KingDeFi: Multi-chain yield aggregator crosses 5 blockchains

KingDeFi becomes the first Multi Chain Yield Aggregator to cross-chain 5 different blockchains (Polygon, Heco, Solana, Ethereum, Binance Smart Chain) maintaining circulating supply and total supply unchanged, and applying a multi-programming language approach across Solidity, Rust, Haskell, and C++ in order to keep expanding to other chains in the near future.

In this article, the focus is on bridge economics and technology.

What is a Bridge?

A bridge is in practice a mechanism that allows the flow of tokens from one chain to another (and back).

Bridges are extremely important because they help projects to move across multiple chains without issuing a new token on a different mainnet (e.g. from BSC to ETH). With this practice, users will always have only one token, one project, one supply but on multiple chains.

A lot of projects have preferred to issue a new token instead of using a bridge. This has been done because a large amount of crypto and DeFi investors are not educated about token economics. As soon as they see a project on another chain, they buy in without asking themselves how this has happened and how this is managed in terms of token supply.

They believe that going multi-chain without a functioning bridge is a bad practice that can cause strong arbitrage and inflation effects between the two tokens issued on two different chains.

Moreover, if you have one company, you should always have one asset representing it on multiple exchanges.

Why is a bridge important?

- Inflation management

The bridge allows KingDeFi to spread their current circulating supply across 5 (and soon more) blockchains without issuing new tokens on each chain. It means that instead of applying creative practices like burning they can now manage price inflation via re-distribution of rewards across different chains.

If the project only works with one chain in order to attract investors, at a certain point price inflation will come as soon as the project runs out of buyers.

Most of the projects start then to buyback and burn or logically decrease APR% so that price impact is not affected. In a nutshell, they try to apply creative financial practices in order to solve a very simple problem: you finish buyers… and so you buy yourself and burn???

KingDeFi strongly believes that this approach is not smart, instead, they decided to build a bridge, which means in two sentences:

Don’t buyback yourself, just open doors to other chains and find new buyers

Don’t burn, just let 5 different chains to “digest” the circulating supply that one chain alone cannot manage

2. Avoiding arbitrage

What would happen if a project issued a new token on a different blockchain without a functioning bridge?

Users would be minting new tokens which would increase the overall aggregated circulating supply of their project.

Investors would arbitrage between the two tokens. One example: Assume KRW on ETH’s chain appreciates in price and KRW on BSC’s chain depreciates. Investors would then be selling the ETH one and buy the BSC one and vice versa.

In the described process, users would be producing an unbalanced supply and demand effect which of course would affect holders on both chains.

They would still have one project which is represented by one asset for their investors, but in reality, they would have just split the project in two by issuing a lot more circulating KRW tokens. The market would find it difficult to “digest” their additional token emission.

Instead, KingDeFi’s team decided to develop a bridge that allows to always have one token, one supply, and multiple chains.

KingDeFi didn’t rush like other projects just to advertise that they are multi-chain issuing new contracts, instead, they took their time and did it properly.

3. Risk management

The bridge’s also functioning as a risk management instrument: imagine in the worst-case scenario that something goes wrong on one of the chains a user is using (fees increase, network congestions, regulation, etc) and they are not able to bridge, then their KROWN tokens will be “stuck” there and the token utility will be then limited into an environment that is not well functioning or that is impacted by some regulatory issues.

With the bridge in practice, users have the possibility to diversify their asset allocation across multiple chains. It means that they are mitigating risk across different blockchains.

4. Business development, new partnerships and portfolio diversification

Bridge provides us the opportunity to transfer KROWN tokens into 5 different blockchains, adding liquidity to each of them, and then re-engineer our farms for multi-chain launch.

It means our users and investors will be able to have a better-diversified portfolio, yields will be than originated by a more diversified amount of pairs and LPs. Additional diversification decrease aggregated impermanent loss risk too.

KingDeFi’s marketing team is already working to strengthen partnerships with best-in-class projects on Solana, Polygon, Ethereum, and Heco. These are all new buyers and potential investors that will get to know KingDeFi for the first time.

5. Multi-programming language approach

Most of the other BSC projects moved multi-chain, but none or very few moved as well into Solana.

There is a simple motivation behind it, Solana uses a different mechanism and is built on Rust instead of Solidity. In order to bridge chains that have different programming language, you’ll need first of all to have devs who knows both languages Solidity/Rust for Solana, Solidity/Haskell for Cardano, etc.

As you can imagine it’s extremely difficult to find those resources, in order to bypass this issue KingDeFi team built a solid partnership with a provider which is currently very close to the Solana and Cardano foundations and helped us to hire internally directly from there, in parallel they support us with consulting when complexity comes into place.

This strategic choice has been key to speed up the bridge development process.

How is KingDeFi’s bridge implemented?

1. Partnership with AllBridge

In order to speed up cross-chain integration, KingDeFi decided to partner with Allbridge, as they believe this is one of the most professional partners which they have integrated so far.

They went through a strict process of due diligence in terms of technology integration, security, efficiency, and team background before deciding to start this partnership.

This implementation is key for KingDeFi as they found a very professional partner on one hand but also speed up the process to the point that instead of bridging 5 blockchains one by one they have now implemented five of them within one engineering integration.

