Litecoin strengthens as LTC suffers. Will the halving alter the scenario?

- LunarCrush reports indicate Litecoin concluded July with strong network activity.

- LTC struggled to deal with short-term selling pressure leading to a price correction.

Litecoin [LTC] is now a few days away from its most anticipated upgrade of 2023. The hype has been building up but the expected impact has so far turned out disappointing. However, new reports suggested that network activity has been improving.

Is your portfolio green? Check out the Litecoin Profit Calculator

LunarCrush recently conducted an assessment of the Litecoin network revealing some interesting findings. According to the findings, the network demonstrated increased activity, especially in terms of social engagement.

The latter was an expected outcome considering the network’s proximity to the highly anticipated halving.

? Litecoin activity is leading the market right now.

?An analysis…

1⃣ A major social engagement spike to 2.16M social engagements within one hour occurred. This measures the depth of activity around social posts. Things like retweets, comments, etc. are included here to… pic.twitter.com/GY6qCLVR9S

— LunarCrush (@LunarCrush) July 30, 2023

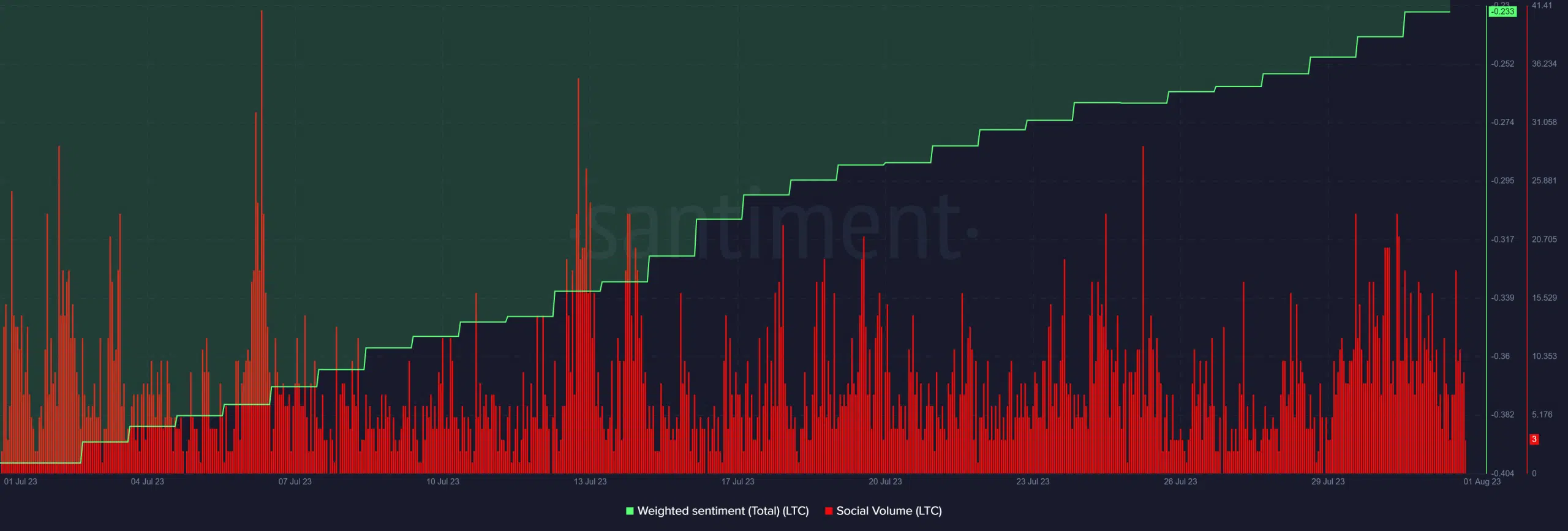

Litecoin reportedly secured the top ranking on LunarCrush thanks to a combination of robust trading activity and strong social activity. A quick glance at Litecoin’s social volume confirmed that it maintained healthy activity in the last four weeks.

Furthermore, investor sentiment has remained high. This indicated that many LTC holders remain optimistic about the coin’s prospects.

As far as network activity was concerned, transaction volume enjoyed a bit of a boost in the last week of July. This was likely associated with the spike in daily active addresses observed during the same period.

A struggle for LTC

LTC investors did observe a bit of bullish momentum in the last week of July. Unfortunately, it turned out to be a short-lived uptick followed by another pullback to the 200-day moving average. LTC exchanged hands at $90.99 at press time.

The above outcome confirmed that LTC was still a victim of short-term sell pressure. On the other hand, we have observed strong support just below the $88 price level, which means there is a psychological buy zone within the same price level.

This was further backed by the fact that the Money Flow Index (MFI) indicated that LTC was still holding on to most of the incoming liquidity despite the short-term sell pressure. The MFI may indicate that there is accumulation taking place which may explain its uptick over the last few days.

However, the level of on-chain volume still stood low, explaining why LTC bulls have been struggling.

Furthermore, it was observed that whales have been suppressing LTC’s potential upside over the last few weeks. That remains the case as seen in the cryptocurrency’s supply distribution metric.

The same metrics indicated that addresses holding between 10,000 and 1 million LTC have been offloading some coins in the last two days.

Read about Litecoin’s price prediction for 2023/2024

The same supply distribution observation underscored the main reason why we haven’t seen a major rally yet. LTC whales are still taking advantage of robust exit liquidity, hence contributing to selling pressure that is suppressing the potential upside.