Lido witnesses surge in staked deposits: Will LDO’s growth be sustainable?

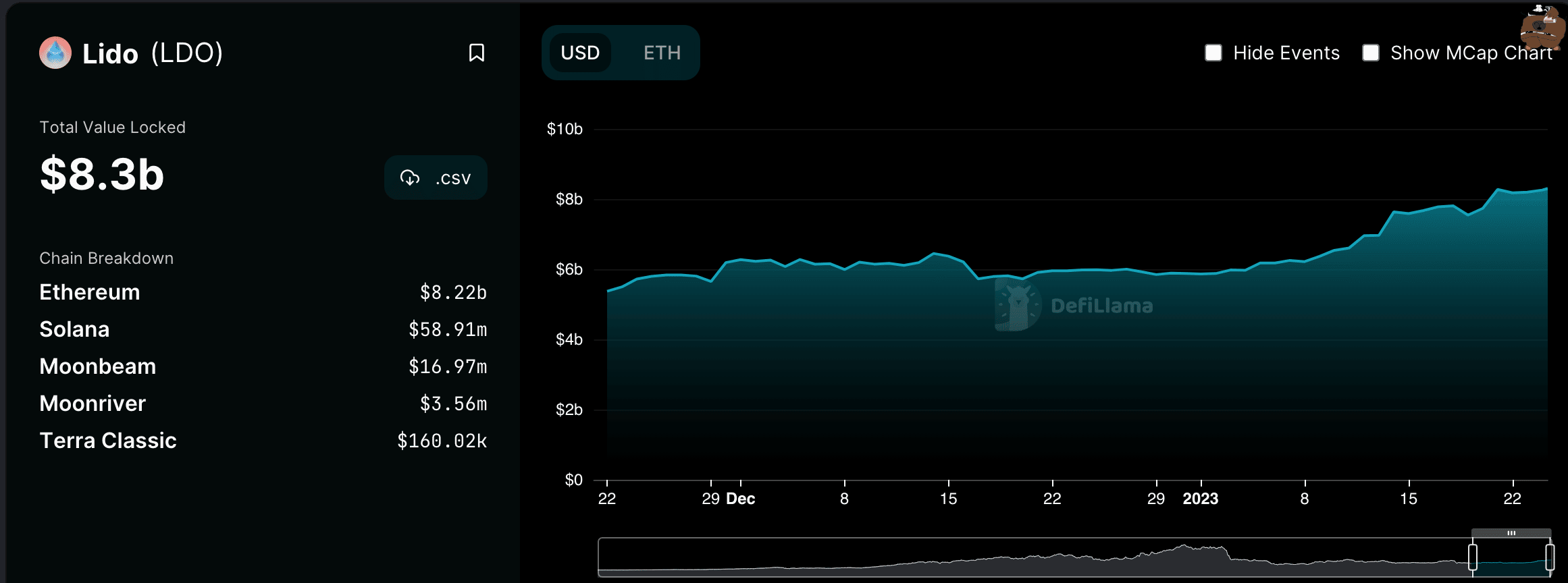

- Lido witnessed surge in staked deposits, TVL grew as well.

- Negative long/short difference suggested potential selling pressure as prices rose.

Over the last week, the Lido [LDO] protocol witnessed a surge in the number of staked deposits on its platform. According to a tweet on 24 January, the number of staked deposits on Lido increased, except that of Solana [SOL].

