Litecoin holders are in for a treat as LTC fractal forecasts a 45% ascent

Litecoin price shows a bullish breakout from a consolidation pattern that has formed over the past three months or so. Investors can position themselves long and await a massive run-up in the near future.

Bulls to trigger exponential run-up

Litecoin price action from 14 December, 2021, to 24 March, 2022, set up three distinctive lower lows and three lower highs. Connecting these swing points using two trend lines, result in the formation of a descending broadening wedge.

LTC broke out of this technical setup on 24 March by producing a daily candlestick close above the upper trend line. Moreover, the breakout was followed by a perfect retest, hinting that an uptrend is likely. The target for this technical formation is the highest peak of the broadening wedge – $163.

Therefore, market participants can expect Litecoin price to kick-start a 31% ascent. However, due to the inefficiency in the price move from 1 December, 2021, to 6 December, 2021, LTC create a fair value gap (FVG). Hence, clearing the $163 hurdle will open the path for Litecoin price to tag the $181.65 hurdle. This move, in total, would bring the total ascent to 45% and is likely where the upside is capped for Litecoin.

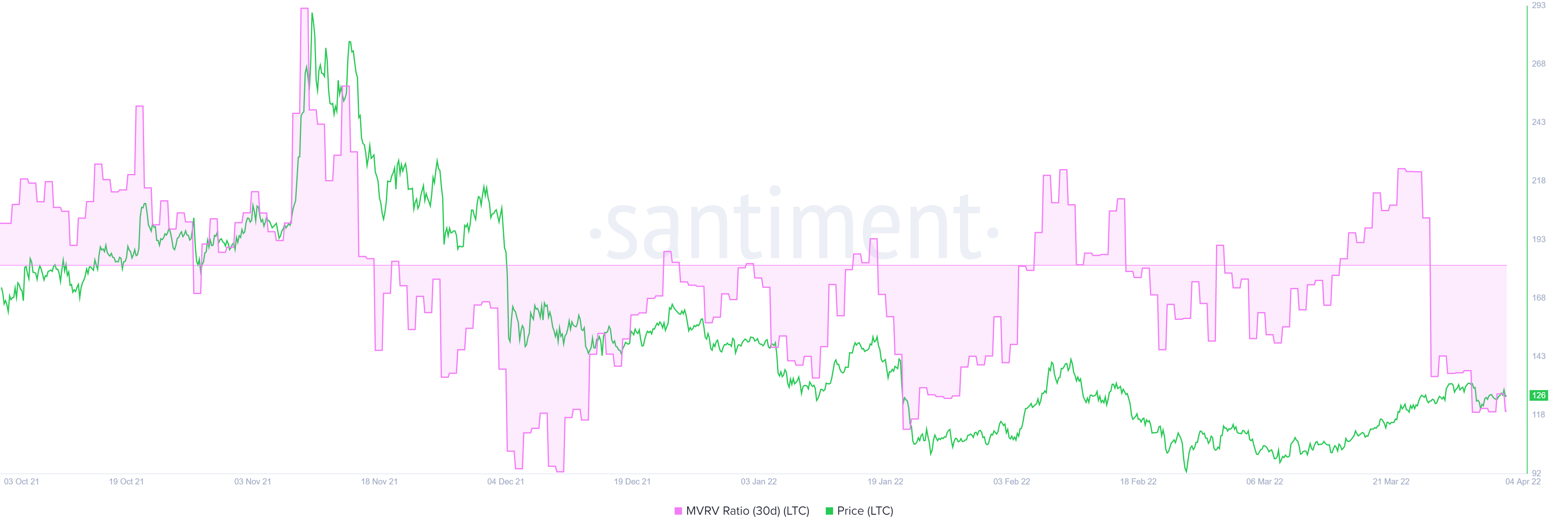

Supporting this massive uptrend for Litecoin price is the 30-day Market Value to Realized Value (MVRV) model. As mentioned in previous articles, this indicator is used to assess the average profit/loss of investors that purchased LTC tokens over the past month.

A value below -10% indicates that short-term holders are selling at a loss and is typically where long-term holders tend to accumulate. Therefore, a value below -10% is often referred to as an “opportunity zone,” since the risk of a sell-off is less.

For Litecoin price, the 30-day MVRV is hovering at -15%, indicating that the short-term holders are selling at a loss. Moreover, LTC has bottomed around this area and triggered an uptrend twice when MVRV has hit -15% in the last four months.

Hence, this setup suggest that Litecoin price is primed for an uptrend, which interestingly coincides with the outlook observed from a technical standpoint.

This outlook matches the bullishness seen from a technical perspective. Therefore, interested investors can keep a close eye on this altcoin and start accumulating the dips.