Is trading LTC, ETC, MATIC, LINK, or XRP (and other alts) more profitable than Bitcoin?

Bitcoin’s price was largely rangebound following the recovery from the crash of May 23. However, altcoins have offered double-digit gains in the same time period. This leads traders to the question, is it worth following Bitcoin through the price crashes and accumulating through the dips, when altcoins offer similar or higher returns on your portfolio.

The ROI on top altcoins is relatively higher and market volatility has led to higher returns since the summer of 2020. Consider $100 worth of these altcoins, from a week ago. The current value would be $130 if you bought TRX, $140 if you bought SOL or DOGE, and nearly the same or lower if you bought Bitcoin.

What does this mean for a day trader? Trading on cryptocurrency exchanges comes with a set of expenses like transaction fees and taking that into account, the fees involved in buying and selling of the altcoin… the entire transaction costs less than it would for a similar value investment in Bitcoin. Given that the transaction fee is relatively lower for altcoins like TRX, XRP, or DOGE, compared to Bitcoin on most spot exchanges and markets, the picture becomes clearer.

Altcoins offer higher ROI to traders in the short term and this is a well-established argument following the statistics from the summer of 2020 and this year since the last week of May 2021. Day traders could book profits on a portfolio with a balance of high to mid-market capitalization altcoins like LTC, ETC, MATIC, LINK, or XRP.

This year traders have booked profits on meme coins like DOGE, unlike short-term investors with negative ROI that bought Bitcoin. Despite lowering the average cost by DCA-ing, the overall cost of holding, trading, or buying Bitcoin, makes it a larger commitment and less rewarding, when the risks are similar or higher, in high market capitalization altcoins.

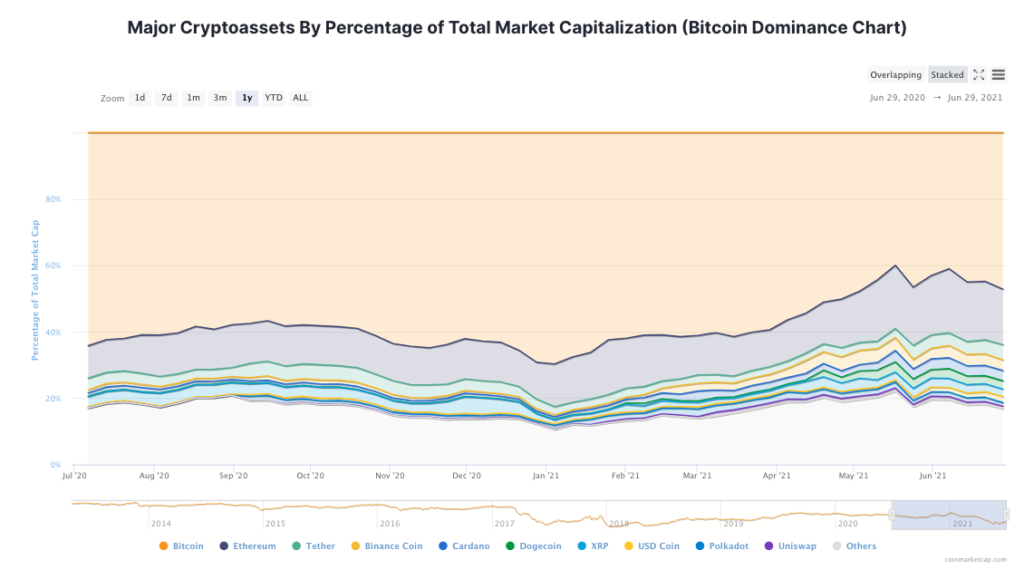

The dominance of BTC and top altcoins || Source: Coinmarketcap.com

Based on the above chart, in terms of dominance, altcoins have improved since May ’21 gaining more ground, however, Bitcoin’s dominance fueled by large wallet investors and institutions remains the same. Though Bitcoin’s price movement has had an impact on altcoin’s market capitalization, investment inflow, and trader sentiment, trading in altcoins may be the way to come out of summer 2021 profitable.

To find out which altcoins are best suited to a highly rewarding portfolio this summer we consider the summer of 2020. Based on price data from coinmarketcap.com, LINK’s price went from $4.09 to $16 level, nearly 275% gains from the beginning of June 2020 to the end of August 2020, and KMD’s price went up 53% in the same period when the price hit a peak in July, the ROI was 53%, it dropped by the end of August 2020.

Several altcoins with high market capitalization currently, like XLM, MATIC, SOL did not offer significant returns in the summer of 2020. It was largely dominated by Bitcoin returns. The altcoins offering relatively high returns have changed since the market conditions and sentiment has changed since 2020, however, traders continue to enjoy higher profitability and short-term returns from altcoins. Is it still worth pulling the weight of rangebound Bitcoin price action and the flash crashes every few weeks?