Is Solana’s parallel growth with Ethereum too good to last

The market had many surprising moments over the last month, with altcoins such as Cardano, Solana taking center stage and recording new ATHs. Towards the end of the month, Ethereum too picked up momentum, with the alt noting weekly gains of 21.82% at press time.

Now, it perhaps won’t be wrong to say that Ethereum and Solana had all eyes on them after speculators identified some similarities between their trajectories.

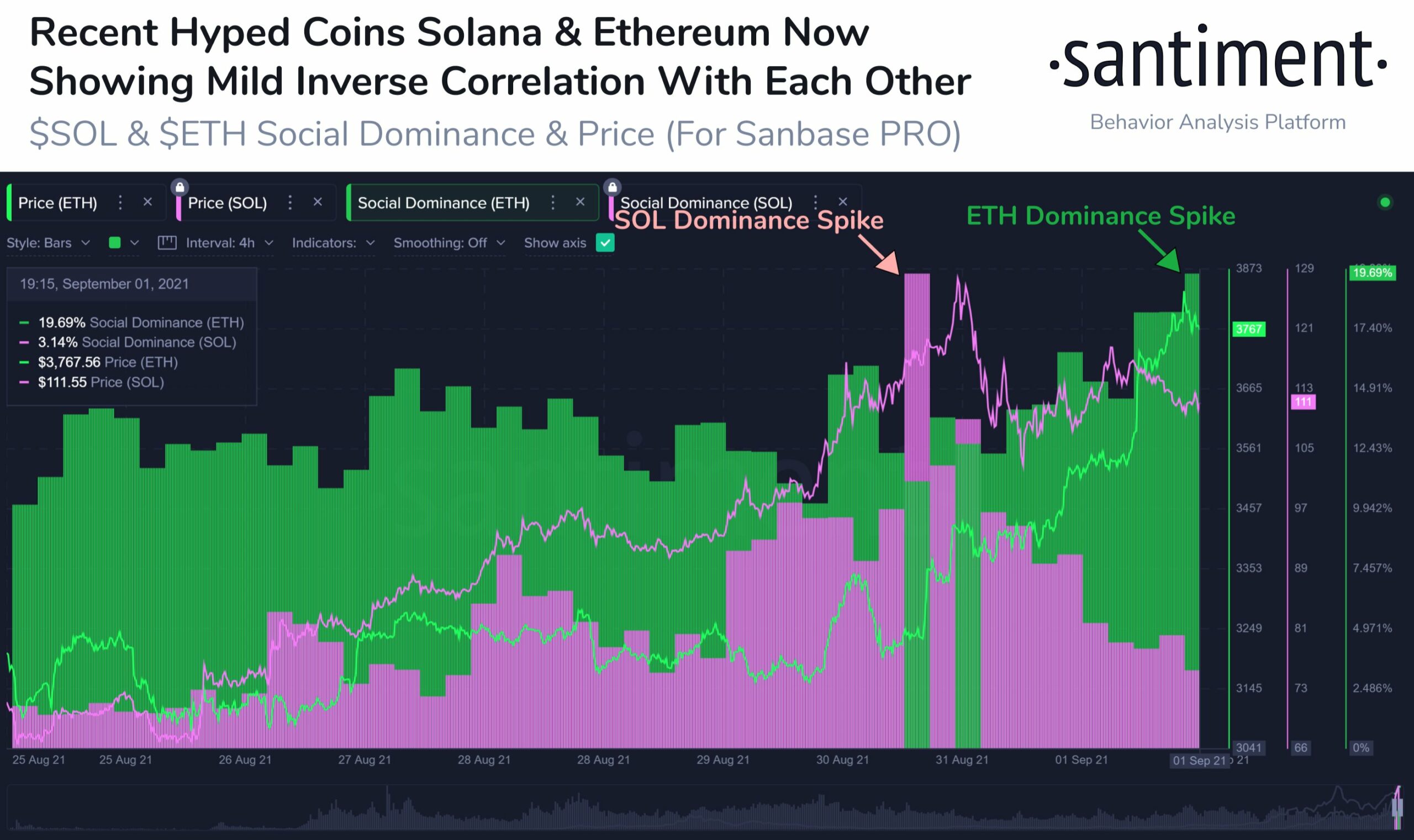

At press time, Solana was up by 58% and Ethereum up by 21% over the week. In fact, according to Santiment, they both took turns to have the market spotlight. However, apart from their impressive price gains, there were other notable trends too.

