MakerDAO cites ‘uncertainty’ to usher in new changes to protocol

- MakerDAO introduces changes to protocol owing to uncertainty in the stablecoin space

- While MKR took a hit on the charts, interest in DAI has continued to grow rapidly

As the FUD around stablecoins gathers steam, many DeFi protocols have started to implement changes and proposals to their networks. MakerDAO, for instance, has deployed new parameters to mitigate the risk against the volatility of stablecoin markets.

Read MakerDAO’s Price Prediction 2023-2024

Making some changes

One of the parameters includes reducing the USDC PSM daily mint limit (gap) from 950 million DAI to 250 million DAI. While reducing the limit for USDC, the mint limit for USDP was increased from 50 million DAI to 250 million DAI. Overall, the debt ceiling for USDP was pushed from 450 million to 1 billion DAI.

These changes in the protocol could safeguard MakerDAO from uncertainty in the future.

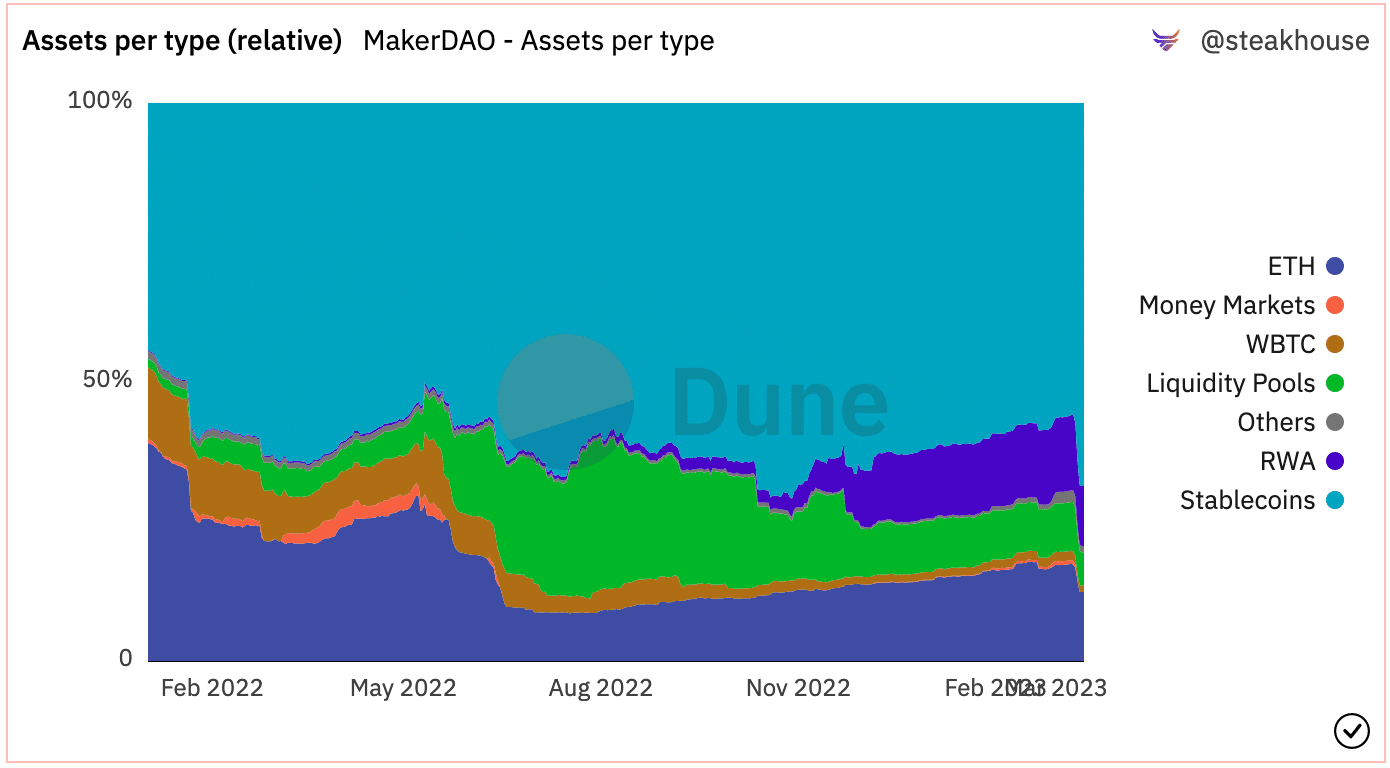

These precautions that were taken are necessary as stablecoins make up 68.6% of all the assets that are being held by the protocol. These stablecoins contribute to 13.6% of the overall revenue generated by MakerDAO.

