Litecoin’s latest decline could have everything to do with these LTC holders

- Litecoin sees signs of a slowdown after being in the list of top performers last week

- A look at what investors should expect moving forward

Last week we saw Litecoin achieve an upside as most of the top coins failed remained struggled to bounce back. As a result, Litecoin was receiving a lot of attention, aided by a favorable mention by Michael Saylor during an interview. But can it sustain its upside now that the market is showing some signs of a slight recovery?

Read Litecoin’s [LTC] price prediction 2023-2024

The Litecoin Magazine took note of Saylor’s recent statements wherein he described LTC as a store of value. Saylor has been one of the leading authorities in the crypto segment, hence his statement carried a lot of weight.

This is not the first time @saylor has mentioned Litecoin in interviews. He has two more aside from the recent twitter space. Good to see he is not bias and understands sound money. https://t.co/sD0dktSh6d

— Litecoin Magazine ŁⓂ️? (@LitecoinMag) November 19, 2022

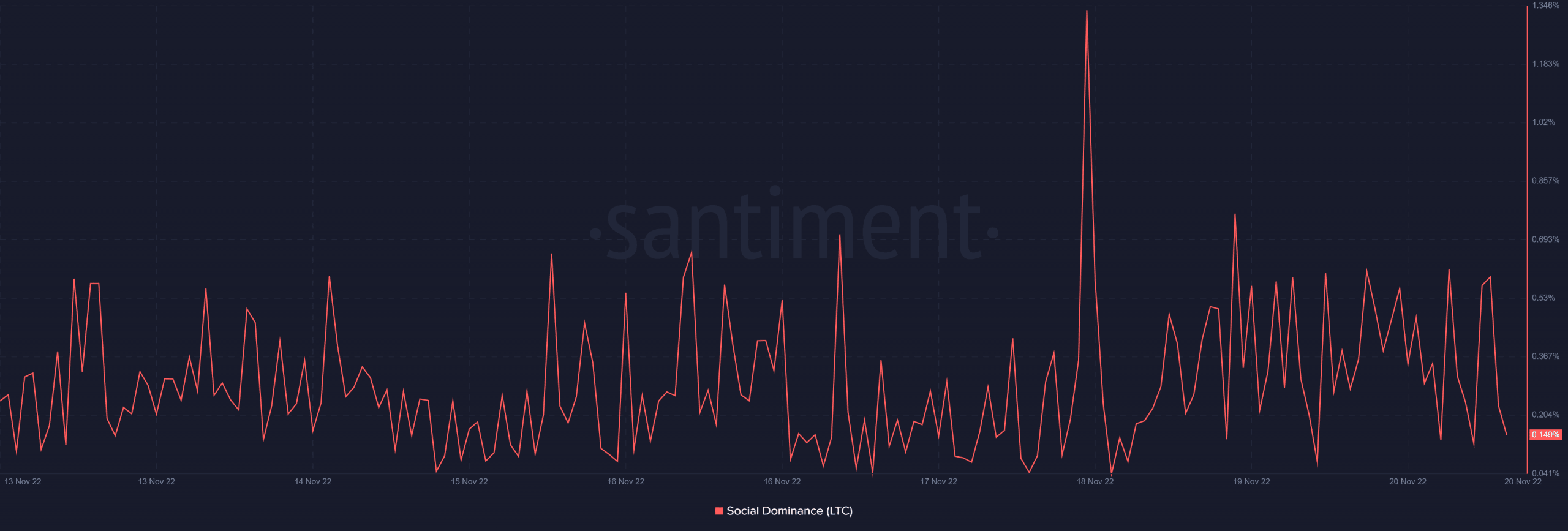

Saylor’s brief mention and categorization of Litecoin alongside Bitcoin was not taken lightly. Hours after his statement, the cryptocurrency experienced a surge in its social dominance metric. Fast forward to the present and Litecoin was among the top trending cryptocurrencies.

The renewed interest in Litecoin had a favorable outcome in LTC’s price action. However, LTC’s momentum has notably slowed down in the last 24 hours, indicating that the bulls might be running out of huff.

