Is NEAR at risk of suffering the same death spiral fate as LUNA

The LUNA and UST crash have shifted the spotlight on other crypto projects running decentralized stablecoins, such as NEAR’s USN. The latter is among the fastest-growing blockchain networks. However, a lot of investors seem to be questioning if that growth trajectory would suffer the same fate as Terra?

Let’s evaluate the differences and similarities between the two blockchain projects. Both projects are similar in that they have to balance the peg through the stablecoin supply. They also use their blockchain’s native cryptocurrency to mint their stablecoin. While Terra used a mint and burn mechanism, NEAR uses a treasury to maintain the dollar peg.

NEAR’s approach safer?

NEAR is locked into the treasury to mint USN and unlocked when the USN is burnt. It is also worth noting that NEAR has a fixed supply and this is one of the solutions deployed to avoid an oversupply that can feed into a death spiral.

NEAR also goes a step further by ensuring that the treasury is over-collateralized and backed by NEAR and USDT. This is ensured through a REF Finance pool, as well as pools on centralized exchanges.

Is there any risk to NEAR’s approach?

Although NEAR’s USN approach seems safer than that of Terra’s UST, it is still not as secure as centralized stablecoins that are backed by fiat. USN has lately demonstrated significant volatility but still manages to regain its peg. There are also fears that the USDT is a part of the overcollateralization mechanism. There lies a looming possibility that a USDT de-peg would likely destabilize USN’s peg.

NEAR peaked at $20.59 in January 2022 but the bearish market conditions have resulted in a significant discount in the last few months. It traded at $5.87 at the time of writing. And, at the time of writing, it was about to form a death cross, suggesting more potential downside.

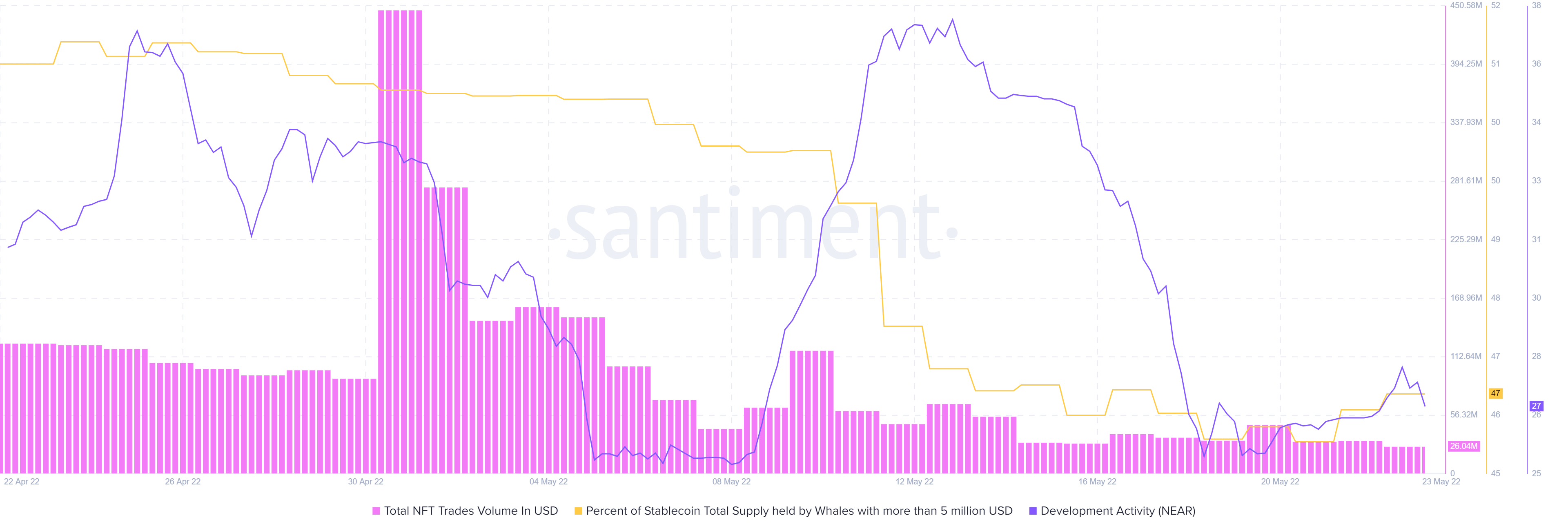

A look at its price action reveals that the total supply of NEAR held by whales has been on the decline for the last 30 days. However, it shows signs of whale accumulation in the last three days, suggesting that NEAR might be about to experience more upside.

As far as its long-term performance is concerned, NEAR may not be at risk of a death spiral and it has also expanded its offerings into the Metaverse and NFTs. In fact, it registered significant NFT trades volumes in the last 30 days and noteworthy developer activity.