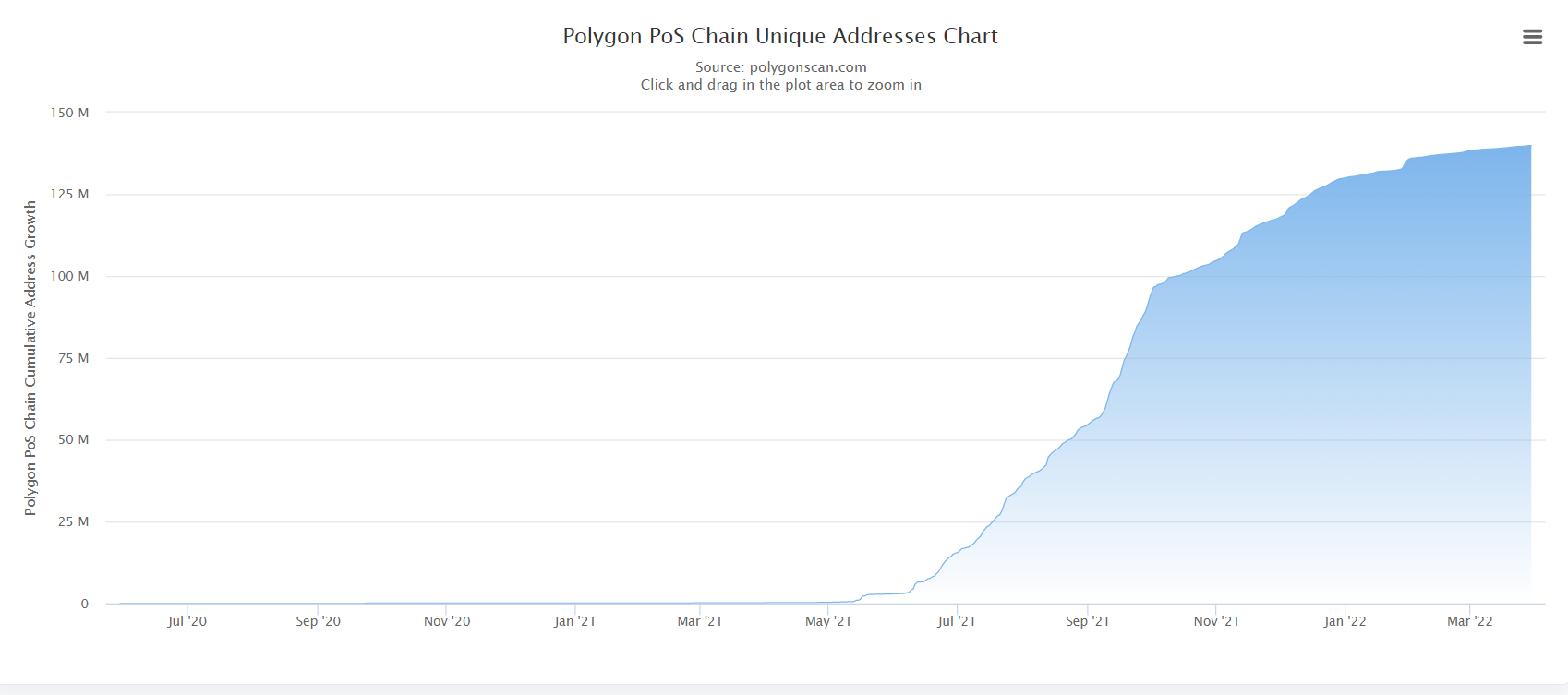

Also, the demand for MATIC has been complacent on the chart. Polygon PoS chain unique addresses chart is clearly forming a plateau. In fact, the daily increase of addresses has declined post 3 February 2022. One of the reasons behind it could be investors’ waning interest.

Furthermore, for investors, one of the most important factors to consider is the number of daily transactions on the Polygon PoS chain, which has been on a decline since June 2021. With the inclusion of outstanding network upgrades, it’s expected that the token might see demand going up in the months to come.

By and large, MATIC seems to be an average performer. However, investors who have faith in the network’s ecosystem could definitely hold a major share of the token in their portfolio.

![Tron [TRX]](https://ambcrypto.com/wp-content/uploads/2025/08/Tron-TRX-400x240.webp)