Lido outpaces competitors in May – the reason is clear

- Lido’s staking market share increased significantly from 29% at the start of the year to 31% at the time of writing.

- Lido had processed nearly 99% of its withdrawal requests at press time.

Lido Finance [LDO], the largest liquid staking protocol, made giant strides of late, emerging as one of the success stories of the decentralized finance (DeFi) ecosystem. The Rollup, a DeFi analytics company, reported that Lido’s revenue increased by 22% over the previous 30 days, the largest increase of any DeFi protocol.

Impressive growth by @LidoFinance as it sits among the biggest revenue generators in DeFi.

Data provider @tokenterminal shows its revenue has grown significantly in the past month and now has one of the most robust 30-day trends with an increase 22.6%. pic.twitter.com/i9I4JqnMxK

— The Rollup (Formerly DeFi Slate) (@therollupco) June 1, 2023

The surge in revenue came following the launch of its much-awaited version 2, which enabled users to withdraw their Staked ETH [stETH] to Ethereum [ETH]. The protocol’s revenue is a fraction of the staking rewards distributed to holders of the native token, LDO.

The king of DeFi

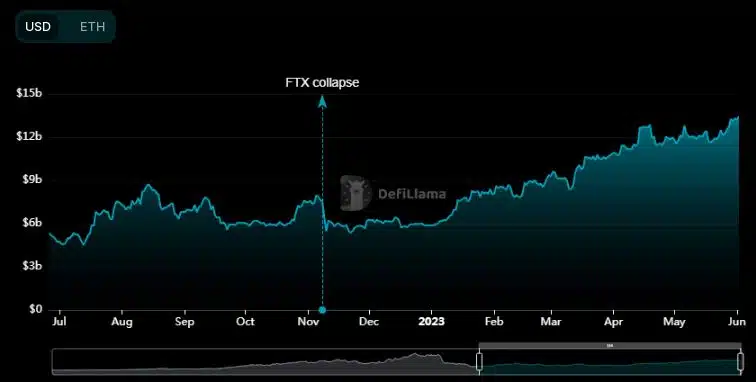

At the time of writing, Lido was the leading DeFi protocol with assets valued at $13.47 billion. According to DeFiLlama, this was more than twice the total value locked (TVL) of the second-ranked MakerDAO [MKR].

As evident, Lido’s TVL has been on a tear since the start of 2o23, bolstered by the hype and subsequent launch of the Shapella Upgrade. Since the launch of Lido V2, the TVL has climbed 15%.

As most of the liquidity on Lido consisted of ETH, the increase in TVL underlined that stakers came back to the protocol to lock more tokens.

This was further demonstrated by the steady increase in active protocol users over the last month, as indicated by Token Terminal.

The go-to platform for ETH staking

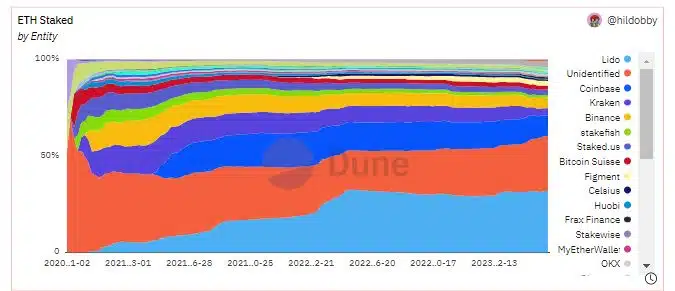

Lido was the undisputed leader when it came to Ethereum staking, The protocol’s staking market share has increased significantly from 29% at the start of year to 31% at the time of writing, according to Dune data. Coinbase was a distant second, with a little over 10% of the staking pie.

As of this writing, Lido has processed nearly 99% of its withdrawal requests, a feat accomplished in less than three weeks. This was largely achieved through Lido’s protocol buffer, which resulted in significant time savings and having to exit any of the validators on the network.

Realistic or not, here’s LDO’s market cap in BTC’s terms

LDO pumps, but…

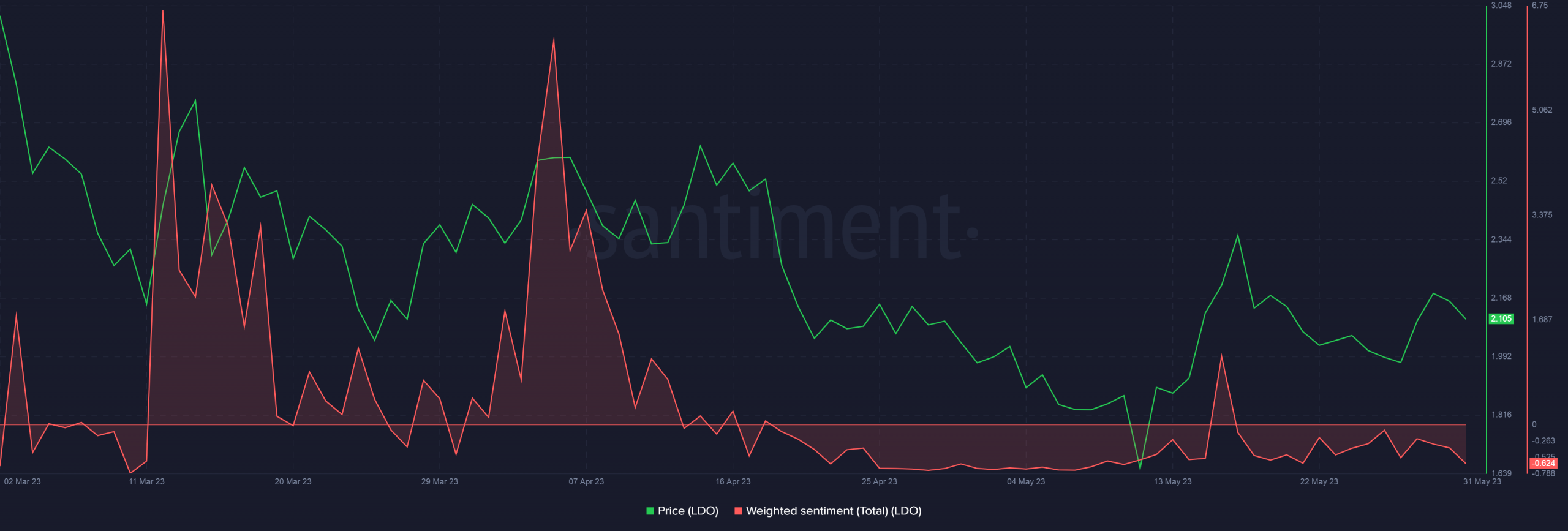

The enthusiasm around Lido spread to its native token LDO, propelling it to become one of the top gainers in the crypto market during the last week. LDO spiked 11.75% in the last 24 hours, exchanging hands at $2.3 at the time of writing, per CoinMarketCap.

Surprisingly, weighted sentiment for the coin continued to trend in negative zone, as per Santiment.