Lido’s latest market move could have ETH stand here despite market conditions

- Lido [LDO] witnesses a massive uptick in APR

- Validators on Ethereum also showed interest along with large addresses

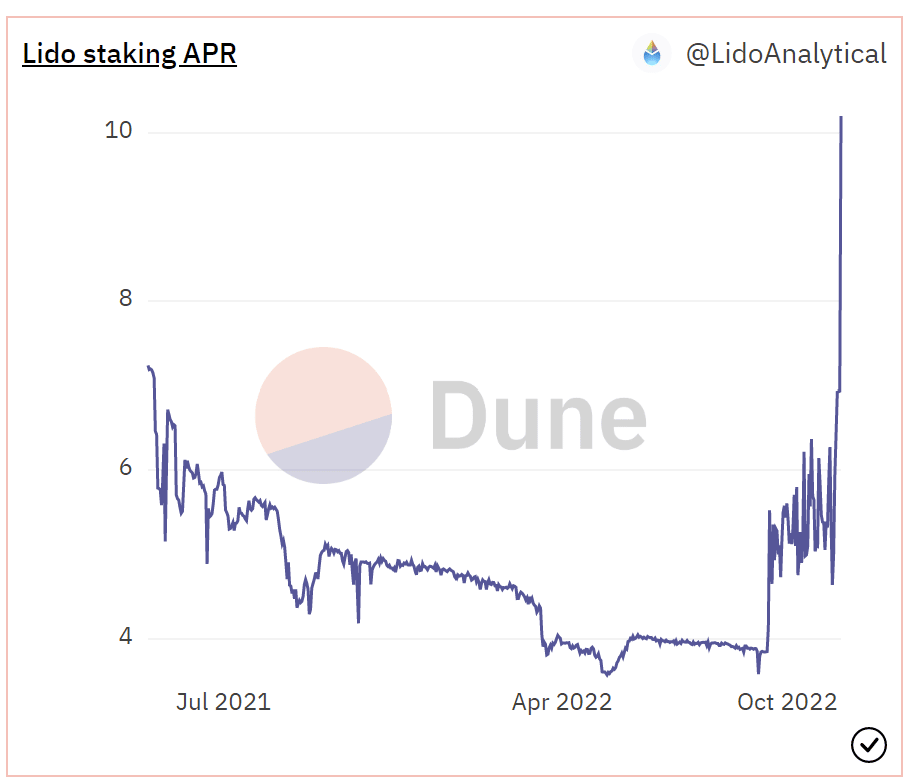

On 13 November, the Lido proposal led to the surge of the allowable APR from 10% to 17.5%. The proposal at hand also led to Lido stETH APR touching 10.2%.

Yesterday, the Lido 143 proposal increased the allowable APR reported by the oracle machine from 10% to 17.5%. It has been voted to pass, and the user staking reward update has resumed. On November 13, Lido stETH staking APR reached 10.2%. https://t.co/0B5tRQiDpG pic.twitter.com/3gOYTVxxGw

— Wu Blockchain (@WuBlockchain) November 14, 2022

The uptick could also be a result of the higher-than-expected EL rewards that were given out.

Read Ethereum’s Price Prediction for 2022-2023

Some APReciation

This spike in APR could be a catalyst that would regenerate people’s interest in ETH and stETH going forward as users will look forward to generating more APR.

Furthermore, despite turbulent market conditions, Lido Finance provided massive APR for people staking their Ethereum. The same was confirmed by a Messari Crypto research analyst via Twitter.

