Litecoin: MWEB developer releases new updates and this is how LTC responded

- LTC registers promising gains as the date of halving approaches.

- Market indicators revealed that the bulls were leading.

David Burkett, MWEB developer, posted new updates related to the Litecoin [LTC] network. Burkett mentioned that he continued working on PSBT, and quickly discovered some limitations in the initial design.

He was able to add signing logic for inputs and outputs. Write the transaction finalization logic. Moreover, Burkett also added that he will be taking some time off, so there will not be any January updates.

The latest update from #MWEB developer @DavidBurkett38 is now available: Continuing the working on PSBT format for hardware wallets including:

✔Add signing logic for inputs and outputs

✔Write the transaction finalization logic

✔Implement component “merging”#Litecoin⚡ https://t.co/GkO4Qbushv— Litecoin (@litecoin) January 15, 2023

Read Litecoin’s [LTC] Price Prediction 2023-24

A month full of greens

Thanks to the bullish market, LTC investors had a great time last month as LTC’s price surged. CoinMarketCap’s data revealed that LTC registered over 6% weekly gains, and at the time of writing, it was trading at $87.96 with a market capitalization of more than $6.33 billion.

As the day of LTC’s halving is approaching, this new year might have even better days in store for Litecoin.

The Litecoin Halving Countdown.. Only 200 days!!

⚡84,000,000 Max Supply

⚡2.5-minute block intervals

⚡Halving event every 4 years

⚡Become scarcer over timeLearn more: https://t.co/u1l4qESPGS #LitecoinFACT #Litecoin $LTC #POW #Halving pic.twitter.com/LOdb53FZ70

— Litecoin Foundation ⚡️ (@LTCFoundation) January 14, 2023

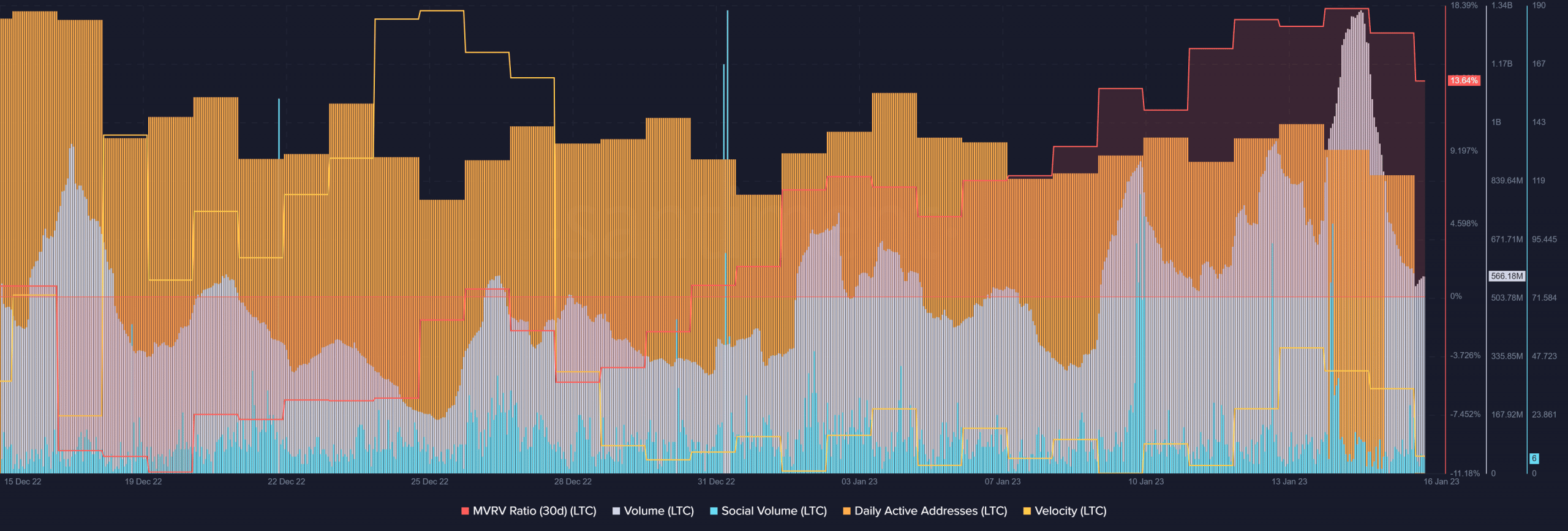

The token also remained pretty active on its metrics front, which might have played a key role in its price pump over the last few weeks.