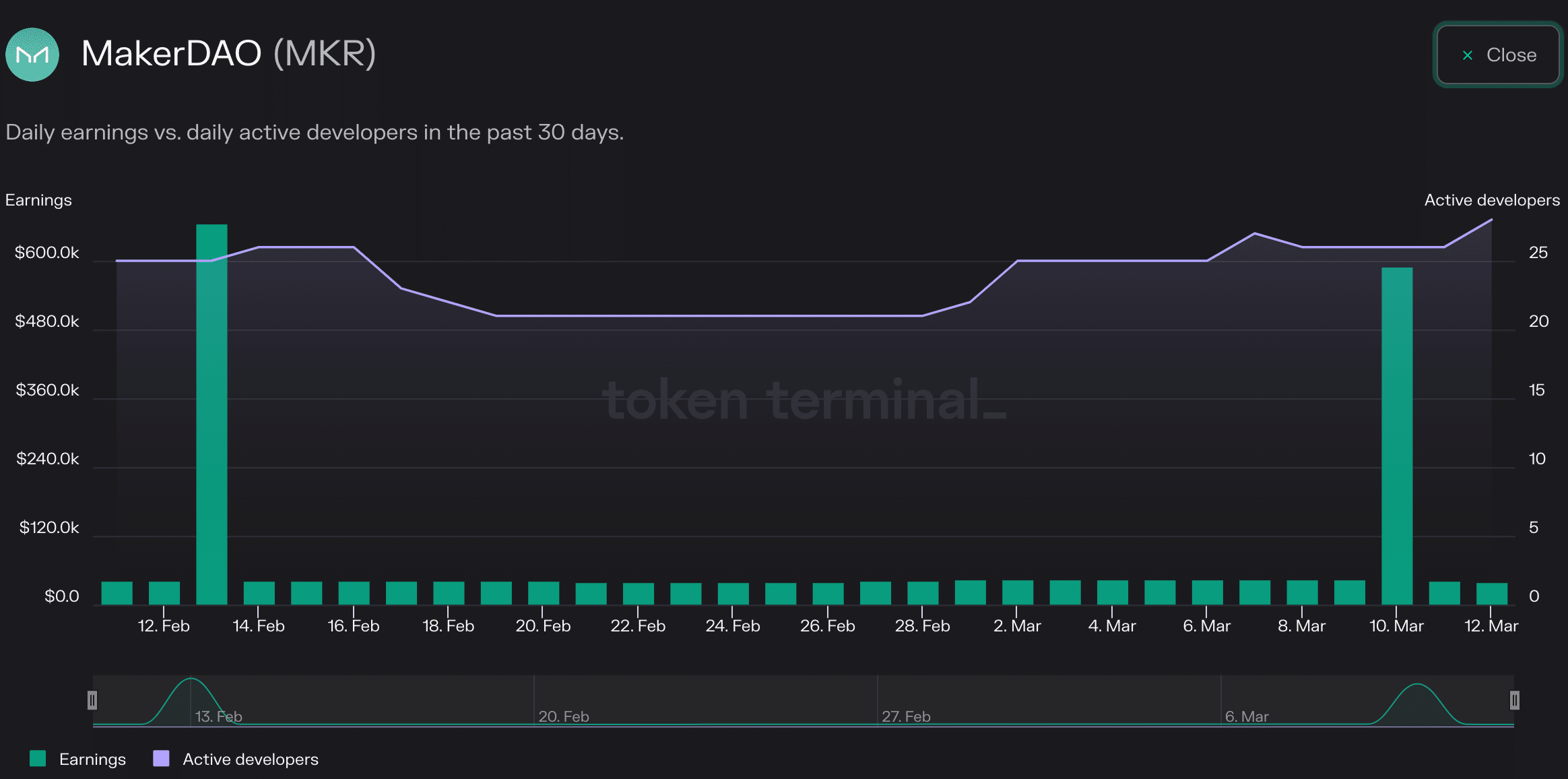

Due to uncertainty in the stablecoin market, coupled with the dominance of stablecoins in MakerDAO’s assets, the protocol’s overall earnings started to decline. In fact, according to Token Terminal’s data, the earnings generated by the protocol fell by 7.1% over the last 24 hours.