ETH staking yields at >10% pic.twitter.com/8ZvEfG1yHi

— Kunal Goel (@kunalgoel) November 13, 2022

Ethereum’s transaction volume

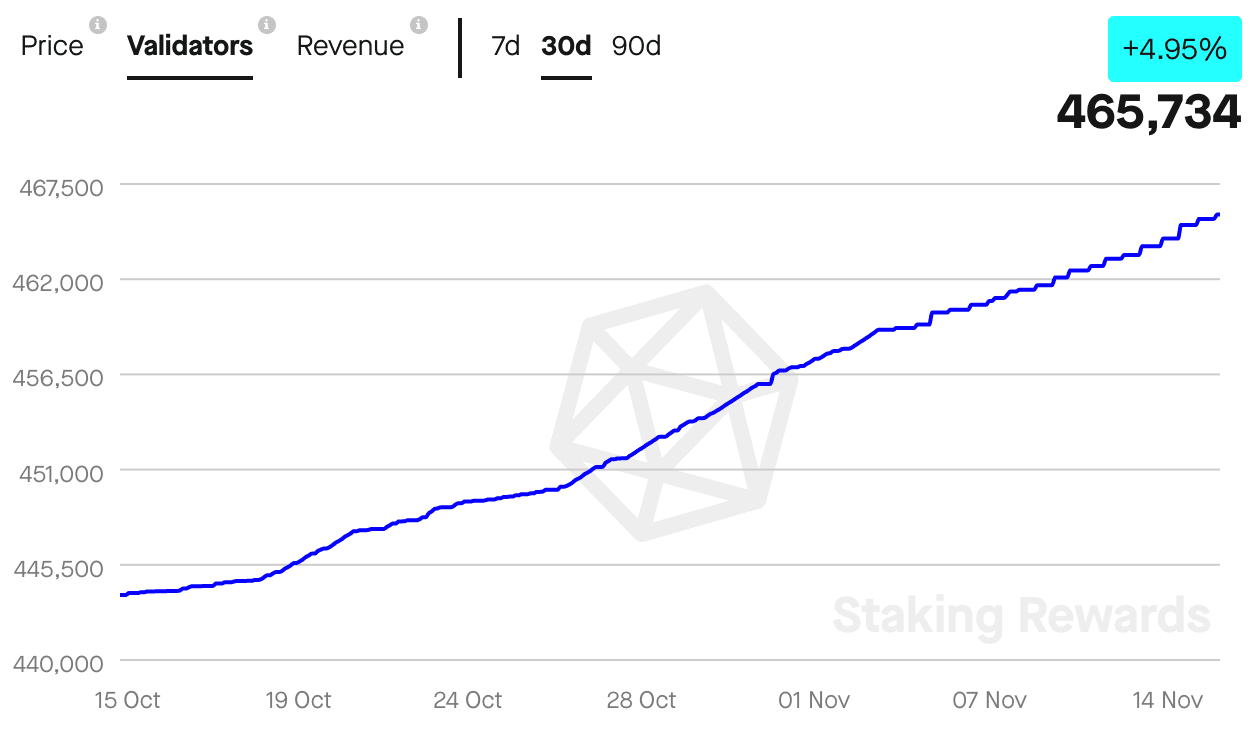

As per additional data from staking rewards, validators on the Ethereum network grew considerably over the past 30 days. It can be observed that the number of validators on the Ethereum network grew by 4.95%. Additionally, the total revenue generated by them appreciated by 34.56% during the same time period.

