Maker: What you need to know about MKR’s November moves

- Maker’s exchange reserve and exchange supply ratio hits a yearly high.

- MKR has surged by 30.8% over the past week.

Since the U.S. presidential election, the crypto market has experienced a strong upswing with Bitcoin [BTC] hitting a new ATH of $89k. This bull run has seen most altcoins and memecoins reach h.

However, some have made modest price recovery while they still remained with an overall bearish sentiment. One such altcoin is Maker [MKR], which has seen a modest price recovery.

In fact, at the time of writing, Maker was trading at $1490. This marked a 1.90% increase on daily charts. Equally, the altcoin has gained on weekly charts by 30.8% and 11.38% on monthly charts.

Despite these gains, MKR remains approximately 76.56% below its ATH recorded four years ago. This implies that the altcoin is considerably underperforming with most investors still bearish. This was evidenced by a spike in the exchange reserve and exchange supply ratio.

Maker’s exchange reserve hits yearly high

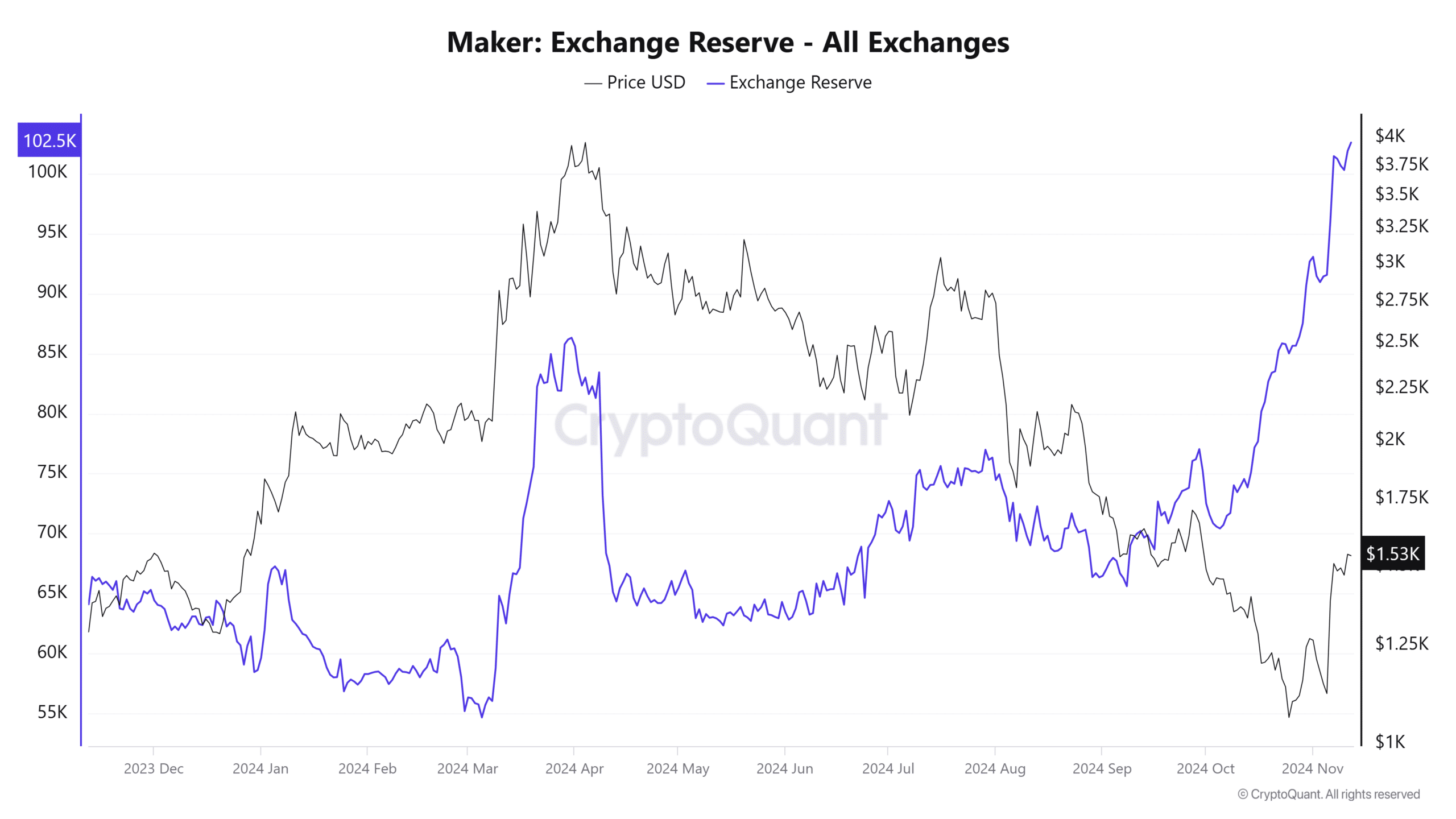

According to AMBCrypto’s analysis of Cryptoquant data, Maker’s exchange reserve was sitting at a yearly high at press time.

Our observation shows that the altcoin reserve on exchanges has surged over the past week after a slight drop at the end of October.

This surge in exchange reserve shows a rising lack of confidence among investors. This is a bearish signal as investors and holders anticipate price to decline and are preparing to close their positions to minimize losses.

