Litecoin, VeChain, Algorand Price Analysis: 02 January

Litecoin and VeChain lacked momentum in the market and appeared to be in a phase of consolidation and saw low trading volume. Algorand saw a breakout to the upside and targeted the $0.54 level.

Litecoin [LTC]

Source: LTC/USD on TradingView

Litecoin struggled to break past the $130 mark over the past few days. Its bullish momentum appeared to be spent on the shorter timeframes, as the 4-hour MACD formed a bearish crossover a few days ago and was at the neutral line at the time of writing.

The $123 level of support has held strong over the past week, but a move beneath this level could see LTC correct to $115 or $108 in the coming days. This dip, if it occurs, can be expected to reverse given the bullish sentiment behind LTC over the past month.

A surge past $130 on good trading volume, conversely, would indicate that $142 is likely to be tested.

The previous move to $140 had faced rejection, and the low trading volume over the past few days suggested that the market was gathering steam for its next move.

VeChain [VET]

Source: VET/USDT on TradingView

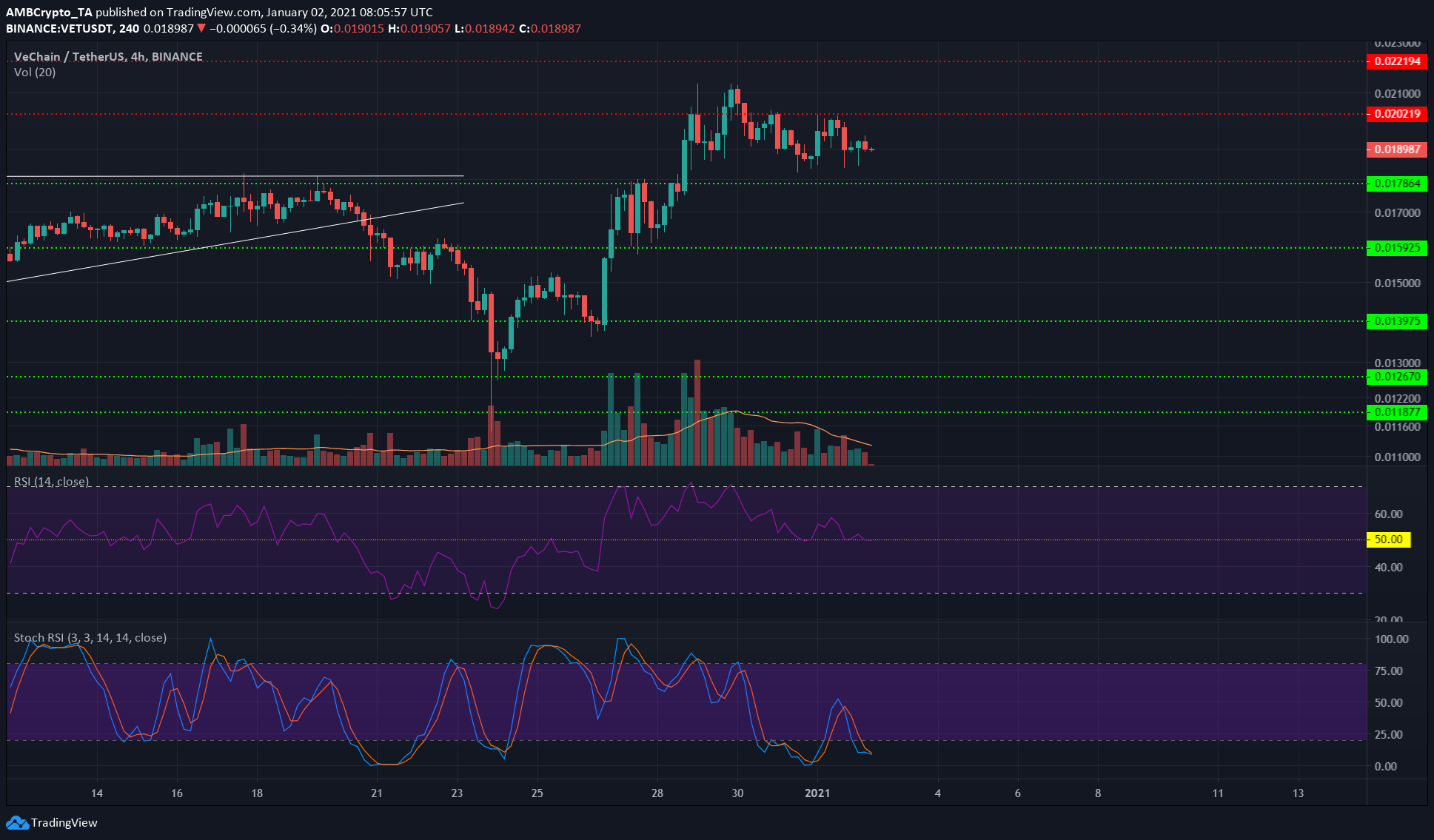

After dropping out of an ascending triangle pattern, VET tested support at $0.0126 and recovered remarkably to test the $0.02 resistance level a week thereafter.

VET rose briefly past $0.02 but was forced lower and was trading at $0.019 at the time of writing. The RSI showed neutral momentum for VET, while the Stochastic RSI was in oversold territory.

Consolidation in the $0.019-$0.02 region could occur for VET over the next few days. A drop below the $0.0178 level of support for VET would likely indicate further losses for VET, but given its longer-term bullish outlook, these dips can be buying opportunities.

A breakout past $0.02 would present the $0.022 level of resistance as a target.

Algorand [ALGO]

Source: ALGO/USD on TradingView

Using a longer timeframe, the 1-day timeframe, it can be seen that ALGO had a clean breakout from the range (orange) it has traded within the past six weeks. The breakout was on well above-average trading volume, while the OBV also registered higher highs accordingly.

The DMI showed the onset of a strong uptrend was imminent as the ADX (yellow) was on the verge of climbing past the 20 value, with the +DMI (blue) to indicate the direction of the trend.

The Fibonacci tool showed some important support levels for ALGO and based on its move from the $0.265 swing low to $0.46, a 27% extension presented a target of $0.54 for the bulls.