Litecoin: Why a buying spree is not enough for a LTC rebound

- LTC’s potential to increase significantly depends on the support around $63 to $65.

- Irrespective of the condition, traders and investors alike were bullish on the price.

For Litecoin [LTC] to re-hit $75, it has to stand firm around the support wall hovering between $63.22 and $65.19, Ali_Charts opined. According to the pseudonymous on-chain analyst, the levels above were the points where a lot of addresses accumulated LTC since its decline.

Read Litecoin’s [LTC] Price Prediction 2023-2024

Conditions for risky decisions

Ali, in his tweet, explained that 215 million addresses buying 3.81 million LTC may not be the prerequisite needed for LTC to surge. Instead, the coin’s inability to hold support irrespective of increased accumulation, could send the value downwards to $50.

Since Litecoin’s halving in the first week of August, the coin has either consolidated or plunged at different intervals. This performance has led to speculation about LTC’s potential to repeat its historical post-halving rally.

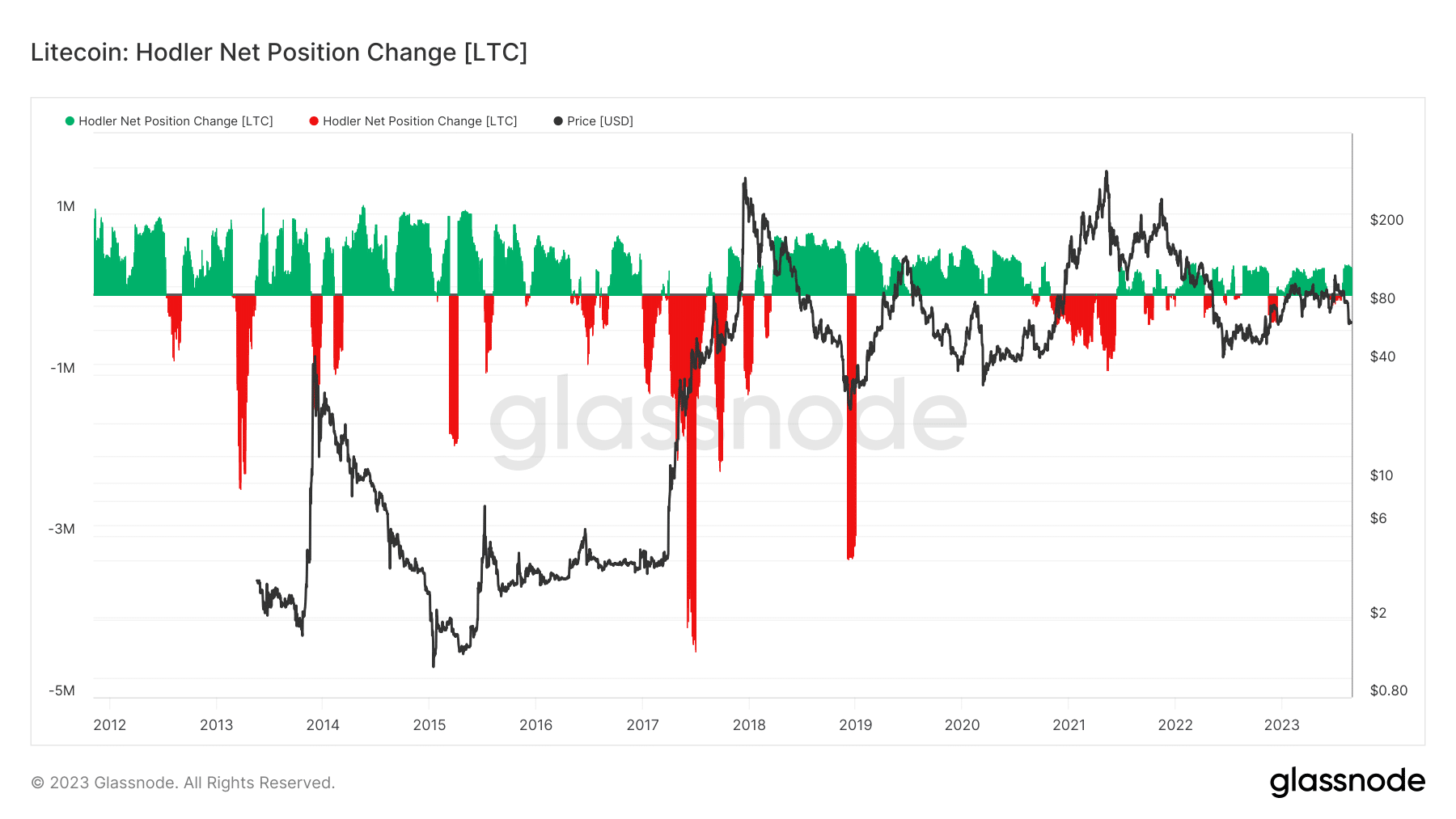

In the last 30 days, LTC has lost 29.27% of its value. But what perception do holders have about Litecoin? Well, one metric that explains this part is the Hodler Net Position Change.

