Why Ethereum stands at last spot in staking race of PoS chains

What would happen to staking rewards on the post-merge Ethereum [ETH] proof-of-stake blockchain? Any idea? Consider the following scenario then.

Staking is one of the most awaited features of the post-Merge Ethereum network. According to IntoTheBlock, initial estimates claimed staking would give users between 12% and 15% in rewards. However, it seems like the percentage would fall lower after the Merge.

Could this explain ETH’s downtime in the staking game?

Worth waiting till the end

The significant growth of staked ETH has accelerated since the launch of stETH, a staking derivative token. But at the same time, the rise in staked ETH caused rewards to decrease proportionally. As a matter of fact, the Ethereum staking reward would fall between 6% and 8% post the Merge.

This is the reason why stakers backed out or rather plan to back out from the network. To support the former, Messari’s insight could be of use here.

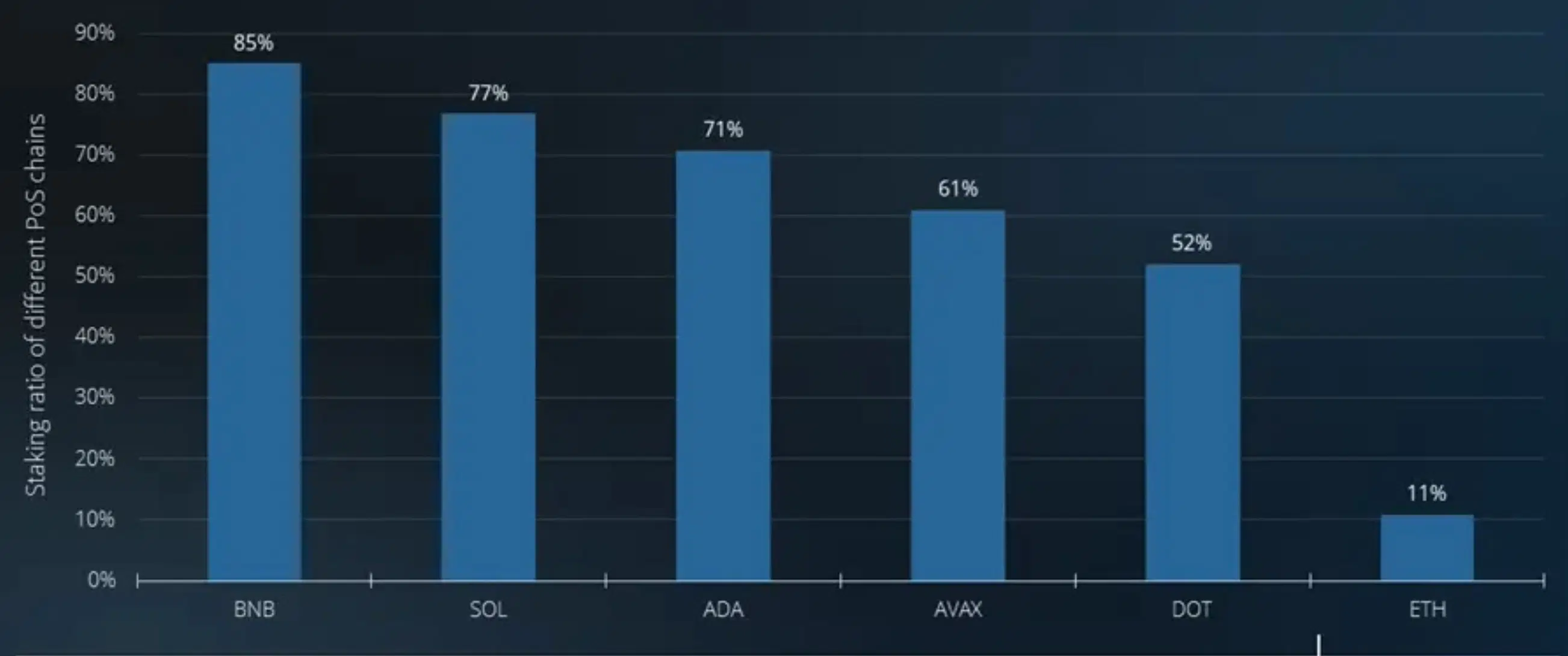

At present, ETH had a low staking ratio compared to other PoS chains like Binance (BNB chain), Solana, Cardano, Avalanche, and Polkadot. Here’s the graph to quantify the ratio.

It’s quite clear that in the staking race of different PoS chains, ETH stood at the last spot with an 11% rate. Could this become better? Potentially yes. “After the Merge and the Shanghai upgrade, the ratio should settle at a value similar to other Proof-of-Stake (PoS) networks,” Messari analyst added.

But for now, things didn’t go quite well.

