Litecoin registers this milestone despite a huge liquidity plunge

- Litecoin maintains strong transaction volume on BitPay earning second place after Ethereum.

- LTC bears dominate while the network hash rate takes a stab at historic highs.

Litecoin (LTC) is celebrating another win despite the ongoing market turmoil. The network’s latest update confirms that it has maintained its transaction consistency on BitPay.

Is your portfolio green? Check out the Litecoin Profit Calculator

The Litecoin network had the second highest number of transactions in the last six months, only second to the Bitcoin network.

It maintained this consistency in February during which it controlled 23.71% of all the transactions on BitPay. The analysis reveals that it outperformed Ethereum and the top altcoins.

Litecoin transactions on the world's largest cryptocurrency payment processor have grown to make $LTC by far one of the most consistently transacted crypto this month and every month. #Litecoin & @BitPay making it easier to #PaywithLitecoin pic.twitter.com/uCvcQRqSCQ

— Litecoin (@litecoin) March 9, 2023

While this is a win for the Litecoin network, it did not prevent LTC from tumbling. The market experienced its most bearish week in 2023, leading to a lot of downsides for most of the top cryptocurrencies.

How has Litecoin faired during the latest market conditions?

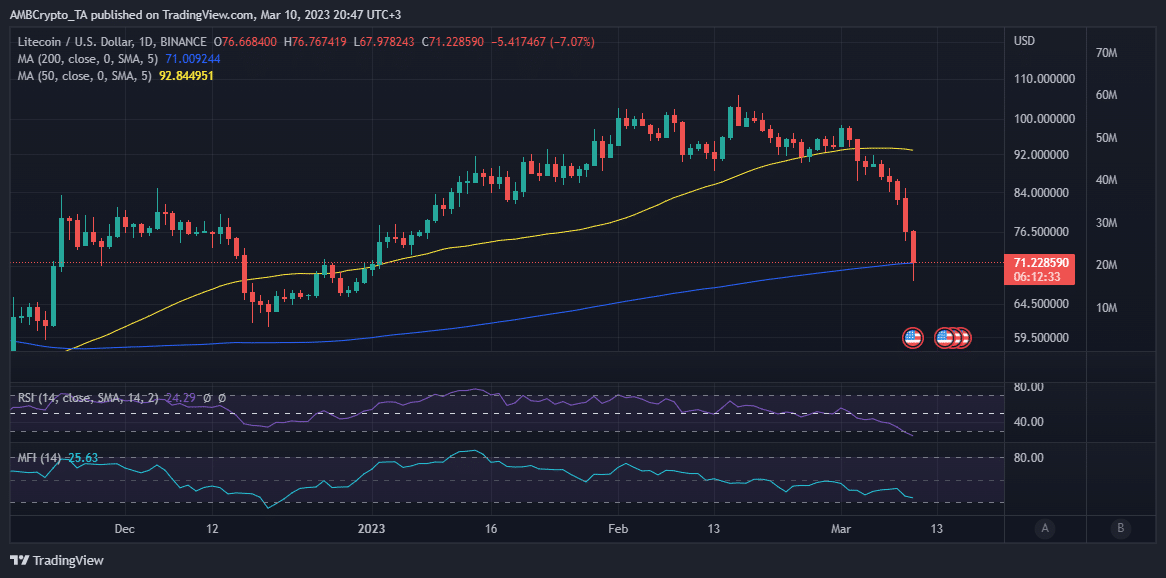

Litecoin was hit hard by heavy liquidity outflows since the start of March. It has already tanked by 30% in the last 10 days. The selling pressure has particularly intensified this week courtesy of the extensive bearish assault that has played out.

Litecoin’s sell pressure was strong enough to push below the 200-day moving average, albeit briefly. It managed to pull back above the same indicator at the time of writing. However, the price remains within the oversold territory.

How many are 1,10,100 Litecoins worth today?

