LDO bulls could have an upper hand only if a surge is observed in…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

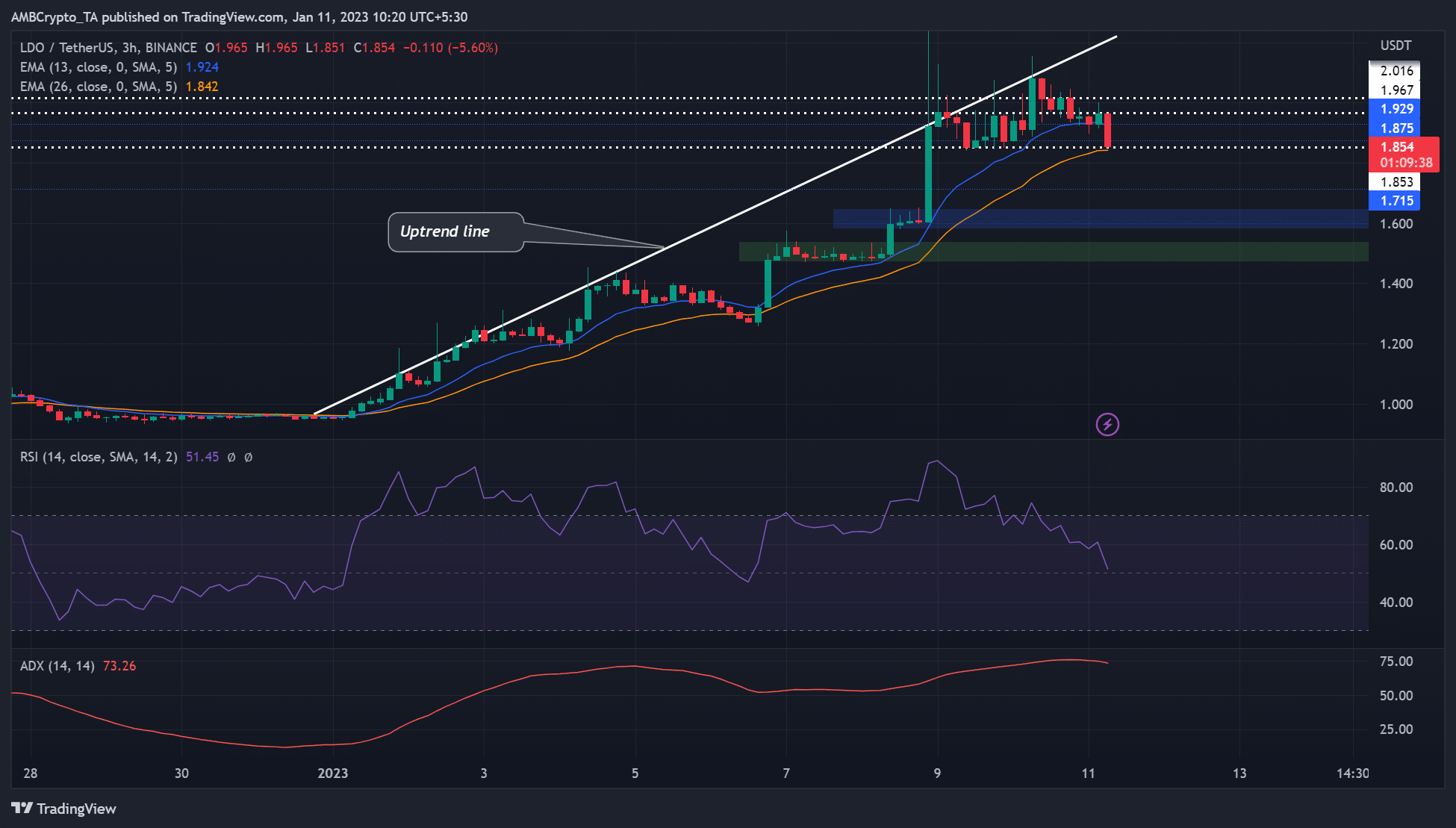

- The LDO bear rally could be short-lived forcing LDO to rebound from $1.853

- A break below $1.853 will give bears more leverage and invalidate the above bias

LDO, the native cryptocurrency of Lido Finance, rallied by over 50% in the past week. At press time, it was cooling off from the rally as the bears slightly took control. It was trading at $1.854 as bears tried to push it lower.