Why Litecoin’s demand may be slowing down

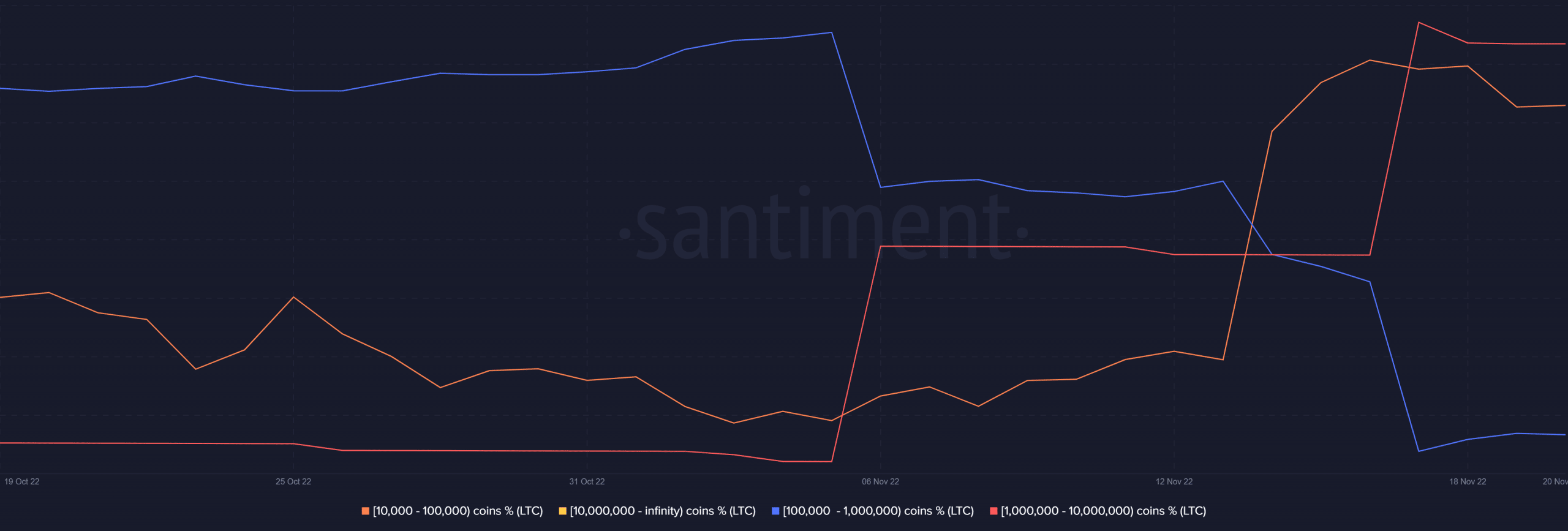

A look at Litecoin supply distribution revealed the reason for LTC to overcome the general market direction. Addresses in the 10,000 to 100,000 category and those holding more than 1 million coins have been accumulating since the first week of November. This explained why LTC continued to rally last week.

However, buying activity from these addresses witnessed a noticeable slowdown in their accumulation. Meanwhile, addresses holding between 100,000 and 1 million coins have been selling, thus contributing to some sell pressure. These top addresses have leveled out their selling activities in the last two days.