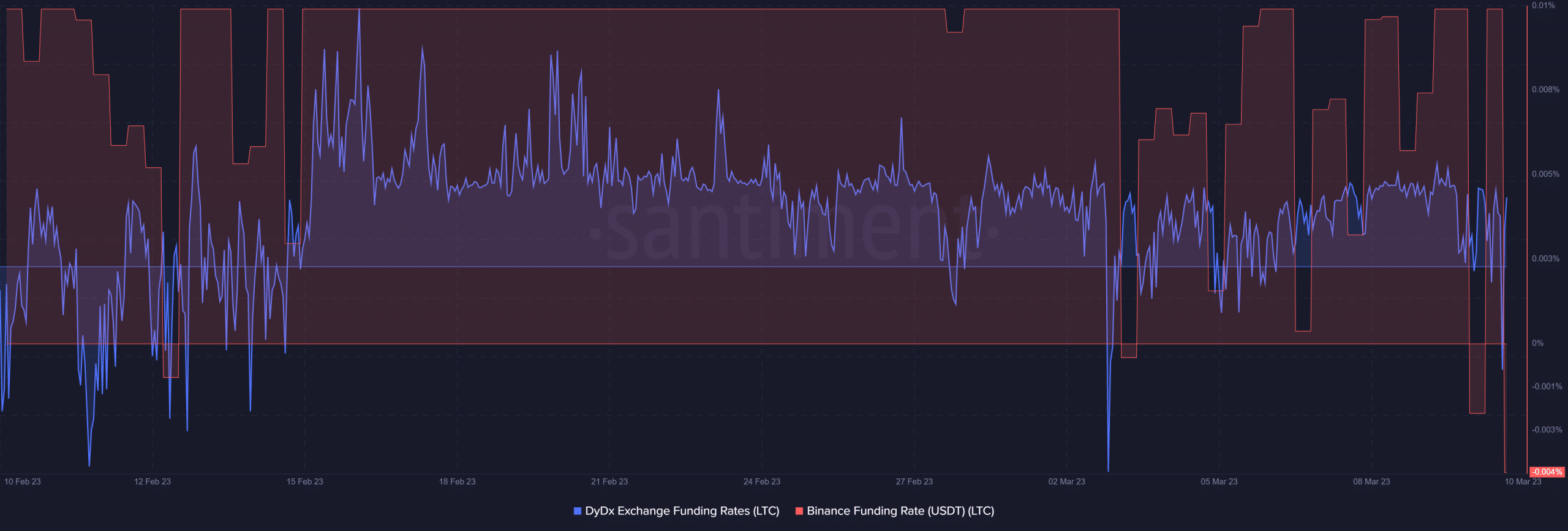

LTC’s price is not the only aspect of the cryptocurrency that has been experiencing a downside. The demand for cryptocurrency tanked this week, in line with the spot market performance.

Both the Binance and DYDX funding rates were down, especially in the last 24 hours.

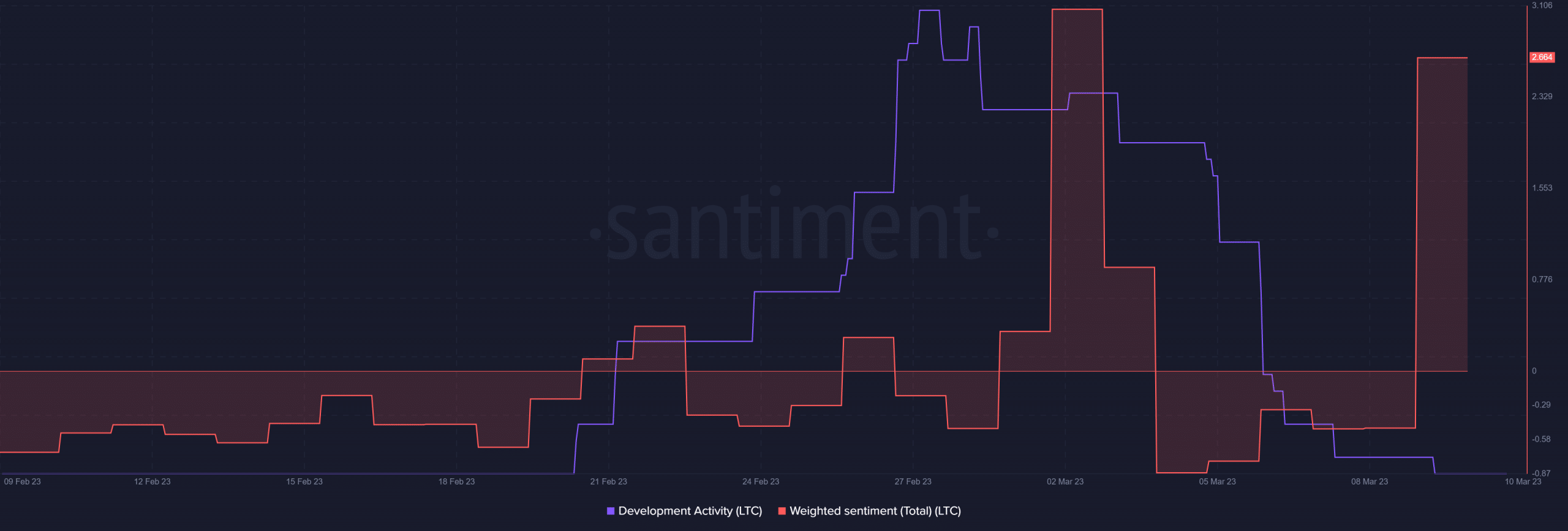

Litecoin’s development activity experienced a revival in the last week of February.

However, it was short-lived and has since then tanked back to its monthly lows. A potential reason for a negative impact on investor sentiment. Speaking of, the weighted sentiment also tanked at the start of March.

Despite the shortcomings in the development activity and the heavy price discount, Litecoin’s weighted sentiment registered a large uptick in the last two days.

This was a confirmation that investors now perceive LTC as heavily oversold.

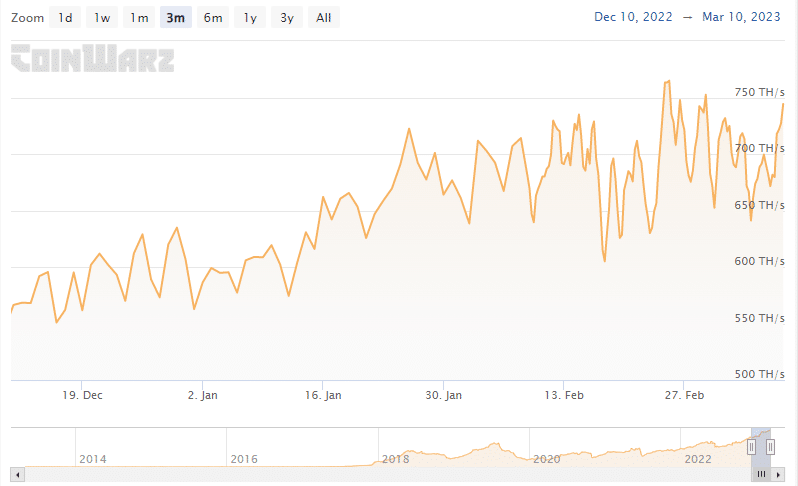

On the other hand, Litecoin is also looking good in terms of its hash rate. The latter has been improving for the last few months. It peaked at 764 TH/S in February before dropping below 650 TH/S briefly earlier this week.