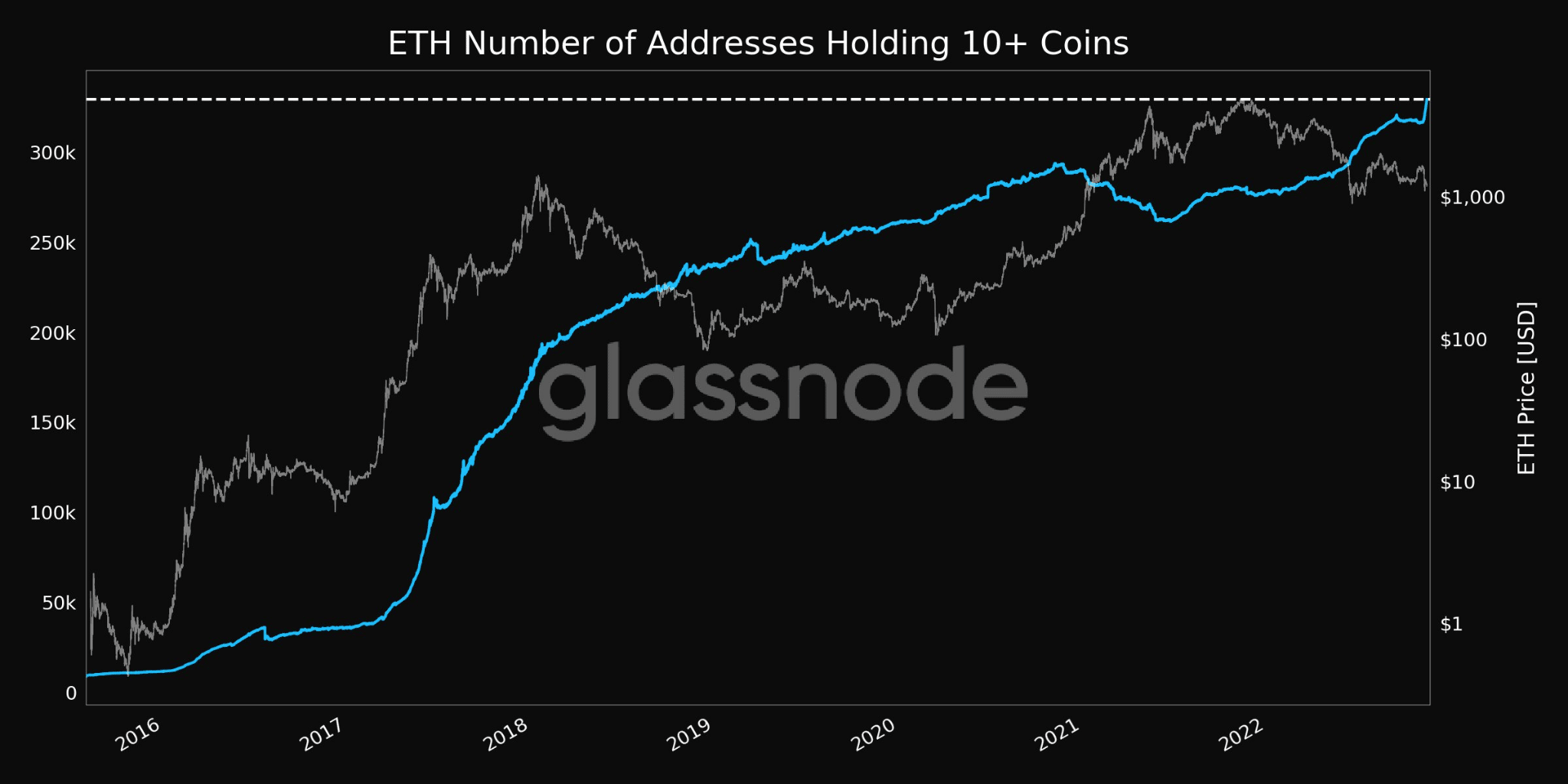

Along with validators, large investors started taking interest in ETH as well. As can be witnessed from the image below, the number of addresses holding more than 10 coins witnessed a massive increase over the past 30 days. Furthermore, addresses holding more than 10,000 coins witnessed a similar uptick.

According to data provided by Glassnode, the mean transaction volume for Ethereum reached a five-month high of $11,970 on 14 November.

In accordance with its mean transaction volume, Ethereum’s network growth appreciated as well. A spike in network growth would suggest the number of new addresses that transferred ETH for the first time had increased substantially.

However, during this period, Ethereum’s velocity declined. This indicated that the frequency at which ETH was being exchanged between addresses had decreased. The total NFT trade volume also fell, suggesting a decreasing level of interest in them.

It remains to be seen whether the spike in APR would attract more people to buy ETH for staking purposes.

At the time of writing, ETH was trading at $1,229.56 and had depreciated by 1.29% in the last 24 hours. However, its volume had appreciated by 28.68% during the same period, according to CoinMarketCap.