Lido Finance: What TVL crossing $6b mark could mean for LDO

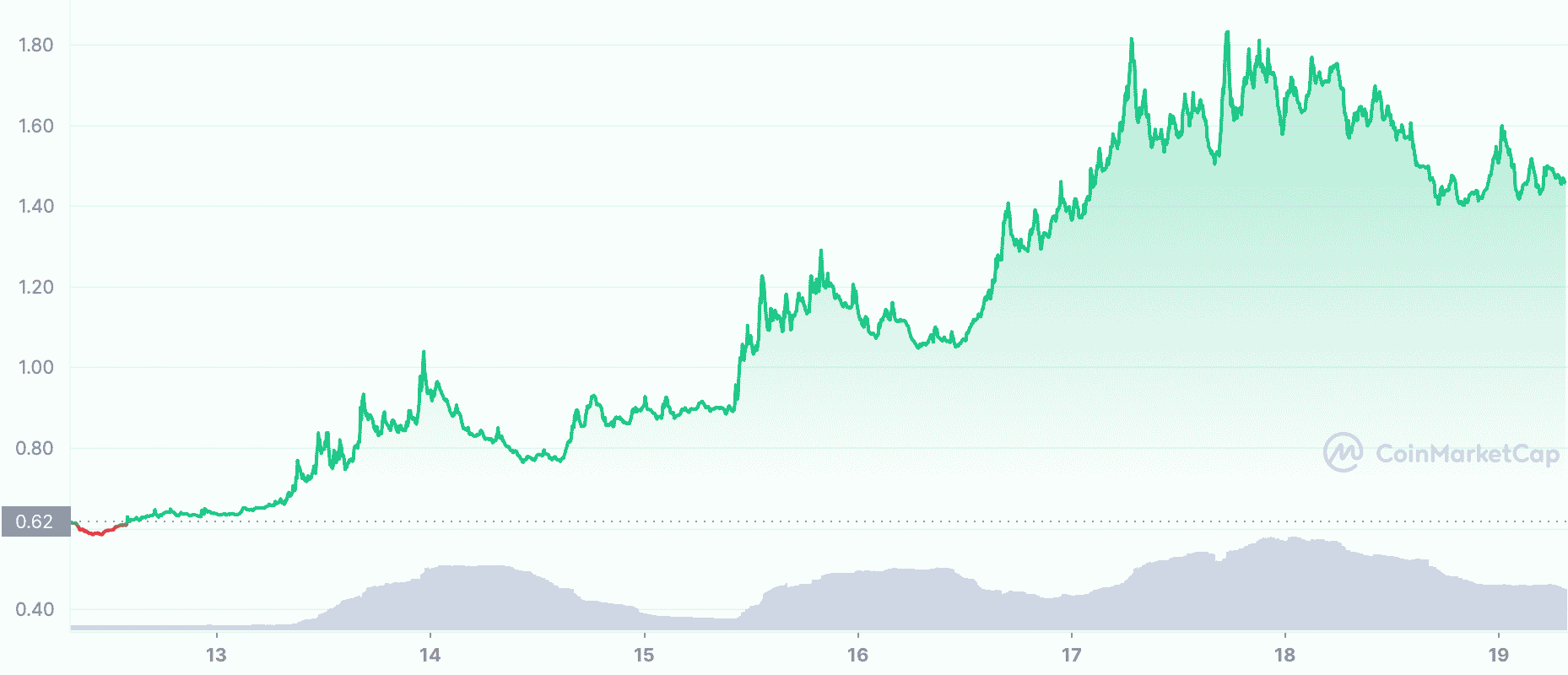

Crypto staking service provider Lido Finance has come a long way. From fears of shrinking liquidity for the staking derivative to Lido’s native token skyrocketing to a weekly-high of $0.66, the organization has stood its ground. But now, the platform wants more as it is expanding to Layer 2.

Bridging the gap

In a blog post published on 18 July, Lido confirmed the launch of the offering of staked Ether (stETH) support across the ecosystem of Ethereum Layer two (L2) networks, Optimism and Arbitrum. The team later shared this development on their social media platform.

Lido is launching stETH on Layer 2 ?️

Ethereum is scaling, and so is Lido.

Lido stakers will soon be able to use their stETH assets in DeFi on Layer 2.

Read more about it here: https://t.co/QCsQry4V41

— Lido (@LidoFinance) July 18, 2022

The network would support Ether staking via bridges to L2s using Lido’s ETH staking token, dubbed wstETH. For Ethereum stakers, this means staking with lower fees and access to a new suite of DeFi applications to amplify yields.

This also means that users could stake directly on the L2s “without the need to bridge their assets back” to the Ethereum mainnet.

The expansion to L2 could indeed be the next step to further improve Ethereum staking accessibility. To do this, the team added,

“Lido has already integrated with Argent to make wstETH available on zkSync users and with Aztec. Now at last we can announce that we are working on the next collection of integrations and partnerships that will be unveiled in the coming weeks.”

But this isn’t it for the platform. Lido Finance has opened a vote and plans to sell 2% of the total LDO (20 million LDO) at a price of $1.45. Dragonfly will lead the investment and purchase 10 million LDOs. Sold LDOs will be unlocked immediately with full voting rights.

LDO is also on the list of tokens with the highest trading volume used by the ETH whales. Meanwhile, the Lido DAO token’s 24-hour trading volume skyrocketed by over 400% to stand at $142.3 million.

All thanks to you

Such developments definitely end up having a rippling effect on the network’s performance. According to Dune Analytics, Lido’s total value locked (TVL) increased significantly over the past 30 days. This number stood at $6.4 billion at the time of writing.

In addition to the spikes mentioned above, the LDO token has also witnessed tremendous growth in the last seven days, specifically in its daily active addresses and transaction volume.