Litecoin attempts to steal Bitcoin’s thunder, but a pullback might be in the works

- Litecoin may be headed for a cliff as price to RSI divergence manifests.

- LTC metrics still highlight strong demand, but some whales are taking profits.

Litecoin [LTC] was taking advantage of its press time bull run to build a favorable image. Some might say that it was trying to steal some of Bitcoin’s [BTC] shine. In a tweet on 21 January, LTC listed five traits that made it appealing and set it apart from its contemporaries.

5 Things You Didn't Know About Litecoin⚡

1) Litecoin was the fairest coin launch ever

2) The founder is still involved

3) Litecoin now has over 141 million transactions

4) You can use Litecoin almost anywhere

5) Litecoin is 4 Times Faster than Bitcoinhttps://t.co/0Ke3pgpBEd— Litecoin (@litecoin) January 20, 2023

Read Litecoin’s [LTC] Price Prediction 2023-24

An important trait that Litecoin highlighted was that it was four times faster than BTC. While such a statement may come off as an attempt to make LTC appear more attractive compared to Bitcoin, it does not necessarily undermine the competition.

If anything, both cryptocurrencies have co-existed in the same market and one does not pose a threat to the other. Litecoin has so far delivered an impressive rally, but is it really a better option for this bull run?

Litecoin can stand on its own

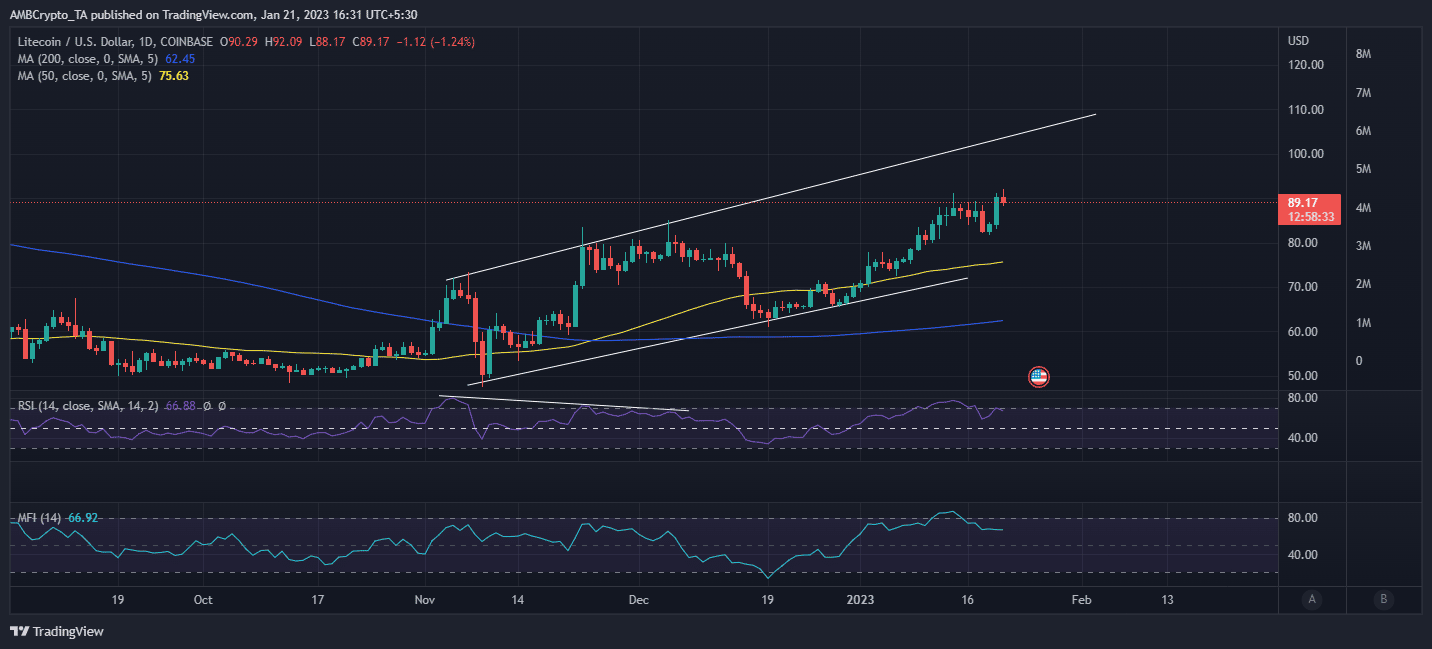

A look at Litecoin’s price action revealed that at the time of writing, it was up by roughly 51% from its lowest 12-month level in June 2022. In contrast, Bitcoin was up by 47% from its November 2022 lows. The former has been trading within an ascending price pattern. An extended upside should at least place it above $100 at the next ascending resistance level.