Even though earnings declined, activity of developers on the MakerDAO protocol surged by 12.2% over the past week. This indicated that the contributions being made by developers on MakerDAO’s GitHub have been increasing materially.

The aforementioned finding can also imply that there may be new upgrades and updates coming to the MakerDAO protocol soon.

Live and let DAI

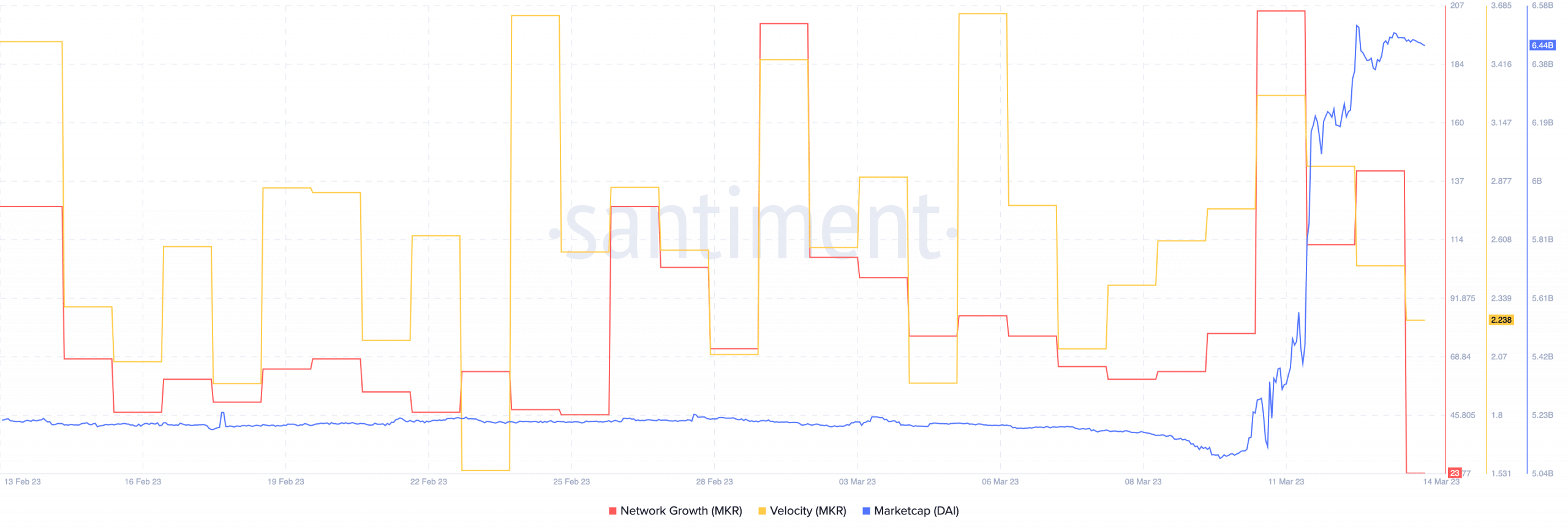

However, the potential of new upgrades and updates isn’t enough to generate interest in MKR. This was evidenced by the declining velocity and network growth of the token. Simply put, the overall activity of the token and interest from new addresses in the token declined over the last few days.

Is your portfolio green? Check out the Maker Profit Calculator

Although the health of MKR has started to falter, the same couldn’t be said about its stablecoin – DAI. Due to the collapse of USDC, interest in DAI rose materially.

This was highlighted by DAI’s marketcap, with the same soaring significantly over the last few days. In fact, at the time of reporting, the market capitalization of DAI was $6.44 billion, positioning it as the fourth-most significant stablecoin in the market.