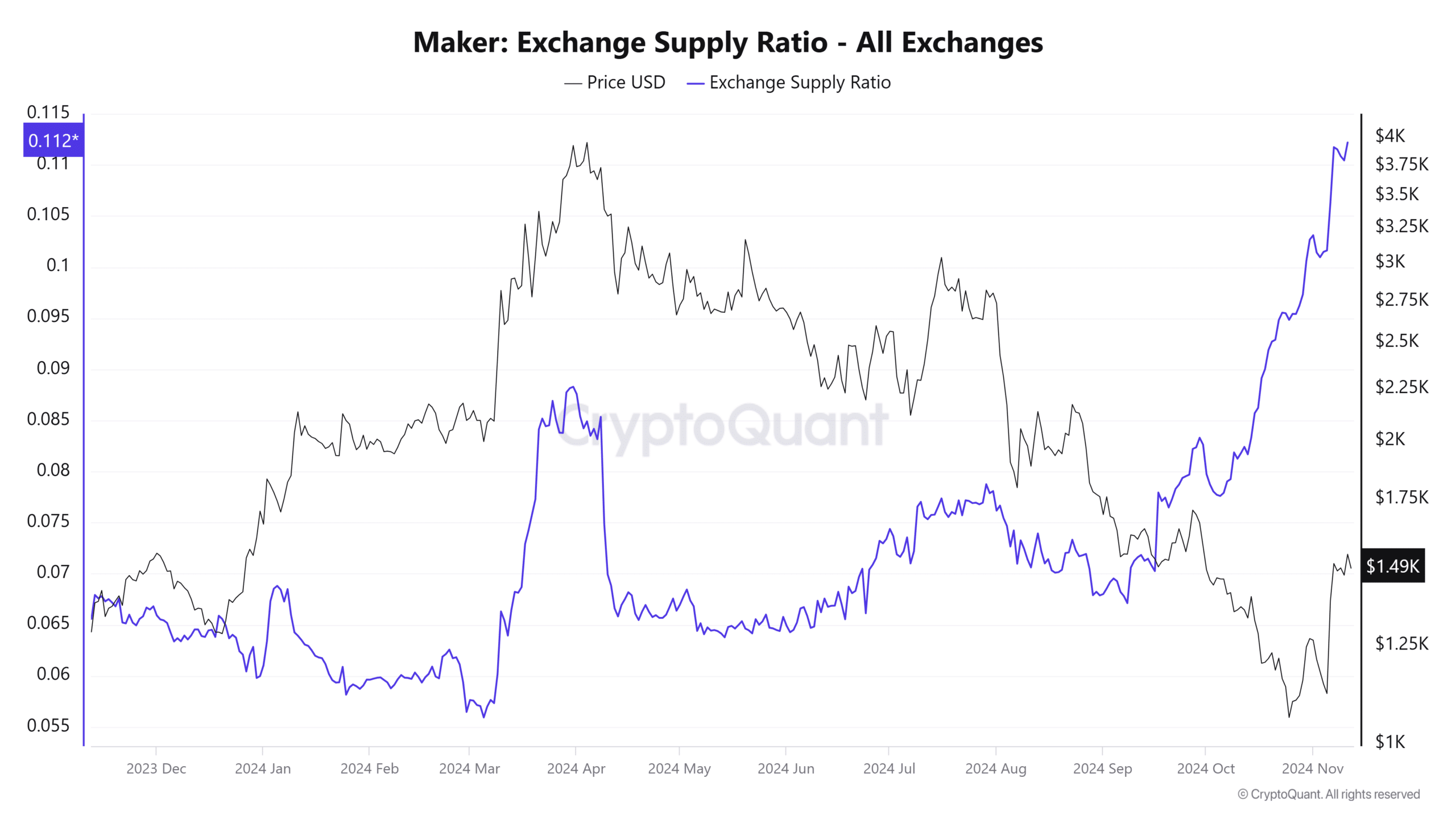

The increased transfer into exchanges is further shown by a spike in the exchange supply ratio. It has hit a yearly high as well.

When these two metrics hit a year high, it shows that the market is extremely bearish and most investors anticipate prices to decline.

What it means for MKR price charts

Usually, a spike in exchange reserve and exchange supply ratio implies that investors are bearish. Therefore, although prices have surged over the past month, the market is still not fully convinced of a potential rally.

This was further evidenced by the fact that ADX has been rising while RVGI has declined.

Looking at ADX, it has surged from a low of 31 to 35 on weekly charts. This suggests that the uptrend is losing momentum while the downward momentum is strengthening.

The same phenomenon is shown by a bearish crossover on the Relative Vigor Index. The signal line has crossed over its RVGI which suggests that the uptrend is losing momentum and its strength is waning.

This acts as a sell signal with sellers trying too gain control. When this occurs investors tend to go short.

Read Maker’s [MKR] Price Prediction 2024–2025

With these indicators showing a potential trend reversal, MKR is likely to decline before the market is strong enough for another uptrend.

Therefore, if these bearish sentiments holds, Maker will find support around $1320. However, if the bulls hold the market with the recent gains, MKR will attempt a $1600 resistance level.