At press time, the price had some room before reaching the ascending resistance line. There was another observation that suggested that the sell pressure may start to hammer down on the price. Its new nine-month high, achieved in the last 24 hours, pushed above the previous high reached on 14 January.

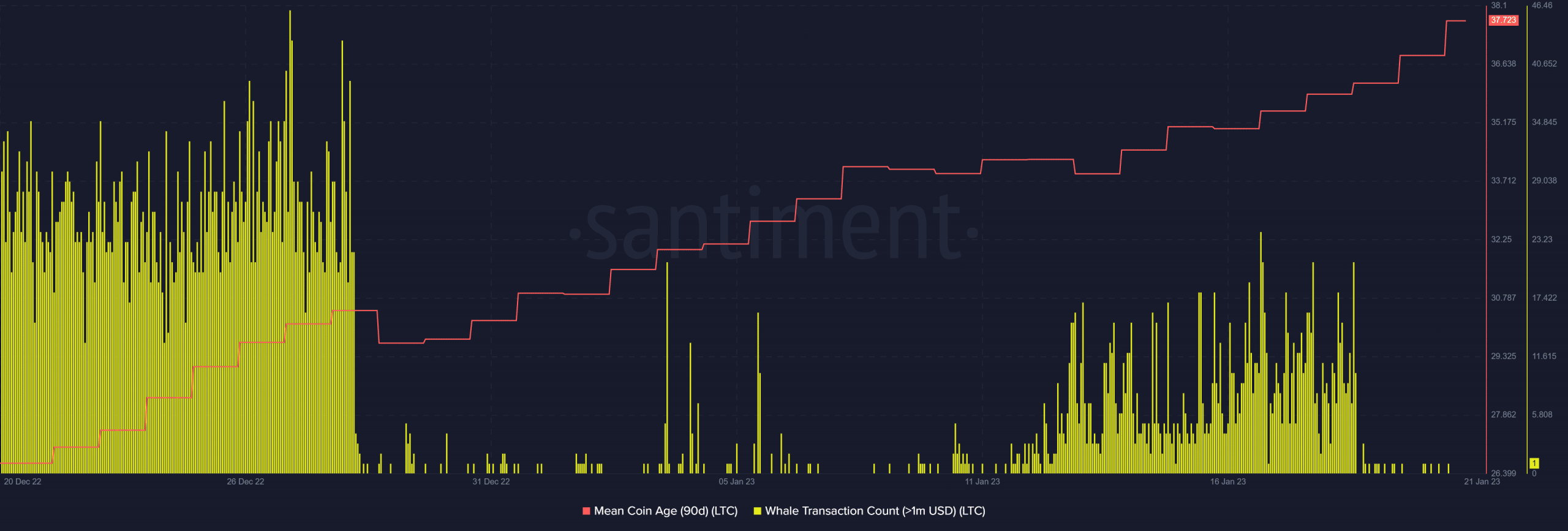

Meanwhile, both the RSI and MFI have experienced some slippage, indicating trend weakness. This observation revealed a price-RSI divergence, which was often a sign of an upcoming bearish move. LTC’s supply distribution showed that some of the largest and most dominant whales were selling already selling at the time of writing.

Realistic or not, here’s LTC’s market cap in BTC’s terms

Addresses holding between 100,000 and one million coins currently control the largest percentage of LTC’s supply. The same address category has been contributing to sell pressure for the last three days.

Despite this, the whale transaction count is still low, confirming that there is low sell pressure for now. The mean coin age metric is has also stuck to an upward trajectory, hence suggesting that investors are still holding on to their LTC coins.

The last time that Litecoin had a price to RSI divergence, there was a retracement in the following days. It might happen again in the next few days. However, investors have to consider that the market dynamics remained in favor of the bulls at press time despite overbought conditions.