KingDeFi team keeps working closely with Allbridge in order to be as well able to bridge into TERRA and AVAX in the incoming months.

2. Integration within KingDeFi UI

Logically KingDeFi wants to provide an outstanding user experience to their investors, in order to do so, they already started the implementation of the bridge UI directly into the KingDeFi website. This development allows their users to bridge, farm, and analyze everything directly on their website, without disconnecting the wallet and move to Allbridge website.

Business development and next steps on roadmap

The bridge is an amazing instrument in order to “open doors” for new partnerships.

The team is now contacting other projects across five blockchains in order to start farms and have new partnerships with the best and fastest-growing projects across Solana, Heco, Polygon, and Ethereum.

Their solidity engineers are working closely with auditors in order to re-engineer our farms into the newly implemented chains, in parallel security developers and advisors are focusing on system security upgrades in order to guarantee protection and safety across all chains.

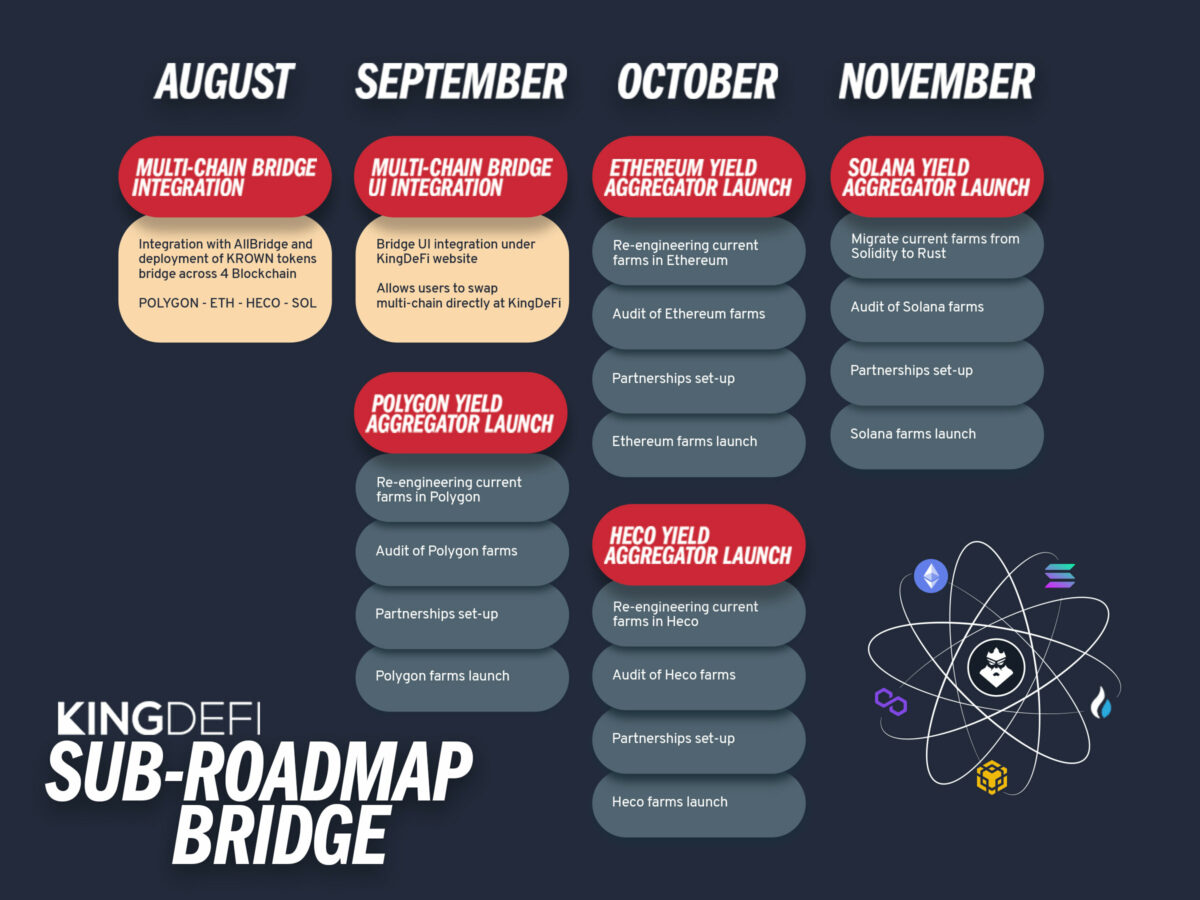

Here below you find:

- “sub-roadmap bridge summary”, which helps users and investors to have an overview of new development coming into place due to the achievement of cross-chain bridge integration

- Training material – how to use the bridge: https://kingdefi-official.gitbook.io/kingdefi/

Useful links

Website: https://kingdefi.io/

Discord: https://discord.gg/9d3RrbNvTM

Telegram Channel: https://t.me/KingDeFi_Official

Telegram Community: https://t.me/KingDefi_Community

Twitter: https://twitter.com/KingDefi2

Medium: https://medium.com/kingdefi

Linktree: https://linktr.ee/kingdefi

Disclaimer: This is a paid post and should not be treated as news/advice.