Litecoin bulls step back due to descending triangle formation, forays into oversold realm

From a year high of $142 to in June 2019 to trading below $55 crucial resistance, the silver crypto was in bearish phase after a short period of consolidation. The latest price drop has pushed Litecoin to the sixth position as it continued to plummet aggressively against the US Dollar.

Litecoin lost over 3% in the last 24-hours and at press time, the altcoin held a market cap of $3.40 billion and was valued at $53.81. LTC registered a 24-hour trading volume of $1.89 billion; 6.5% was contributed by trading pair LTC/BTC at CoinEgg.

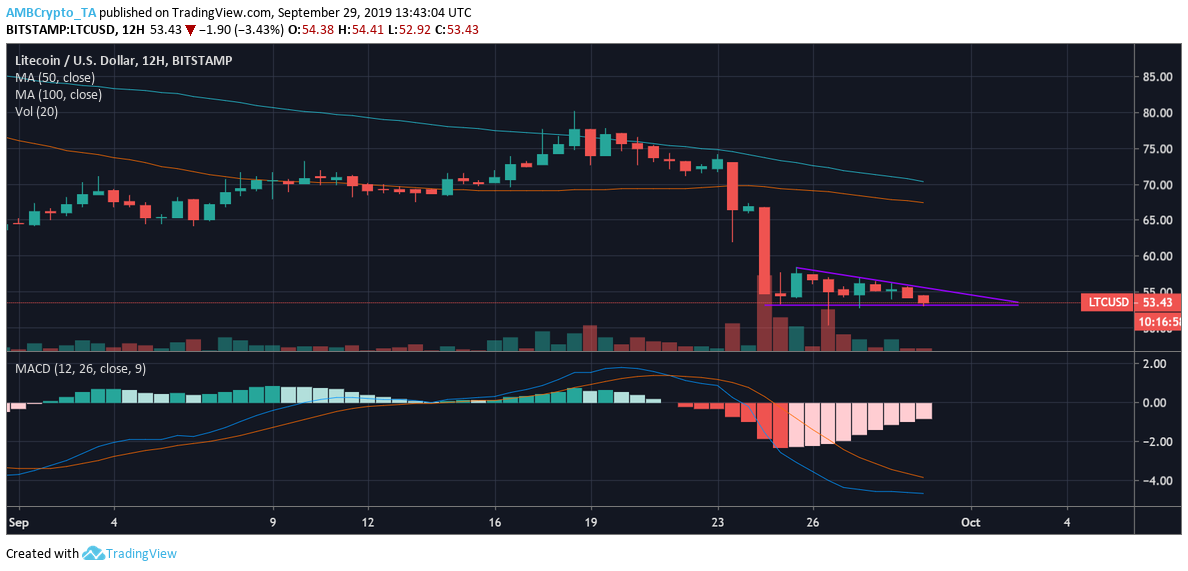

LTC 12-hour Chart:

Source: TradingView

12-hour LTC chart pictured formation of a descending triangle with price following a horizontal trendline at the bottom and the top sloping downward trendline. Higher highs were marked at $57.52, $56.12 and $55.50. The coin relied on the support levels at $54.56, $55.03 and $53.32. The declining volume accumulation in the price chart above predicted an approaching breakout. Following the completion of the descending triangle pattern, LTC may exhibit a bearish breakout.

The reading line of MACD indicator resigned to stay below signal line, depicting the altcoin’s inclination towards bears. Additionally, 50 moving average line also hovered below 100 moving average line further suggesting the dominance of bears.

Sell-off gains traction:

Source: TradingView

Litecoin was in the oversold zone with RSI indicator below 30-mark on September 29th. This implied an overselling sentiment among buyers despite a brief respite in the early hours. 21 moving average was way above the candlesticks which further depicted a stronghold of bears.

Conclusion:

A reversal in the trend at this stage was highly unlikely and the above charts and indicators predicted a highly bearish market sentiment for Litecoin. A further downward spiral could cause the coin to fall below the $50 support level.