Is it worth betting on SUSHI, CAKE, BURGER, PIZZA, YAM & KIMCHI now

Food-themed tokens have been in the crypto-space for quite some time now. Right from pizza and burger to yam and kimchi, every mouth-watering food item has a DeFi token to its name. However, these tokens made their presence exclusively felt over the past few days.

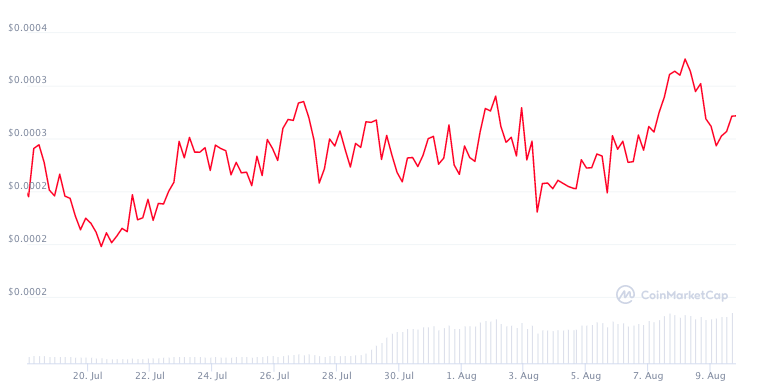

Since 20 July, the value of almost all of the above tokens has doubled. BURGER’s price witnessed a jump from $3.05 to $6.46. In the same time frame, SUSHI’s price noted a surge from $6.2 to $10; CAKE’s price surged from $10 to $18, PIZZA’s price from $0.1 to $0.2, YAM’s price from $0.48 to $0.82 and KIMCHI’s price from $0.00020 to $0.000336.

Wait, have you ever heard of these tokens before?

SushiSwap has arguably carved a niche for itself in the DeFi space already. This community-oriented DeFi liquidity pool platform provides rewards to liquidity providers. The protocol is, however, not-so-democratic and users do not necessarily have a say in governance related issues. BurgerSwap, in that respect, is much more democratic. Users have a voice and the right to vote as well. In fact, they get rewards whenever they exercise their voting rights.

Yam Finance too, for that matter propagates decentralized governance where YAM HODLers decide the future via on-chain voting. Its treasury has also been growing at an impressive pace of late. Interestingly, YAM tokens have an elastic supply and it expands and contracts based on the market conditions. There are over 10 million PIZZA tokens in supply and over a tenth in circulation. Users can additionally trade on the Pizza DEX and take part in their exclusive stablecoin investment program too.

Just like SushiSwap, KIMCHI rewards users for providing liquidity. PancakeSwap also, for that matter, permits users to exchange tokens, provide liquidity via farming and fetch returns. CAKE users can additionally try their luck with lotteries and NFTs too.

So, are these tokens worth taking a chance on?

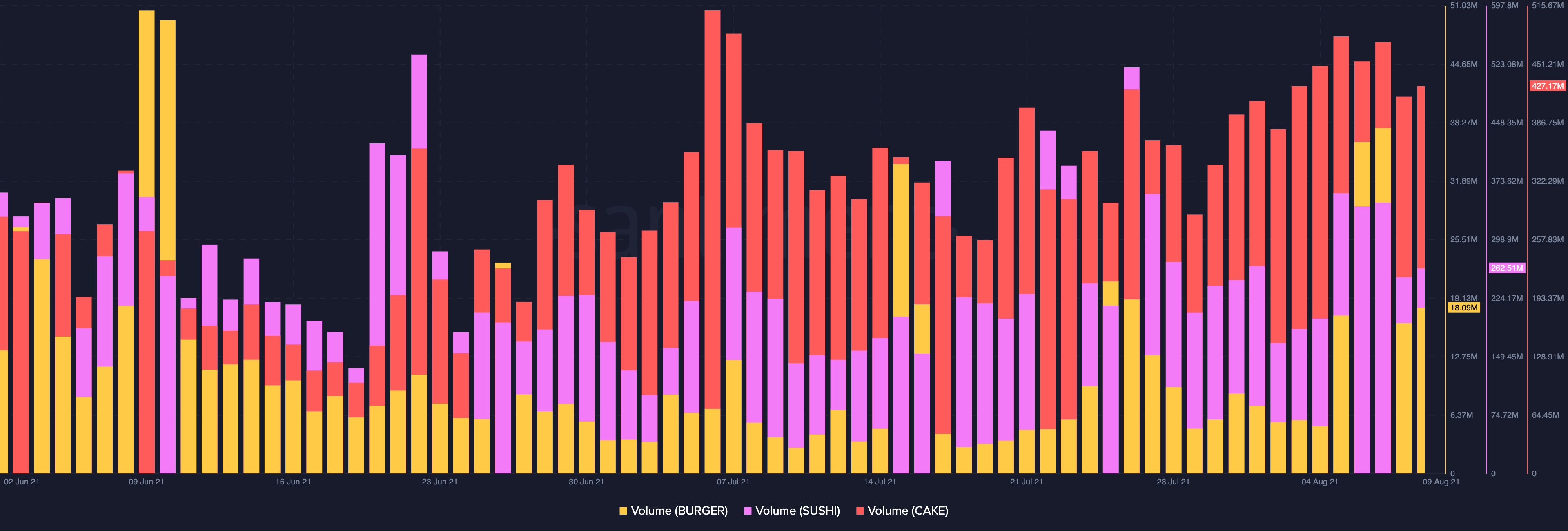

The volumes for these tokens have, as such, started witnessing notable spikes. In fact, at the time of writing, BURGER’s volume typically reflected a value of $18.09 million, while the same for SUSHI and CAKE stood at $262.51 million and $427.17 million. KIMCHI, YAM and PIZZA’s volumes too, for that matter have been rising.

Well, money is evidently being pumped into these projects, and at this point they do seem to be compelling investments for the short term. Traders can look forward to making a buck or two until the craze is hot. If the hype builds up in the coming weeks, these food-themed tokens could end up becoming the next big craze in the DeFi world.

However, just like CAKE, details about most of the founders of other projects remain undisclosed. The ecosystem has seen various rug-pulls and ponzi schemes resurface out of the the blue. Ergo, long-term investors need to wary of potential red flags and keep the sustainability factor in mind before taking a call.