However, the bears should not be too excited because of two reasons. First, the impending US Consumer Price Index (CPI) announcement due on 12 January could trigger a market reaction in favor of the bulls if there is a decline in the CPI index.

Secondly, LDO’s Relative Strength Index (RSI) exhibited a trend that could repeat and tip the scales in favor of the bulls.

Read Lido DAO [LDO] Price Prediction 2023-24

Will LDO fall further away from the uptrend line, or is retest likely?

Previously, LDO’s Relative Strength Index (RSI) on the three-hour chart rebounded around the mid-point. A trend repeat could tip the scale in favor of the bulls.

Therefore, bulls could come in at $1.853 and push LDO up towards the resistance range of $1.967 – $2.016 or break above it to retest the uptrend line. Thus, LDO could trade within the $1.854 – $2.016 range in the next few hours/days.

On the contrary, if bears manage to go below the 26-period exponential moving average (EMA) of $1.842, bulls could find steady support around $1.600 (blue zone) or the green zone ($1.500). But this would invalidate the above bias described above.

How many LDOs can you get for $1?

The Average Directional Movement Index (ADX) was 73, indicating a strong momentum for the bulls. However, a decline in ADX will indicate bears are gaining more influence in the market.

LDO’S sentiment remained relatively positive, but development activity hit rock bottom

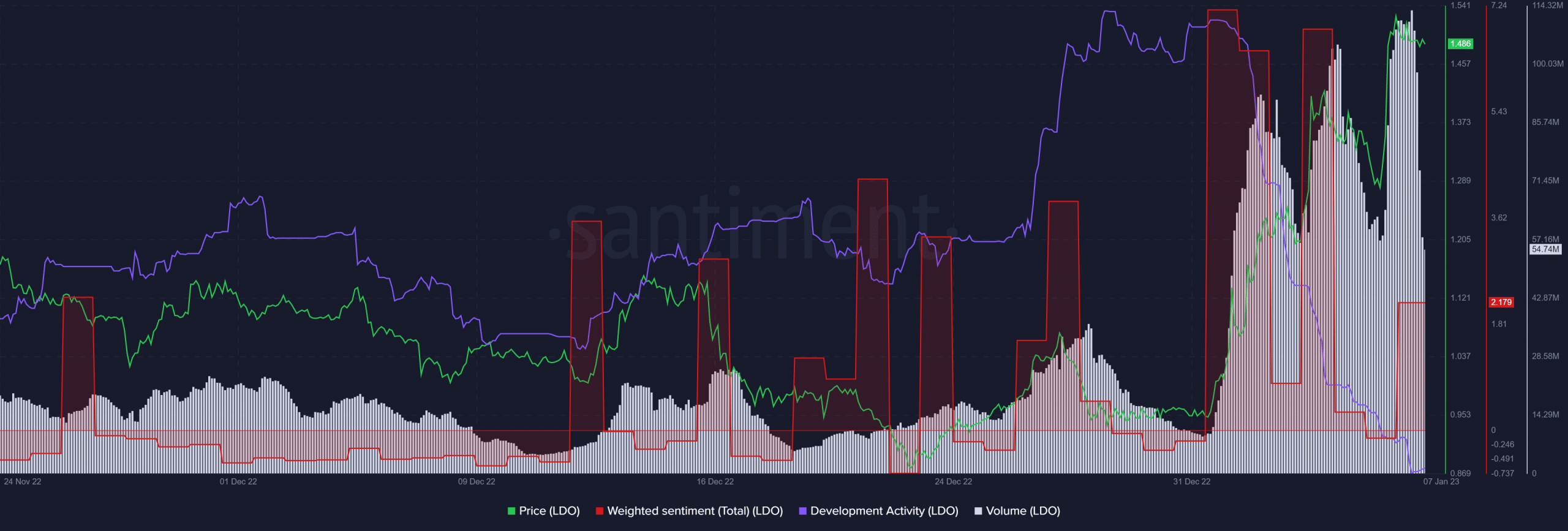

According to Santiment, LDO saw an uptick in volume as prices rose and declined when prices fell. At press time, there was a considerable contraction in volume that could undermine further buying pressure and uptrend momentum in the short term.

In addition, LDO’s development activity had hit rock bottom. Although we would expect the sharp drop in development activity to impact investors’ outlook negatively, the asset’s weighted sentiment remained relatively positive.

However, the recorded investors’ confidence would need a considerable trading volume to boost the uptrend momentum.