Litecoin’s [LTC] price is compressed in a key range – Is a breakout likely?

![Litecoin’s [LTC] price is compressed in a key range - Is a breakout likely?](https://ambcrypto.com/wp-content/uploads/2023/05/image-1200x900-21.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Structure was almost neutral at press time

- Futures market exhibited no clear trend direction

Litecoin [LTC] attempted to recover recent losses but faced a key obstacle alongside macro headwinds. The asset depreciated by 18%, dropping from $103.5 to $84.1. So far, a further drop has been kept in check by ascending trendline support (yellow line).

Is your portfolio green? Check LTC Profit Calculator

On 3 May, Fed raised the interest rate by 0.25%, prompting U.S stocks to slide lower by the end of the daily trading session.

Bitcoin [BTC] dipped slightly on 3 May, but edged higher at press time, reclaiming $29k in the process. However, uncertainty still exists. Hence, BTC may not firmly hold on to the $29k price range and possible fluctuations will affect LTC.

A pump or slump – Which way for LTC?

After hitting the supply zone (red) and bearish order block at $103.5, LTC corrected but steadied near the $84-price level. Notably, the drop left behind an imbalance and FVG (fair value gap) of $92.60 – $97.58 (white). The FVG blocked LTC’s recovery attempt in late April.

At press time, the ascending trendline (yellow line) checked a further plunge and LTC traded at $88.12. If BTC drops below $29k and $28k, LTC could breach the ascending trendline and retest the lower support zone of $74 – $80 (cyan).

Notably, the lower support lines up with VRVP’s (Visible Range Volume Profile) POC (point of control) red line. It means the likely drop could see a strong rebound at this level.

On the contrary, LTC could attempt to clear the FVG and retest the bearish OB of $103.5 if BTC maintains a hold of $29k and surges forward.

LTC also formed an ascending triangle pattern. The price action made the same highs at bearish OB and higher lows along the ascending trendline. It means an upside breakout above the bearish OB could be likely.

In the meantime, the RSI dropped from its upper ranges and hovered slightly below the 50-mark – A dip in buying pressure. The OBV also moved sideways in the same period – A sign of wavering demand.

Sellers and buyers on push and pull

Read Litecoin’s [LTC] Price Prediction 2023-24

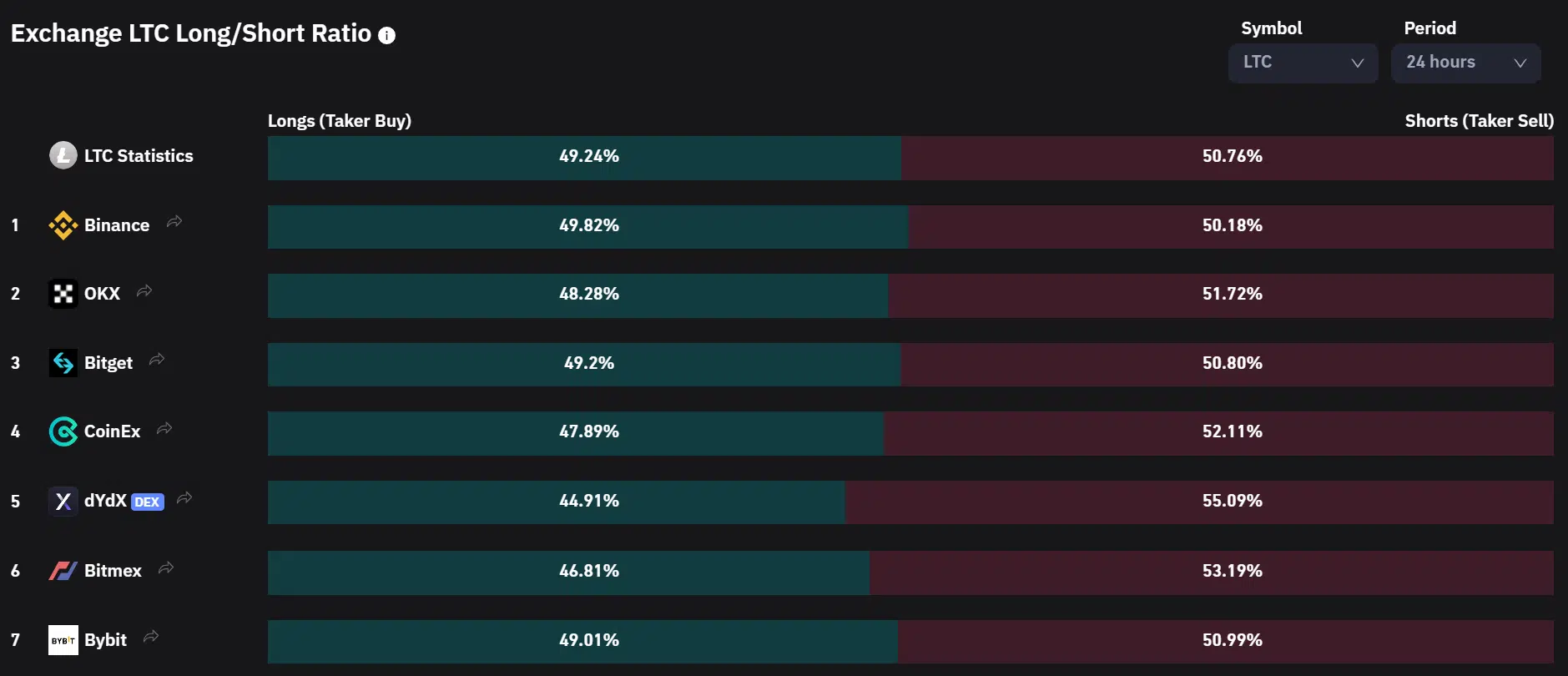

Coinglass data also revealed a limited spread between short and long positions in the past 24 hours. The exchange long/short ratio showed short positions had slight dominance at 50.76% while long positions stood at 49.24% – An almost neutral sentiment in the Futures market.

Similarly, liquidations data between 2 May and 4 May revealed the trend fluctuated from bearish to bullish. For example, on 2 May, more short positions were wrecked. On 3 May, more long positions were wrecked.

The fluctuations call for caution and BTC price action tracking for better-optimized trades.