Is Uniswap [UNI] shooting for stars after its listing on Robinhood

![Uniswap [UNI]: Shooting for the stars after listing on Robinhood](https://ambcrypto.com/wp-content/uploads/2022/07/ines-pimentel-opkaRk20tAw-unsplash-1-e1657869063162.jpg)

In a tweet on 14 July, broker and cryptocurrency exchange platform Robinhood announced the addition of Uniswap’s UNI to its crypto trading platform. Following the announcement, the price of the native token rallied by over 20% during the intraday trading session.

Well, the token is currently ranked #18 on CoinMarketCap with a market capitalization of $5.14 billion. At press time it was up by 13% in the last 24 hours. Investors have continued to fill their bags with UNI tokens. Here is a look at the token’s performance following the listing on Robinhood.

‘UNI’-que price rally

Exchanging hands at $6.97, a 13% uptick was recorded in the price of UNI in the last 24 hours. This came after the token registered a high of $7.14 in the early hours of the trading session on 15 July. Furthermore, within the last 24 hours of Friday (15 July), an 18.77% uptick was logged in the amount of UNI tokens that have been traded.

Also seeing a growth in the period under review was the token’s market capitalization. At $5.14 billion during press time, the token’s market capitalization registered a 12% growth over the last day.

At the time of writing, increased buying pressure was observed. On a daily chart, at press time, the Relative Strenght Index (RSI) of the token marked a spot at 67.40 while the Money Flow Index (MFI) was spotted at 70.32.

Trading at its January 2021 level, the price of the token has been on a downtrend since May 2021. At the time of press, the UNI was 44% shy of its all-time high of $84.45 recorded in May 2021.

