Loopring [LRC]: All the pros and cons of buying into this bullish altcoin

Loopring was one of the market’s best-performing altcoins back in November 2021. It gave nearly 10x returns in a matter of days. Alas, since then, its fall has been pretty devastating too. Even so, the situation seems to be improving, as highlighted by a previous article on 10 February. In fact, according to the same, LRC may have been poised for a 50-100% rally in the days to come.

It has since been consolidating in an accumulation zone, one that lasted for all of February and a major part of March too.

Breakout imminent?

And yet, a near 26% rally over the last 24 hours has brought LRC closer to the immediate resistance of $1.2 than ever before. From incredibly good volumes to manageable RSI levels of around 67 at press time, all technical factors seemed to indicate that a flipping of this crucial resistance of the past two months is finally close at hand.

Trading close to $1.1 at the time of writing, a breakout over $1.2 seems quite imminent. A breakout over the $1.2-region would also turn out to be a breakout over the 200-day moving average, signalling a reversal in the broader trend too.

Online chatter about this coin also saw a major uptick with its recent 26% rally. Such an increase in social dominance could point to further optimism in the alt going forward.

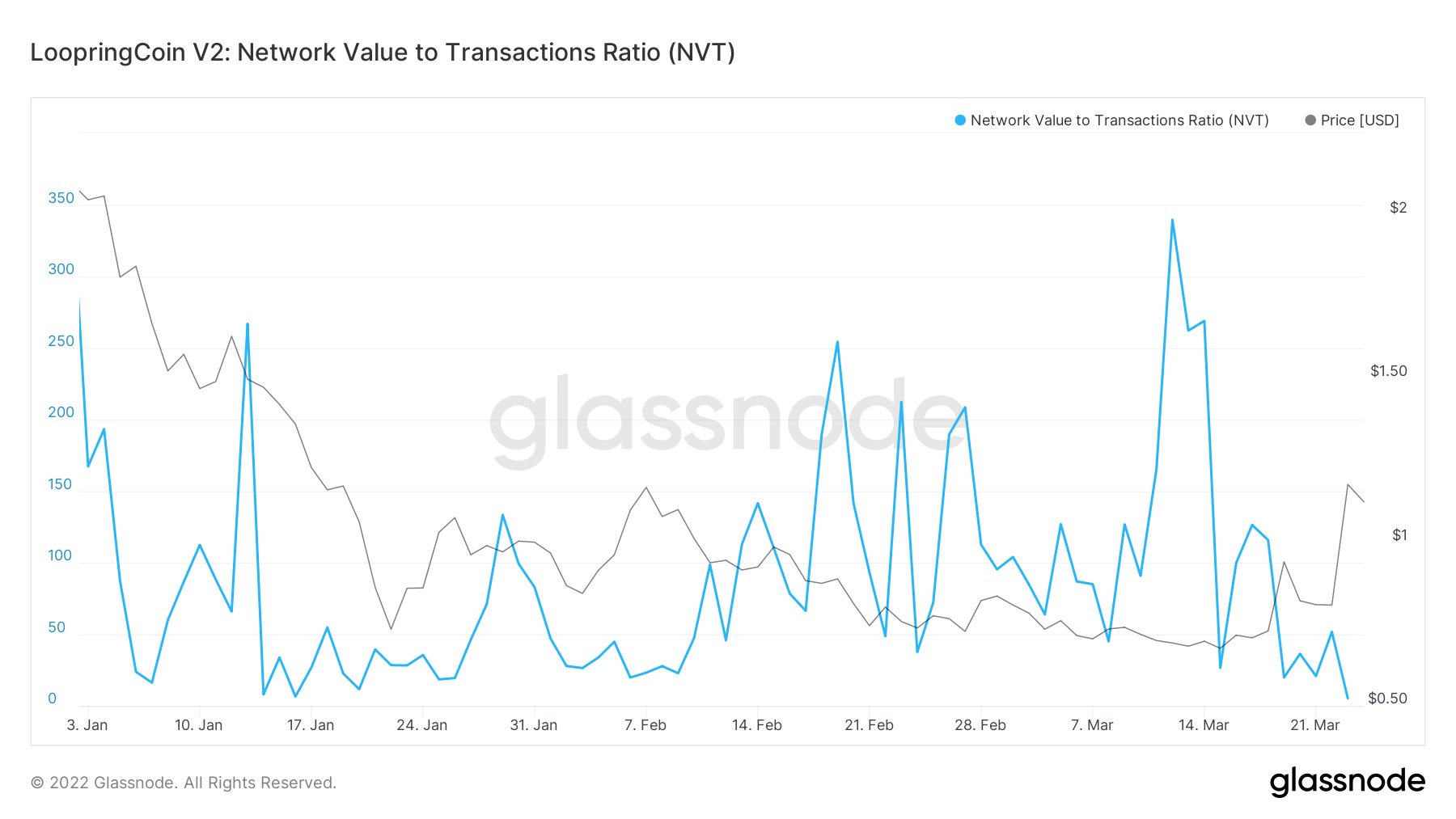