Ethereum stealing traction from Solana

Social sentiment generally aligns with price pumps, especially in the case of alts. For both Solana and Ethereum, crowd sentiment played a crucial role in their price pumps. In fact, their social dominance was highest as their prices saw newer highs.

On 30 August, Solana’s high social dominance coincided with its all-time high price of $119. Just a day later, Ethereum managed to steal social dominance as the metric peaked alongside a high price of $3,830.

Source: Santiment

Solana dominating cashflows?

Even though Ethereum managed to steal social attention, Solana seemed to be on fire in terms of flows by assets. CoinShares’ Digital asset fund flows weekly revealed that investors have increasingly been “selling off Bitcoin funds in favor of investments tied to other cryptocurrencies.”

Notably, Solana funds led investment growth this month, tacking on more than $7 million in the week ending 20 August. The same for Ethereum was $3.2 million while there was a loss of $2.8 million for Bitcoin. What’s more, Solana took over BTC’s cash AUM and totaled $15.57 million.

Other than that, the recent NFT hype has had a huge role to play in pumping both Ethereum and Solana. Strong demand for NFT trading and investing pumped ETH’s total transaction fees which were around 10k ETH per day. This was a relatively high level, comparable to ‘DeFi summer’ and the 2021 bull run.

Likewise, for SOL’s price, Degenerate Apes, Solana’s first big foray into NFTs, acted as a good push. Since the launch, Degen Ape sales have recorded more than 100K SOL in volume traded, with a price floor of almost 15 SOL.

Undoubtedly, Solana has had a rather quick run to glory. But, can this so-called ‘Ethereum-killer’ actually beat other Ethereum-killers or maybe Ethereum one day?

Here’s what the metrics say

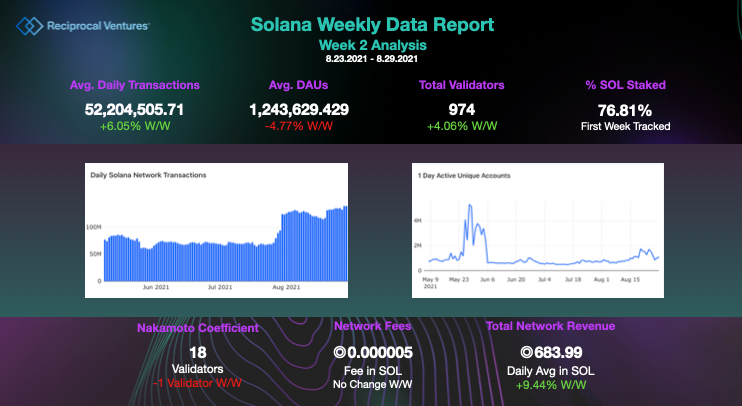

Notably, daily active users (DAU) have fallen for both Solana and Ethereum. Despite a drop in DAUs, the average transactions per day on Solana saw a modest uptick while its competitors fell off W/W.

SOL had 52.20 million (+6.05%) average transactions per day while ETH’s stood at 1.17M (-4.00%). Solana’s price in the near term could see some minor pumps owing to the recent announcement by the Solana Foundation about an upcoming hackathon with $5M in prizes plus funding.

Source: Craig Burel

Solana is seen by many in the industry as a rival to Ethereum as it claims to offer cheaper transactions and faster transaction speed at 50,000 transactions per second. All in all, while it did look like Solana is doing pretty well, it is largely pumping because of its smart contract operability and recent NFT hype.

However, as blockchains begin to use smart contracts and move into NFTs, Solana could face more competition in the years to come.