Doubling down on the fall

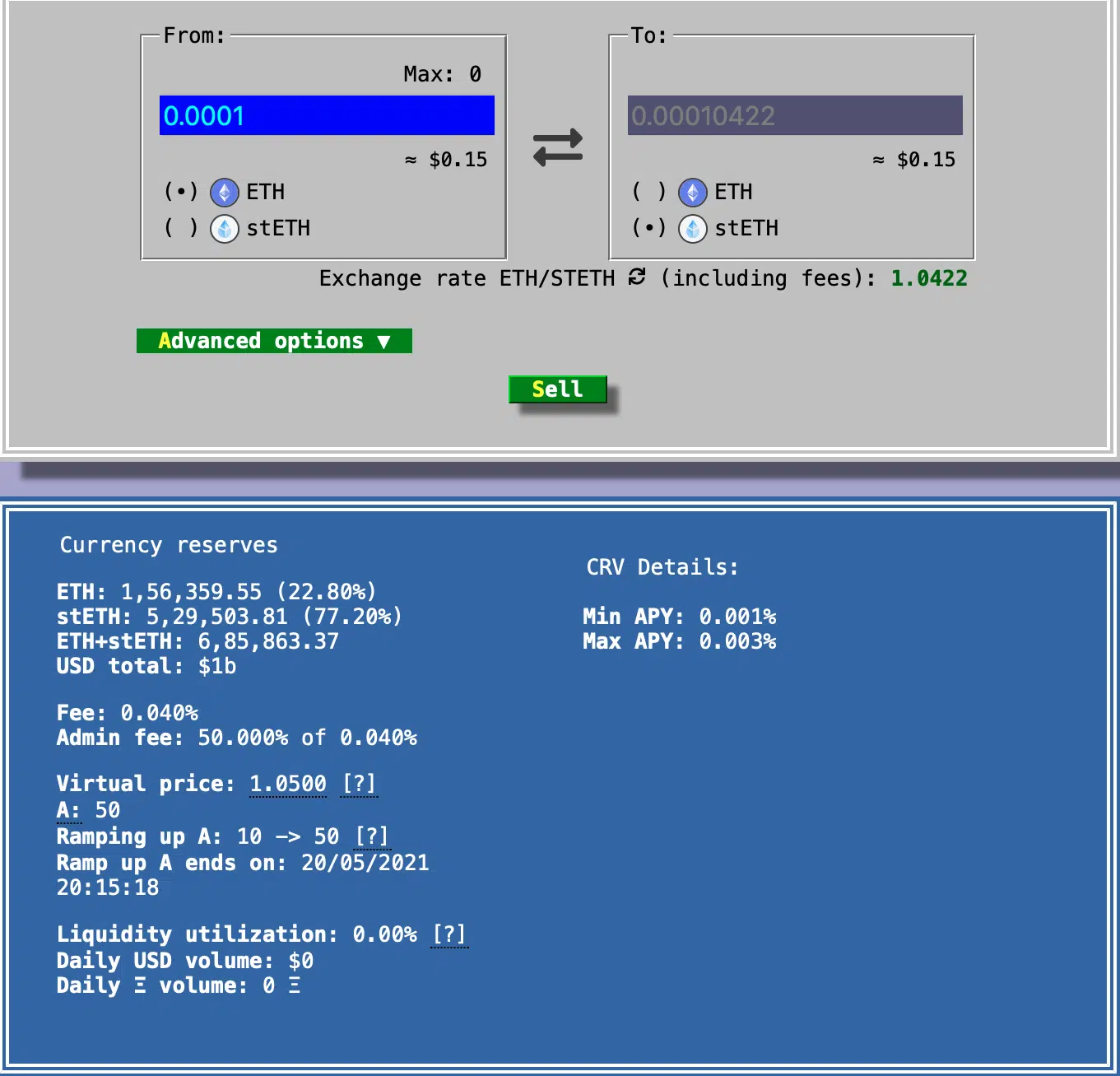

The stETH exchange price on Curve dropped to 0.9585 ETH. Currently there were 155,860 ETH (accounting for 22.72%) and 530,141 stETHs (accounting for 77.28%) in the current pool.

This could come as a major shock to some. Consider this, just two months ago, more and more transactions swapped ETH for stETHon Curve Finance than the other way around. This means that people bought stETH at a major discount.

I want out- regardless

That being said, there are some concerns related to the staking rewards. Following the fall in staking rewards, dominant holders did try their hands at moving their staked ether across different wallets.

For instance, a wallet belonging to insolvent crypto hedge fund Three Arrows Capital removed $33 million worth of staked ether (stETH) from the Curve pool, according to on-chain data.

As per a Dune dashboard, 29,435 CRV worth $34k and 31,276 LDO worth $69k were also swapped on CoW Swap. The hedge fund is most likely to convert the holdings into Ethereum [ETH] and transfer funds to other wallets.

But again, the aforementioned narrative(s) could see a turnaround after the Merge as the yields would be higher and anyone would be able to stake accordingly.