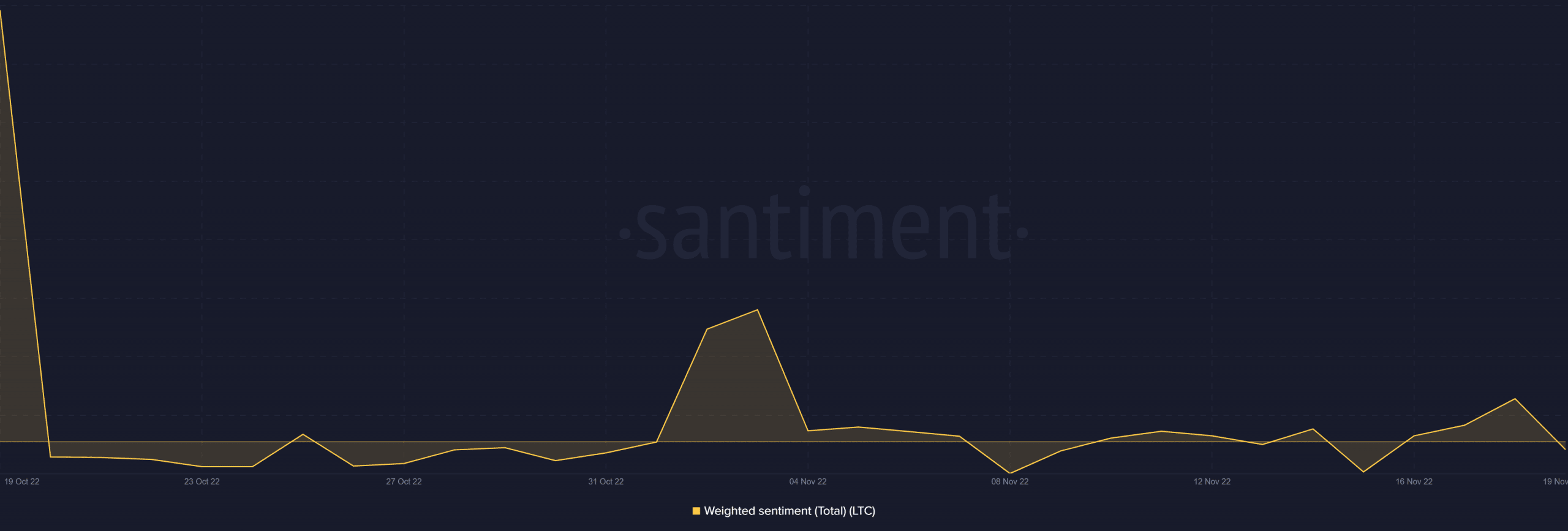

The slowdown in LTC’s upside was accompanied by a shift in sentiment. Its weighted sentiment metric dropped substantially in the last two days. This indicated that investors might be expecting some downside.

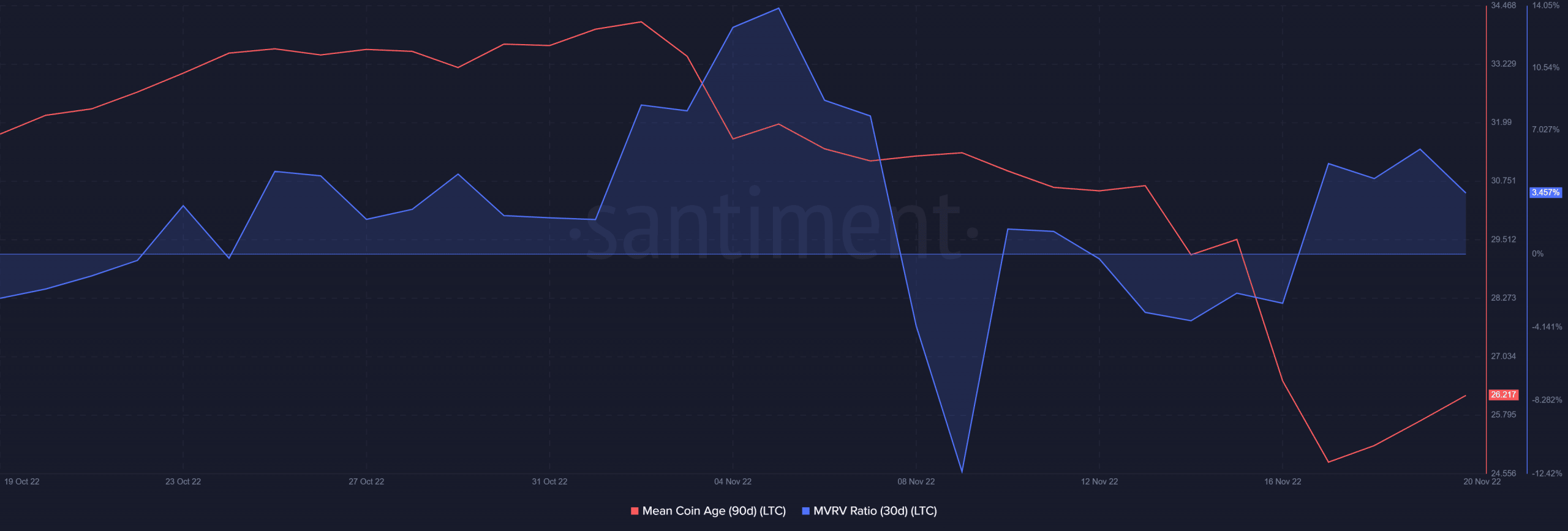

This observation also confirmed why demand had notably tanked in the last couple of days. Litecoin’s 90-day mean coin age registered an uptick in the last three days. This was a sign that investors have been holding on to their coins during the rally.

Furthermore, its Market Value to Realized Value (MVRV) ratio also achieved a sizable uptick in the last three days. This indicated that the traders that bought at recent November lows stood in profitable zones at the time of writing.

Why was this important? Well, short-term traders who bought the recent dip might be looking to cash out some profits. If that was the case, then we should expect to see a resurgence of sell pressure.

On the other hand, a return of bullish demand may help cultivate and sustain a bullish sentiment among Litecoin investors.