From Glassnode’s data, the Hodler Net Position Change was 362,378. The metric shows the monthly position change of long-term investors of an asset. Negative values of the metric indicate a widespread cashout.

On the other hand, a positive Hodler Net Position Change implies that HODLers were accumulating from new positions.

A look at the chart above showed that a notable amount of LTC was cashed out prior to the halving. However, the switch to buying significant quantities implies that HODLers are confident in LTC’s price action, and a new top may be reached in the short term.

Off-season for bears

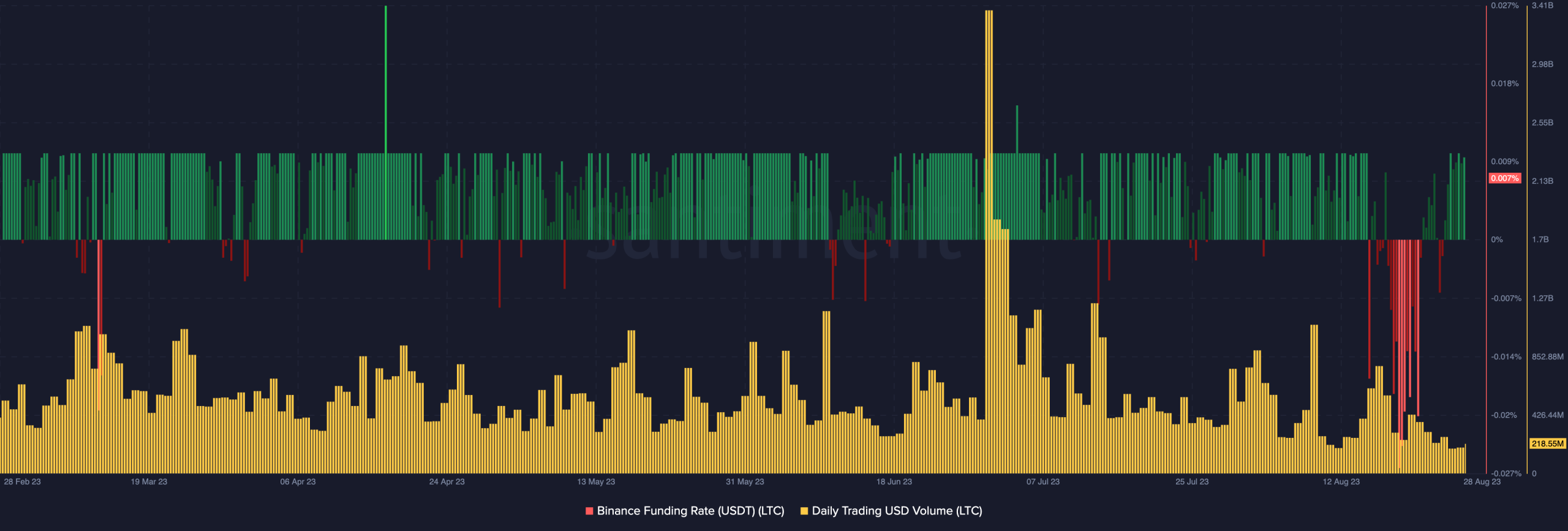

Interestingly, it also seemed that traders shared the same sentiment that LTC could price higher soon. According to Santiment, Litecoin’s funding rate was 0.007%. Formerly, as of 24 August, the funding rate was as low as -0.02%.

Funding rates are payments made between short and long-positioned traders. When the funding rate is positive, it means that traders are bullish on the price action. In this case, longs pay short to keep open their perpetual contracts.

Conversely, a negative funding rate implies a bearish sentiment such that shorts pay a funding fee to longs to have their positions open. Additionally, the daily trading volume of LTC on exchanges dropped to 218.55 million.

Is your portfolio green? Check the Litecoin Profit Calculator

This decrease suggests that wallets with LTC on exchanges are currently not interested in selling off their holdings. If the exchange volume decreases further, then it is unlikely that Litecoin’s price may plunge below $60.

But a high interest on exchanges could change the LTC direction, and the coin’s trajectory could move as bears desire