Litecoin [LTC]: Your take-profit targets can be a revisit of this area

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

Coinglass data showed $364 million worth of liquidations over the past 24 hours. This came in the wake of a 7% drop in Bitcoin’s [BTC] price within the past day.

Litecoin [LTC] followed in the footsteps of Bitcoin, alongside the rest of the altcoin market. The longer-term view for Litecoin was to look for opportunities within the range LTC established over the past three months.

LTC- 1-Day Chart

The range (yellow) that Litecoin established in May and June remained unbroken. Moreover, the mid-point of the range lay at $54. At the time of writing, LTC appeared to slip beneath the midpoint and toward the support at $52. This support level was only a short-term one, and Litecoin could easily plunge further.

A daily session close beneath the $54 mark would open up a shorting opportunity. The short positions can set their stop losses just above the $55 mark. Take-profit targets would be a revisit of the $42-$44 area.

Rationale

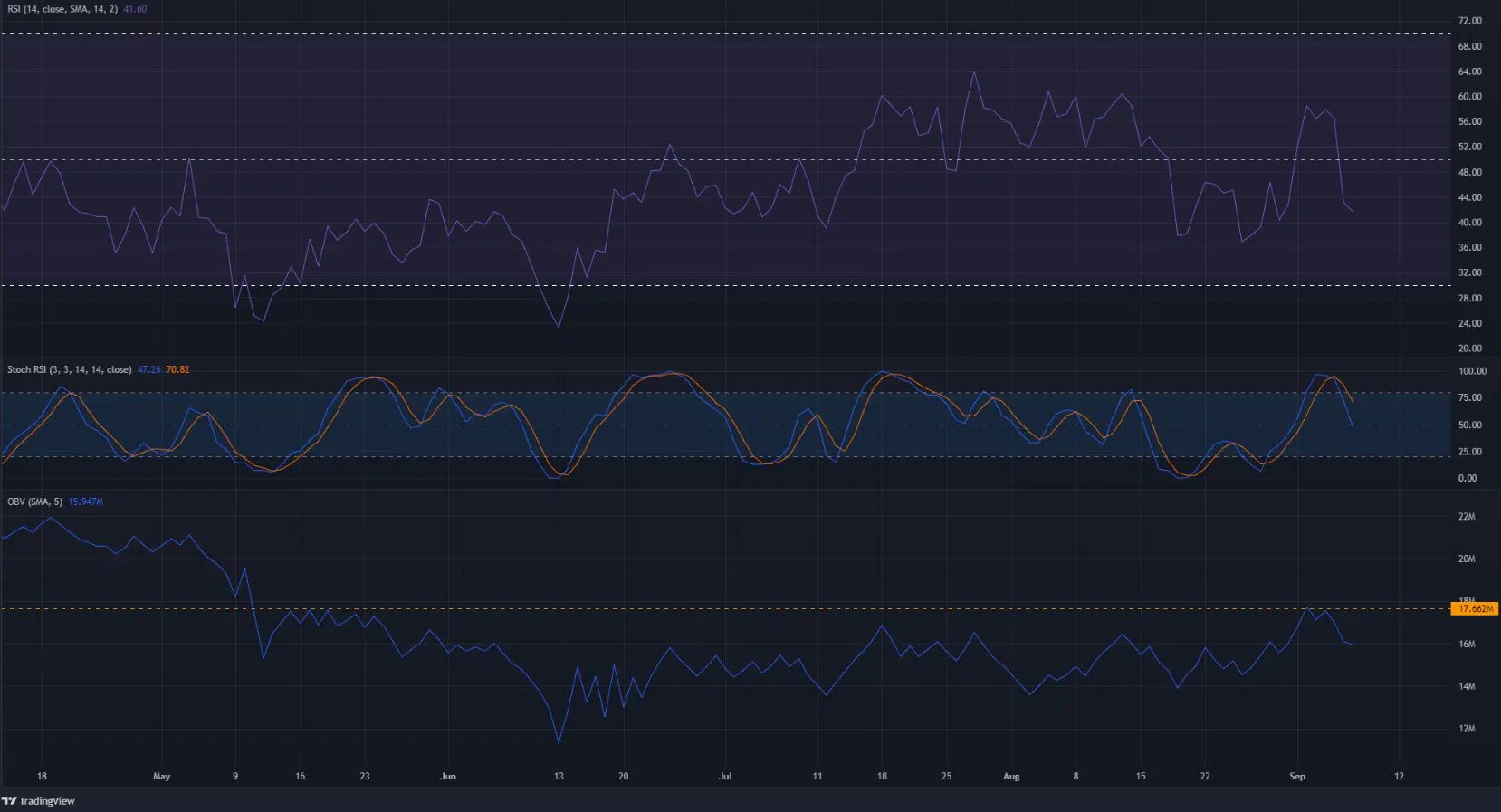

The Relative Strength Index (RSI) on the daily chart has oscillated from 60 to 40 over the past two months. This indicated the lack of a strong trend behind Litecoin on the daily timeframe. Given the formation of the range, this finding was coherent. It also supported the idea that a break out from the range was not yet visible.

The Stochastic RSI formed a bearish crossover in overbought territory and plunged lower. Combined with the RSI’s fall beneath neutral 50, the momentum behind LTC has flipped to bearish.

The On-Balance Volume (OBV) made some gains in August but was unable to pierce a resistance level from May. It faced rejection at this level once more and fell lower. Sellers were dominant once more and further losses in the market were likely.

Conclusion

A buying opportunity would arise on a revisit to the $42-$44 area. The risk-reward would be much better at that point for longs. In the next week, Litecoin has a bearish bias if it can not climb back above the $54 mark.

Bitcoin was not particularly strong either, but it did have support near the $18.5k and $17.8k levels. A bounce for Bitcoin could see some relief for Litecoin as well.