LTC’s MVRV Ratio increased steadily, which was bullish. Litecoin’s volume followed a similar route and went up. The social volume also spiked quite a few times, reflecting LTC’s popularity.

Moreover, the daily active addresses on the LTC network remained consistent, which indicated a stable number of users on the network. The concerning factor was the network growth, which went sharply down.

Realistic or not, here’s LTCs market cap in BTC’s terms

The bulls are hard to beat

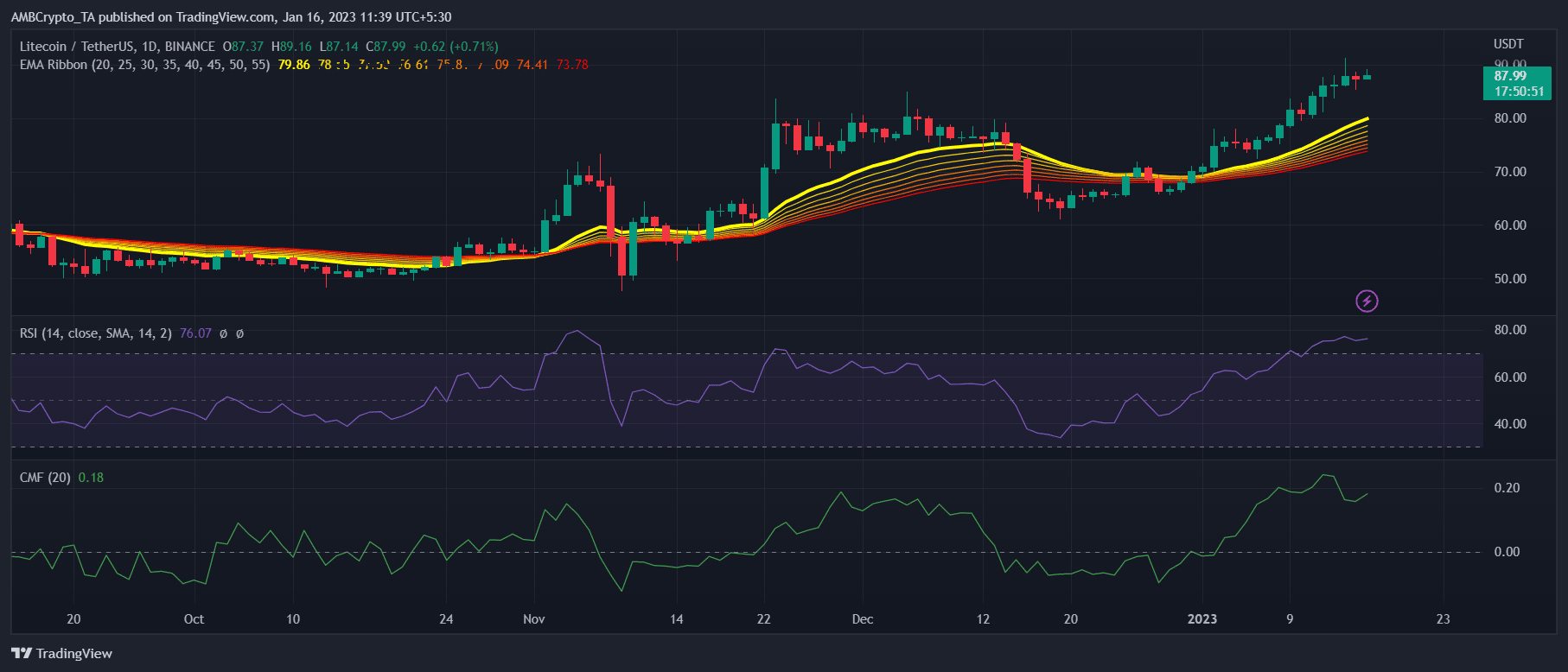

LTC’s daily chart revealed a massive bullish advantage in the market as most of the indicators were in buyers’ favor. As per the Exponential Moving Average (EMA) ribbon, the 20-day EMA was well above the 55-day EMA, suggesting a continued uptrend.

The Chaikin Money Flow (CMF) was also resting above the neutral mark, which looked bullish. Nonetheless, the Relative Strength Index (RSI) was in the overbought zone, which might lead to an increase in selling pressure.

![Aptos [APT]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-12-1-400x240.webp)