On-Chain performance

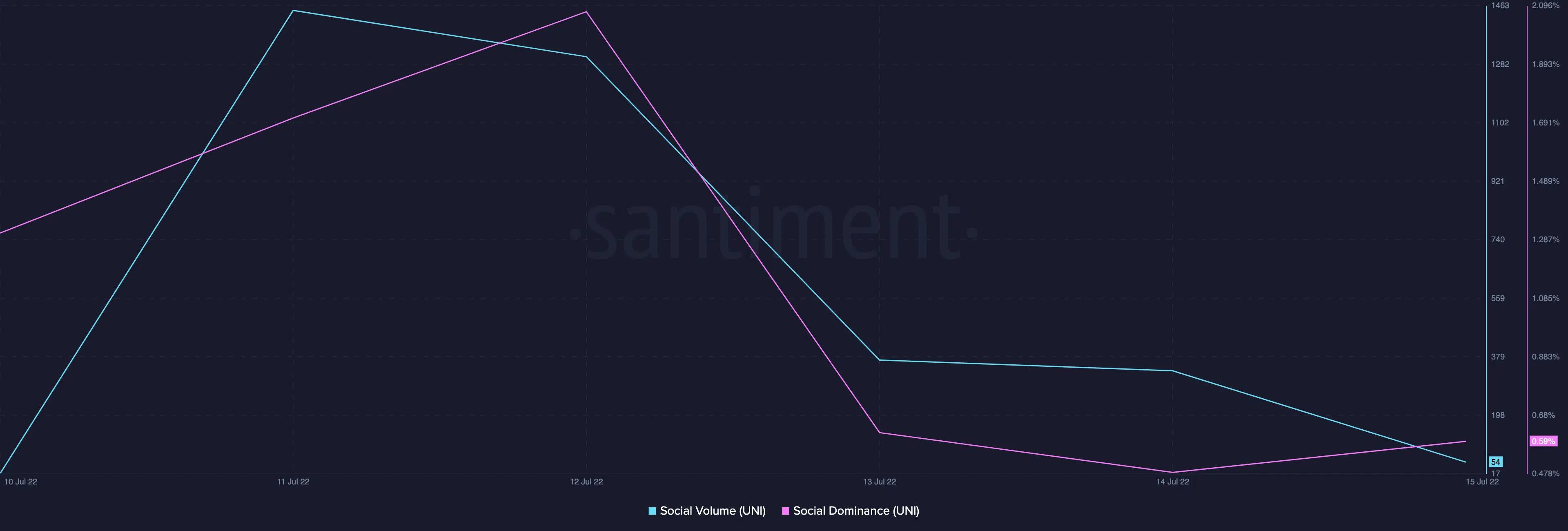

Despite the addition to Robinhood and a significant uptick in price, UNI did not see any traction on the social front in the last 24 hours. It saw a 54% decline in its social volume. At press time, this was pegged at 54.

UNI, however, managed to score a 22% uptick in its social dominance within the period under review. At the time of writing, this was 0.59%.

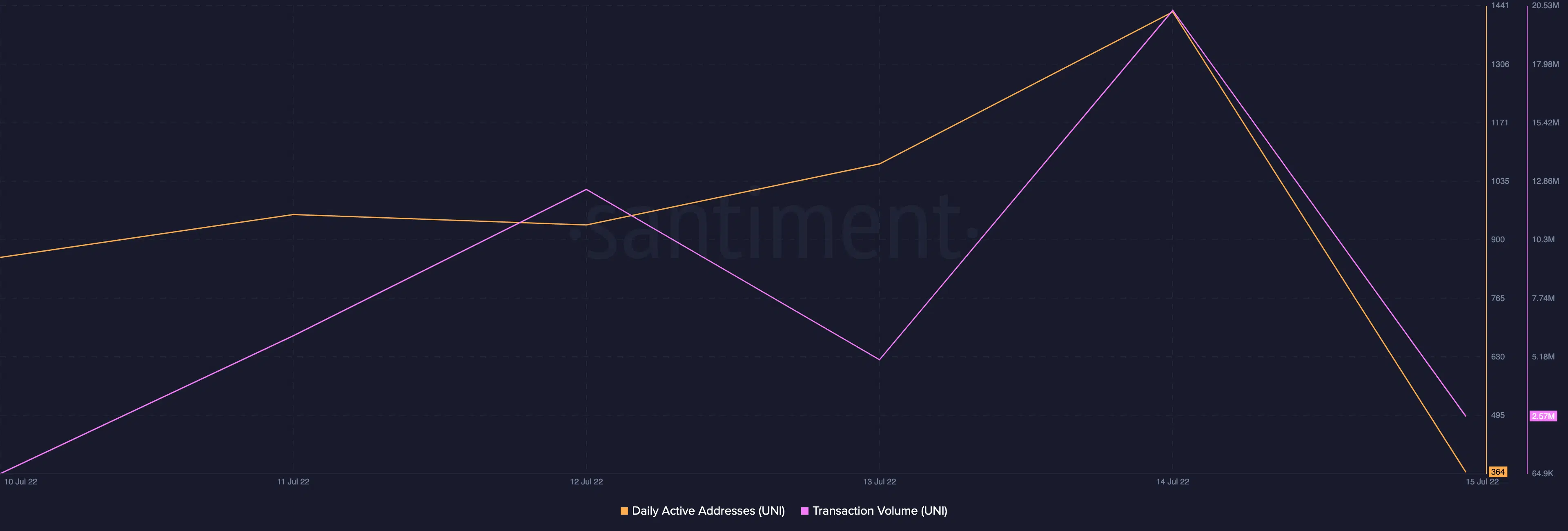

Surprisingly, the number of unique addresses that transacted the UNI token in the last 24 hours dropped. 364 addresses at press time, a 74% decline in daily active addresses on the network was registered in the last 24 hours.

The aggregate amount of UNI tokens across all transactions completed in the last 24 hours fell from 20.33 million to 2.57 million.

With the RSI and MFI deep in overbought regions, such positions are usually followed by a bearish retracement. Hence, caution might be required.