LINK’s recent surges may fail to flatter investors because…

- Chainlink [LINK] attracts increased attention with a surge in social volume and development activity.

- Despite positive metrics, Chainlink’s price remains bearish, as indicated by the Relative Strength Index (RSI) line.

According to recent metrics, Chainlink [LINK] has emerged as a subject of increased interest amid the bustling crypto realm. How has this newfound attention influenced its price? Additionally, what factors might be responsible for the surge in attention from the crypto community?

Read Chainlink’s [LINK] price prediction 2023-24

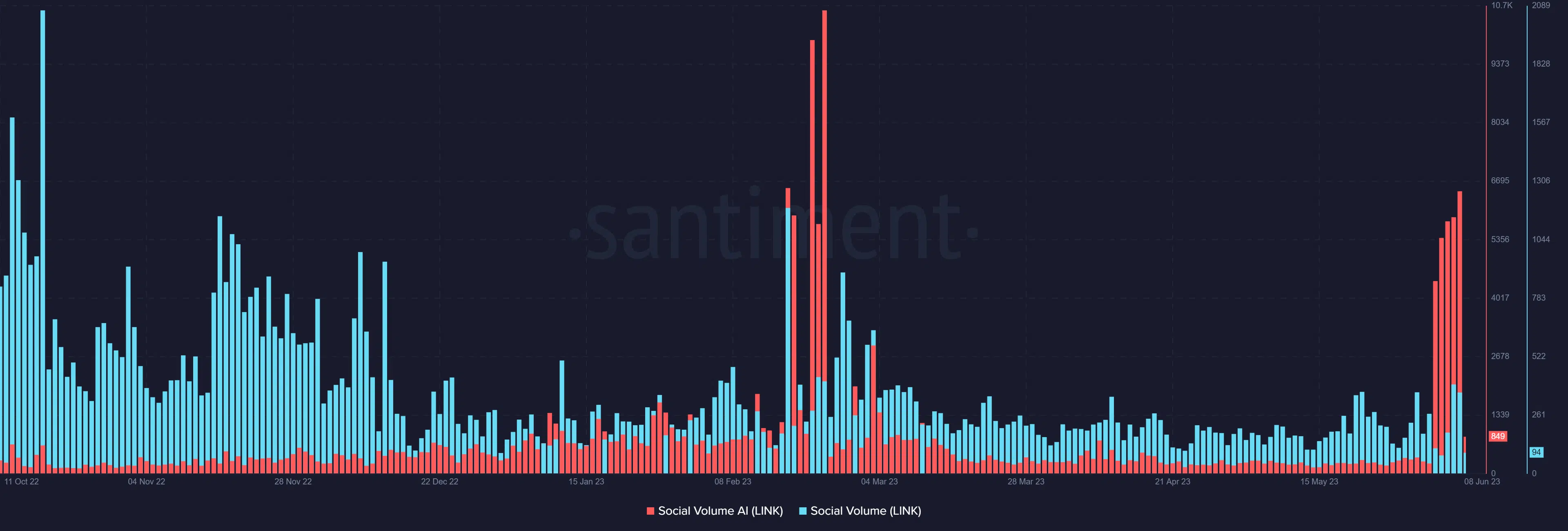

Chainlink sees a surge in social volume

Due to recent developments, Chainlink has recently garnered significant attention from the crypto community. According to data from Santiment, there has been a noticeable surge in the social volume surrounding Chainlink.

Santiment’s report revealed that this spike could be attributed to two key factors: the increasing demand for its oracle services and ongoing initiatives to reduce the operational costs of decentralized oracle networks.

Chainlink operates as a decentralized oracle network and cryptocurrency, primarily connecting smart contracts to real-world data. Establishing this crucial link, Chainlink enables smart contracts to interact with external systems and access off-chain resources. As of this writing, the development activity also surged.

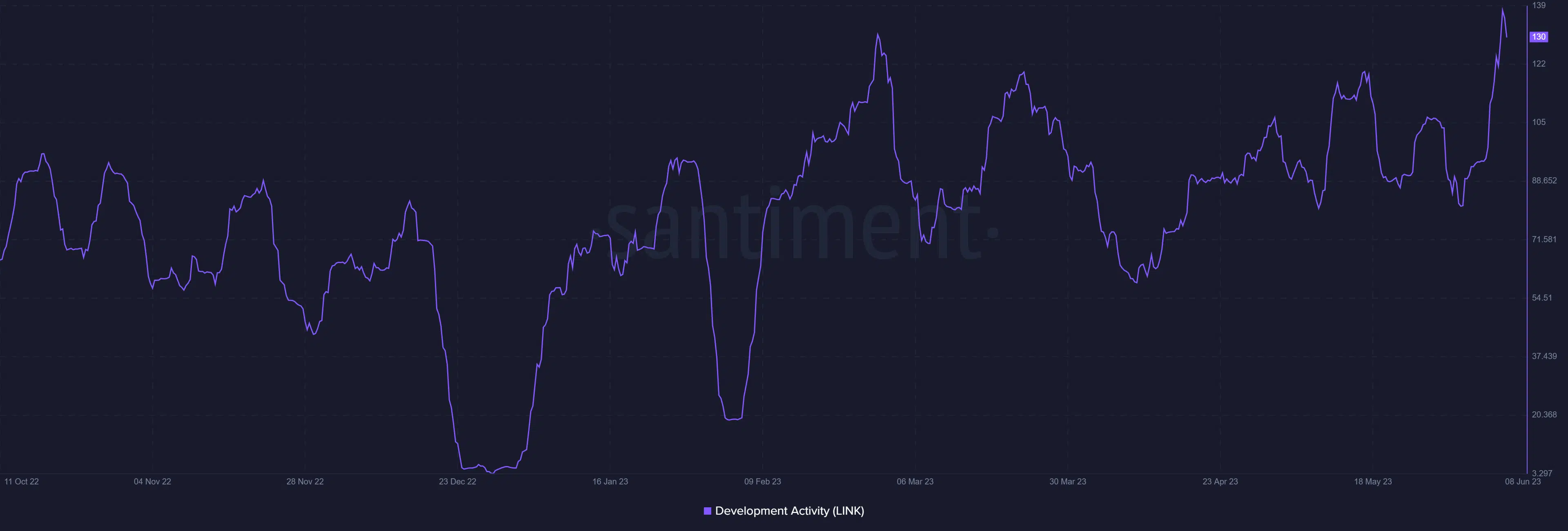

Chainlink’s development activity

Alongside the increase in social volume, another significant Chainlink metric that experienced a surge was development activity, as observed in the data from Santiment. The upward trajectory of development activity began around 4 June, which interestingly coincided with the news of the SEC lawsuit against major cryptocurrency exchanges, Binance and Coinbase.

This surge in development activity reached a level not seen in over eight months. This indicated a noteworthy rise in developer engagement within the ecosystem.

As of this writing, the development activity stood at 129, experiencing a slight decline from its peak of 139 on 7 June. According to Santiment’s analysis, this spike in development activity can be attributed to the increasing number of GitHub repositories that reference one or more Chainlink services.

How much are 1,10,100 LINKs worth today

LINK remains bearish despite positive metrics

Over the past few days, Chainlink [LINK] experienced a notable decline based on its daily timeframe chart. However, the downward movement saw a temporary pause during the observed trading period.

As of this writing, LINK was trading at approximately $5.9, showing a gain of over 1% from previous levels. Despite this slight recovery, it remained firmly within a bearish trend, as indicated by the Relative Strength Index (RSI) line below 40.