Is it time to focus on large-cap altcoins like Ethereum, Litecoin, Polkadot, Chainlink

Bitcoin is rallying and as the price increases, there is increasing selling pressure on the token and is likely to cause the next price correction. Altcoins with small market cap have offered double-digit returns, and a low market cap means low liquidity, however, the latest exchange listings and updates have given a boost to the price for tokens like NPXS (117% up), HNT (47.97% up), SC (100% up). Large market cap altcoins like Ethereum are the focus for most retail traders as increased liquidity has increased the volatility and allowed for price movements and more frequent profit booking opportunities.

Altcoins in the top 20 are right at their HTF supports and waiting for a dip in Bitcoin’s price. Once the inflow shifts to altcoins, there may be a possible decoupling from the fractal. Traders would argue that mid-caps are interesting due to the price action, and they are looking for a bounce-back. However, it does not apply to the current price cycle, since currently, Bitcoin is under increasing buying pressure and something similar is unraveling in the altcoin markets.

Most altcoin charts are choppy, unlike Theta, which ranks 14th with a 17% price gain in the past 24 hours. Among the choppy ones, and in the top ten is Litecoin/USD pair, and LTC is closely following Bitcoin. This is an altcoin with a large market cap, long-term bullish sentiment based on price chart and trading volume. Defi tokens like UNI that have flooded exchanges and increased liquidity have low exchange outflows. DeFi tokens have done more than offer double-digit returns, in some cases, the returns have been around 100% or more growth on the same day or a week.

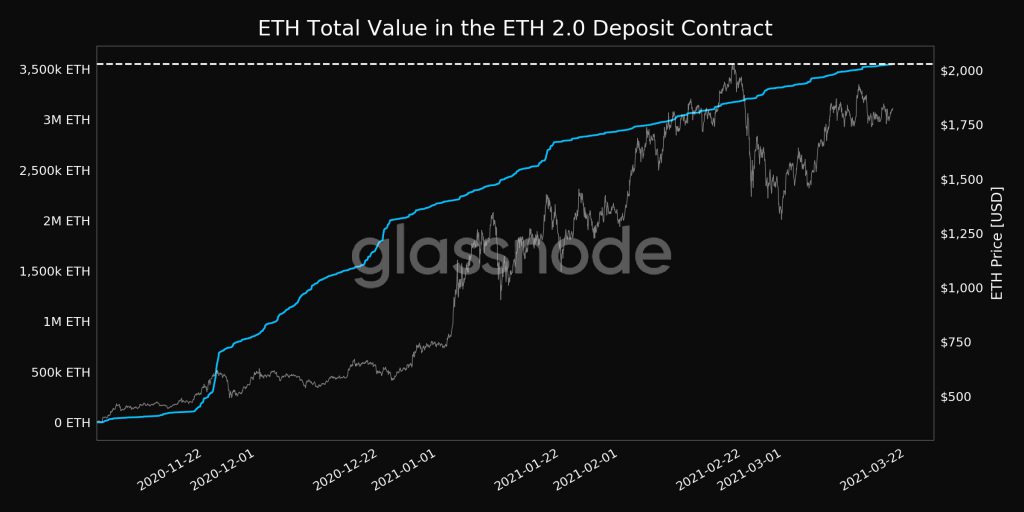

ETH total value in the ETH 2.0 Deposit contract ||Source: Twitter

Corresponding to this time on the Ethereum network, among other tokens, Uniswap’s exchange outflow has hit a 3 month low. So is it time to focus on large-cap altcoins? Mid and low cap are bullish in the long-term but the current price action suggests large-cap has got the most retail attention and investment among top alts. Currently, it looks like the price action in DeFi and other tokens would lead to a revival of the alt season and Ethereum stands to gain significantly.