Leverage or no leverage, which one is it for Bitcoin?

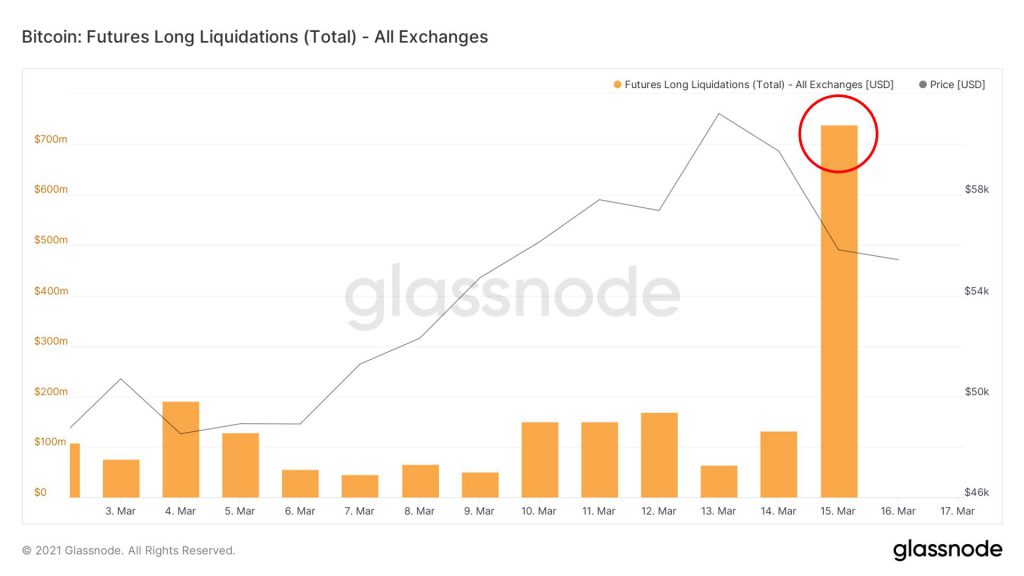

At the beginning of the week, on March 15, 2021, $738 Million of Bitcoin longs were liquidated. Of these liquidations, 60% of contracts were leveraged over 20x. This indicated that traders are wiping out Bitcoin from exchanges. An increase in leverage increases the selling pressure and has historically led to a price correction.

On March 17, 2021, alone there have been Bitcoin long liquidations worth $500 Million. The chart below shows that there is excessive greed on derivatives exchanges and over 60% of contracts were leveraged 20x or more.

Source: Glassnode

Long liquidations have historically shifted the price trend in previous bull markets. So what’s the right move for a retail trader?

Long liquidations clearly signal that if trading in leverage, shorts may be the way to go for now. It is most definitely likely that the price on futures exchanges may affect the spot market.

Liquidations on derivatives exchanges have a direct impact on the sentiment and this affects the spot price. Most retail traders are moving from spot to derivatives exchanges in favor of leverage and this is one of the top reasons for the impact of liquidation on spot exchange prices and portfolios.

For retail traders, this is the ideal time to buy Bitcoin below the $55000 level. Bitcoin’s active supply has dropped consistently, with the increasing liquidation on derivatives exchanges. This may not be as positive for the price as it was in the past when the supply shortage narrative led to new ATH.

However, retail traders watching out for an opportunity to buy or HODL would do so post the next correction. On derivatives exchanges, the increasing leverage is proving to be profitable for traders opening short positions though it has a negative impact on price.

However, what’s more interesting is that a drop in price can be profitable at the current point in the market cycle. The entire narrative of Bitcoin outflows from exchanges and whale movements have a long-term impact on price; however daily trade activity and activity on derivatives exchanges can be relied on for making short-term adjustments in open position and leverage.