Litecoin: Will the price range above $60 extend?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

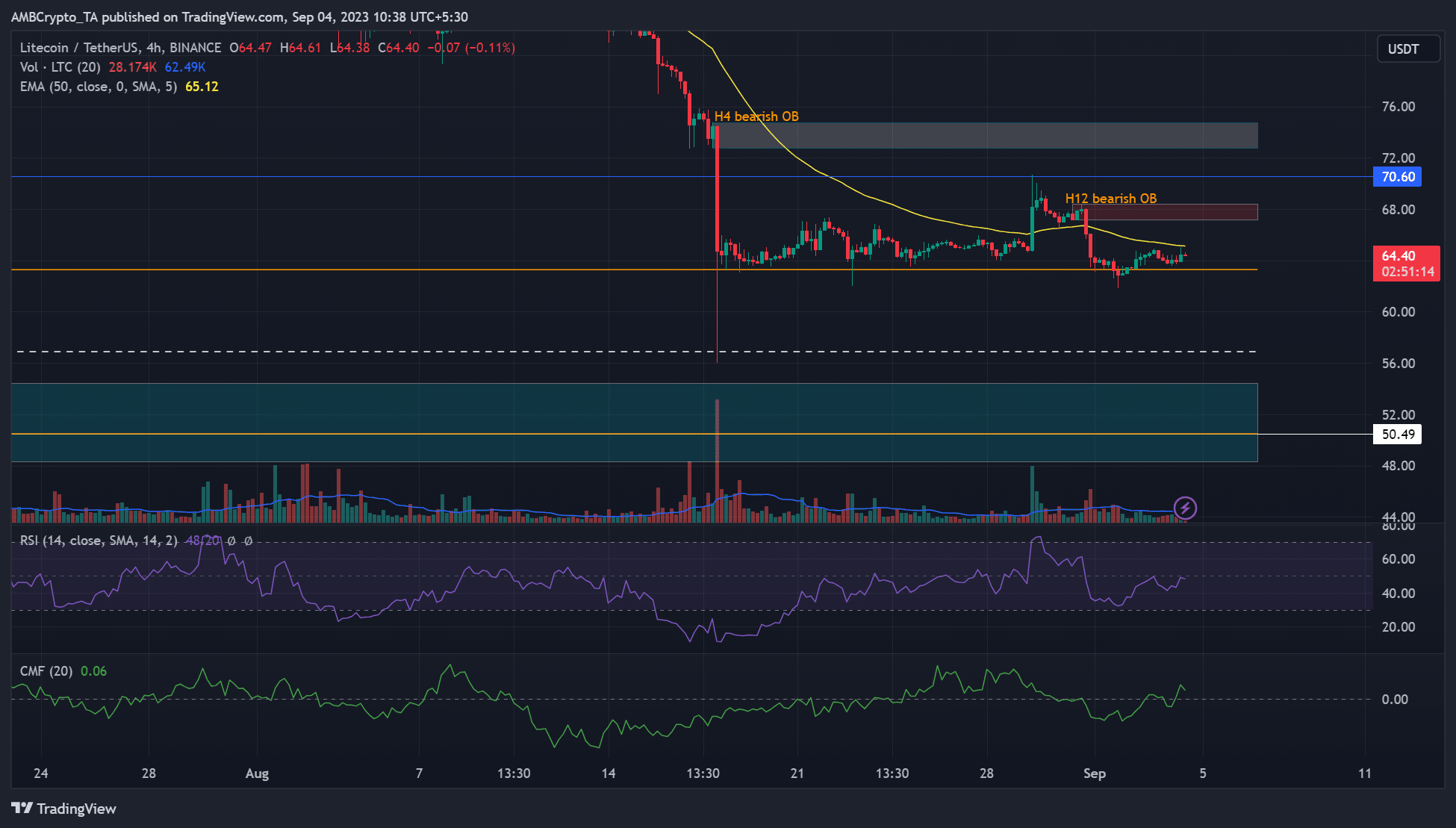

- LTC consolidated above $60 since mid-August but was unable to bypass $70.

- A major sell limit order was placed at $66, and buy limit orders at $60, $55, and $50.

Litecoin [LTC] could extend its ongoing price consolidation above $60 based on technical indicators and order flow data. A look at technical indicators showed that bulls were still weak at press time, but the price had eased above $60.

How much are 1,10,100 LTCs worth today?

The zoomed-out chart showed that the current price action was above the August 2022 range-high of $63. LTC chalked a range formation of $50.5 – $63 in August 2022.

The recent weekly candlestick session (28 August – 3 September) closed above the range-high ($63), proving that bulls were willing to defend it further.

What’s next for Litecoin’s price action in the short term?

On the 4-hour chart, an H12 bearish order block (OB) exists near $68 and an immediate dynamic resistance level of 50-EMA (Exponential Moving Average) at $65.

Since the mid-August extended price dump, LTC bulls have defended the August 2022 range-high of $63. But they were unable to go beyond $70. Besides, the H12 bearish OB and 50-EMA could derail bulls, too.

So, LTC could extend its consolidation above the range-high ($63) in the next few hours/days.

Conversely, a breach below $63 could set it to depreciate towards the mid-range of $57 or the confluence of the range-low ($50.5) and weekly bullish OB of $43 – $54.5 (cyan).

Meanwhile, the H4 RSI hasn’t forayed above the 50-mark in early September; denoting buying pressure remained subdued. However, the CMF crossed zero, underscoring substantial capital inflows to LTC markets.

Significant sell/buy limit orders at $66, $60, $55, and $50

Source: Mobchart

Is your portfolio green? Check out the LTC Profit Calculator

According to Mobchart, an order flow tracking platform, significant sell limit orders were placed at $66 (3.11k LTC) and $70 (3.26k LTC) on Binance Exchange’s spot market at press time. The levels fall between the H4 50-EMA and the H12 bearish OB and the recent high ($70). So, LTC could face difficulty clearing these hurdles.

On the other hand, there were significant buy-limit orders at $60 (3.59k LTC), $55 (4.94k LTC), and $50 (4.74k LTC). So, LTC could see a rebound if it drops to these levels.

But if BTC continues consolidating above $25k, LTC could take a cue and extend its price range above $60.