On-chain valuation metrics for LRC seem to be picking up on the optimism too. The NVT Ratio, despite its recent jump in market cap thanks to its rally, has dipped significantly. This may be a sign of a far larger increase in transaction volumes on the blockchain.

Major value creation seems to be underway, lending weight to the aforementioned breakout theory. Even its MVRV Ratio is in the negative territory, suggesting that the coin may still be very undervalued at the moment and if holders were to sell their holdings, most of them would realize major losses on their books.

LRC’s daily active addresses also saw a substantial jump in numbers, lending support to optimistic numbers from the NVT Ratio.

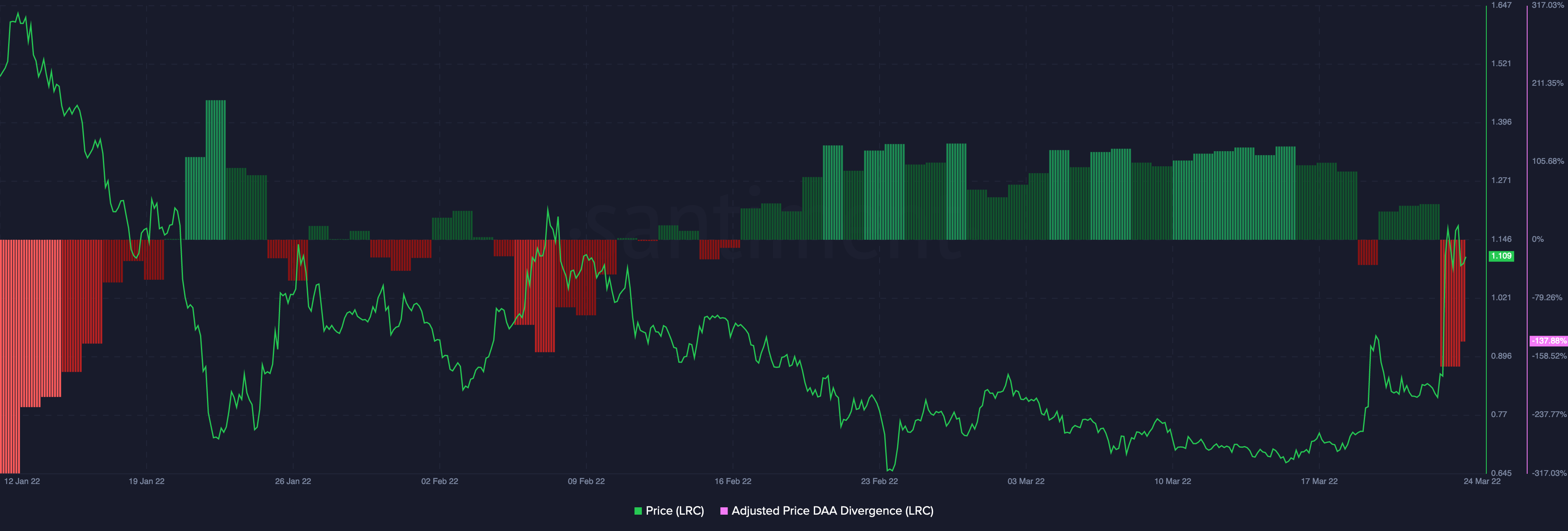

Possibility of profit-booking

However, there is one concerning sign as well. The adjusted price DAA divergence flashed major red sell signals despite this price hike. This does come as a surprise and something one needs to keep an eye out for. Inferring from all the positivity from the other metrics so far, one can reason that sell signals here might as well point to some profit booking after the 26% intra-day rally.

Even so, there’s nothing to change the overall bullish view on the coin. A buy-the-dip strategy could be applicable in this particular situation.

LRC seems like a good coin to buy into, both for the promise it holds as a project and its fundamentals and technical indications. A gradual accumulation at current levels with aggressive buying once there is a breakout may be the best way to go ahead.