Is the shift to ‘newly created and technically-superior’ cryptocurrencies inevitable

Cryptocurrency has seen a significant rise in demand over the years. In his article titled The Osmosis Theory of Wealth Transfer: Gold to USD to Cryptos, Dr. Ryan Orr, Ph.D., discussed the gradual shift and an eventual, meteoric rise in the value of digital assets in recent times. Discussing the same in comparison to assets such as gold and USD, the co-founder and CEO of artCOA Inc. opined,

“…the pumping of financial wealth from the older safe-haven assets to the newly created and technically-superior ones will be as certain, predictable, and spontaneous as the process of osmosis…”

In this context, consider this noteworthy survey. Published by cryptocurrency exchange CryptoVantage, it is titled, “Generational Philosophies on Investing in Crypto.” This survey explored the the different approaches of three different generations, that is, millennials (born between 1981 and 1996), xennials (born between 1977 and 1983), and generation x (born between 1965 and 1980), towards cryptocurrencies.

As stated in the report,

“Millennials have dominated the press as the most crypto-friendly generation, but they aren’t the only ones on the bandwagon. Investors across all generations and micro-generations – like xennials, who fall between millennials and generation x – are investing in cryptocurrencies.”

The report also discussed the popularity of crypto assets among those being surveyed. As expected, millennial investors lead the statistics, with 12% of their total portfolio featuring digital currencies. For xennials, it was 9.2%, while for generation x it was approximately 6.3%.

Source: Cryptovantage

Despite this, millennials were not the group making the most profit on their cryptocurrency investments. Xennials, with the largest total investment, were the most likely to make a profit off crypto assets at 80.5%, compared to 76.2% for millennials and 71.5% for gen ‘x’ers.

This contradicts with notion that older investors were skeptical of or ignorant about digital assets. In fact, many within this age-group enjoyed major gains through their crypto holdings. Moreover, as per the study, 3 out of 4 people profited off cryptocurrency investments, overall.

Diversity in crypto tokens

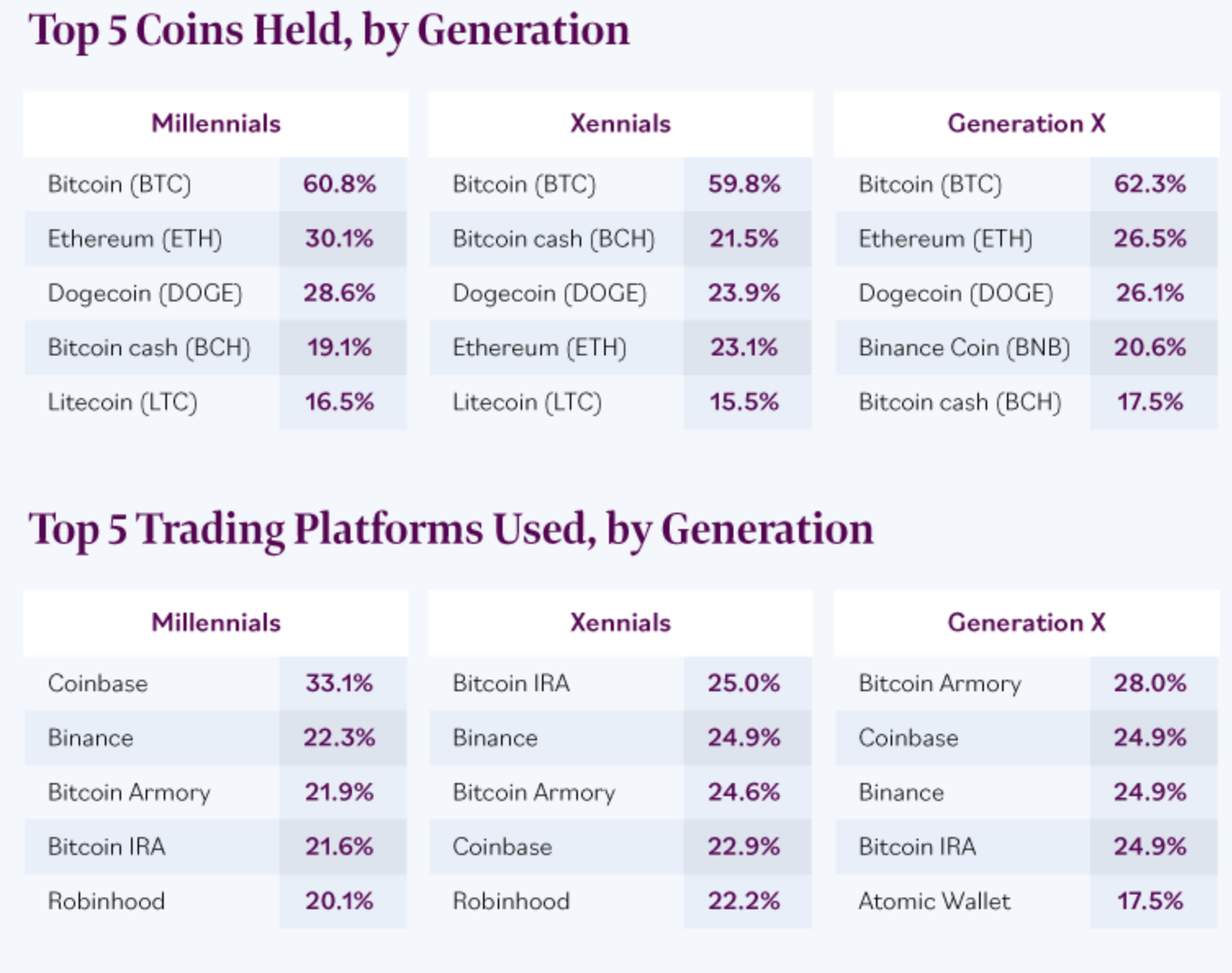

While Bitcoin is the most preferred investment asset for all making up for around 60% of each group, ETH took the next spot for millennials and gen-x. However, surprisingly, xennials preferred Bitcoin Cash and Dogecoin to Ethereum.

Moving on to the different exchange platforms, the youngest generation used Coinbase the most. Xennials used Bitcoin IRA (the most), while Generation X chose Bitcoin Armory.

Source: Cryptovantage

Reason for investing in these asset classes?

The most common reason to start investing in cryptocurrencies, across all generations was curiosity. Around 18.5% of the oldest investors believed that virtual assets will be the currency of the future and chose this answer as the third most important reason to jump on to the crypto bandwagon.