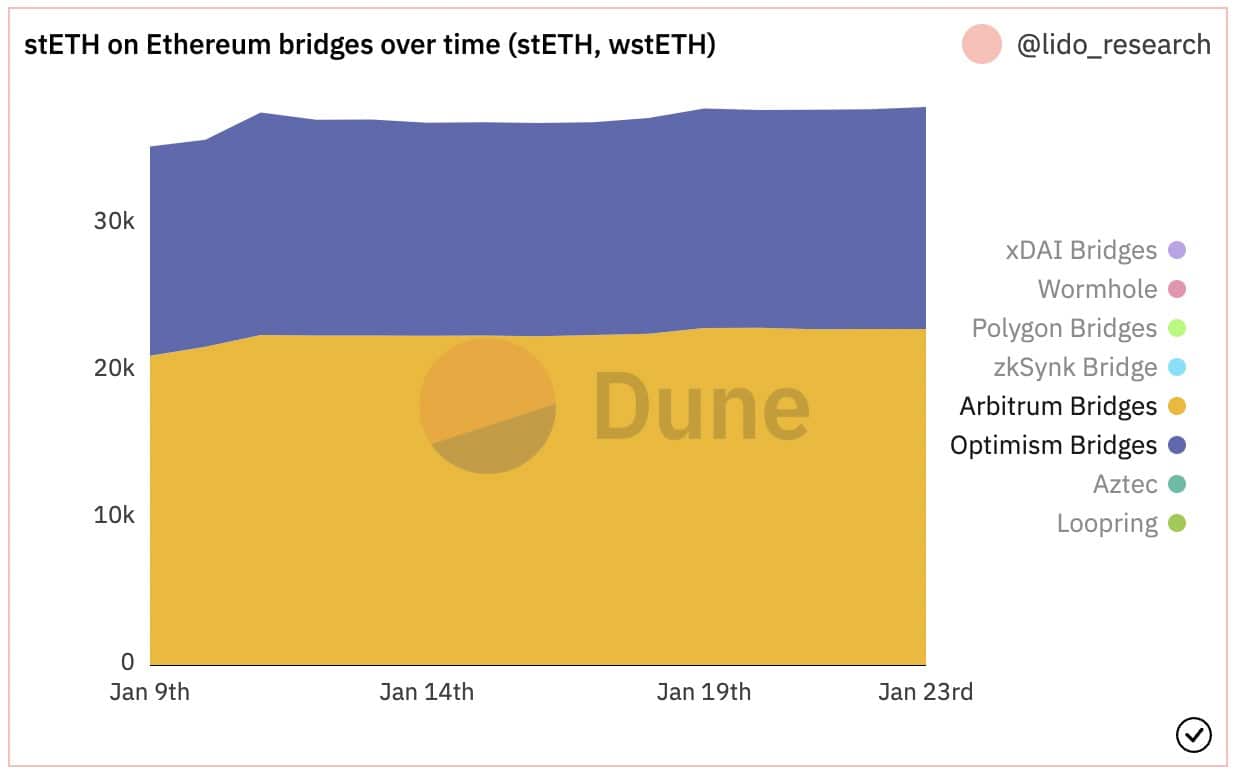

?️ Lido on L2

Following a wave of integrations and continued LDO incentives, wstETH continued its growth on L2:

– @arbitrum: 22,856 wstETH (7d: +2.01%)

– @optimismFND: 14,945 wstETH (7d: +3.03%) pic.twitter.com/1h10vbW0lN— Lido (@LidoFinance) January 23, 2023

How many are 1,10,100 LDO worth today

Thus, more users were choosing to stake their holdings through the Lido platform at press time, indicating that the protocol still had potential for growth.

Along with the surge in staked deposits, there was also growth observed in Layer 2 solutions. Specifically, Wrapped stETH [wstETH] increased by 2.01% over the last week on Arbitrum and by 3.03% on Optimism [OP].

This suggested that more users were turning to Layer 2 solutions to stake their assets and Lido was benefiting from this trend.

All of these factors impacted Lido’s TVL, which grew by 7.77% in the last week.

However, despite the growing TVL, the number of unique users on Lido declined. In the past month, the overall number of unique users on the Lido protocol fell by 7.31%. This implied that while more users are staking their assets on Lido, fewer were actively using the protocol and engaging with its services.

Even though the number of unique users on the protocol declined, the revenue generated by Lido increased by 6.31% over the last week, according to Messari. Thus, Lido was still generating income and could showcase growth in this area.

LDO faces pressure

These factors have contributed to the growth of the LDO token’s prices. However, the growing prices of the LDO token also impacted its MVRV, which grew alongside the LDO’s price. A high MVRV indicated that LDO holders would profit if they ended up selling their positions.

Is your portfolio green? Check out the Lido Profit Calculator

Additionally, the long/short difference was also negative, suggesting that most addresses holding LDO were short-term holders. These short-term holders could end up selling their positions for a profit and impact LDO’s prices negatively.

It remains to be seen how long Lido can retain its dominance and growth. At the time of writing, the price of LDO was $1.01 after increasing by 0.71% in the last 24 hours, according to CoinMarketCap.