MakerDAO: How RWA holdings contributed to profits amidst stablecoin saga

- MakerDAO’s RWA holdings led to profits amid stablecoin market issues.

- Protocol maintains stability but faces a decline in unique users.

The stablecoin market faced a significant challenge as USD Coin [USDC] came under scrutiny. MakerDAO, the protocol behind stablecoin DAI, also felt the impact. But despite this, MakerDAO saw profits, thanks to its RWA holdings.

Is your portfolio green? Check out the Maker Profit Calculator

According to data provided by Delphi Digital, MakerDAO made a $3.8 million profit through its RWA holdings. These holdings contribute significantly to MakerDAO’s overall earnings, making up 11.6% of its total holdings. Real World Asset (RWA) is a type of collateral that is not cryptocurrency-based but is more traditional and tangible, such as U.S. Treasury Bills and Bonds.

.@MakerDAO has profited $3.8M through their investments in U.S. short-term treasuries. pic.twitter.com/q10AkGxLn8

— Delphi Digital (@Delphi_Digital) March 15, 2023

Having a closer look

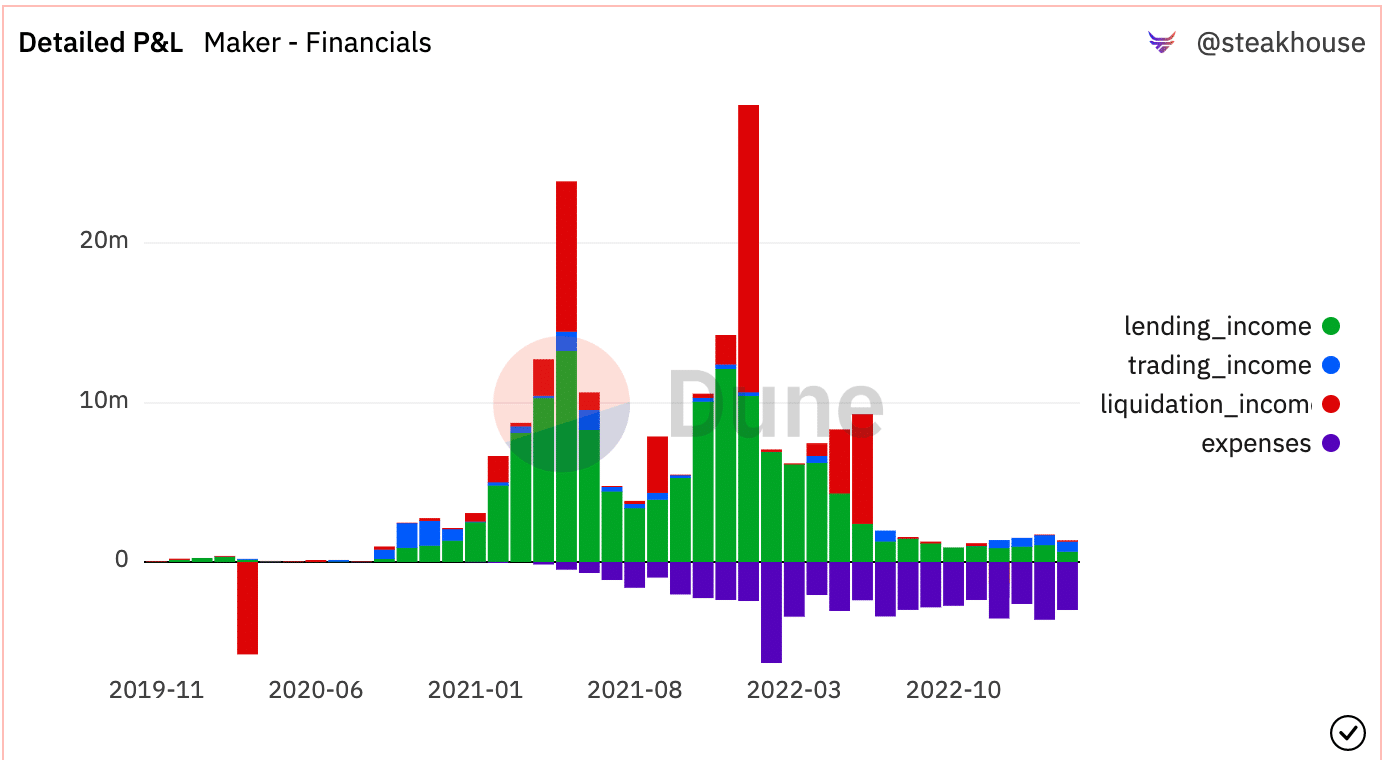

However, MakerDAO’s PnL statement painted a negative outlook due to high expenses on upgrades and updates. A significant portion of MakerDAO’s earnings are possibly being spent on upgrading and maintaining the protocol. These expenses outweighed their earnings, leading to a net loss for MakerDAO.

Nonetheless, MakerDAO’s recent proposal to create PSM circuit breakers shows its dedication to improving its protocols, considering the market’s volatility. This proposal will allow Maker governance to disable a PSM immediately without governance delay. This step will ensure that the protocol can react quickly to market changes and maintain stability.

The state of the protocol was relatively healthy as the volume on MakerDAO increased by 55% over the past month. This shows that despite the challenges faced by the stablecoin market, MakerDAO has maintained its momentum.

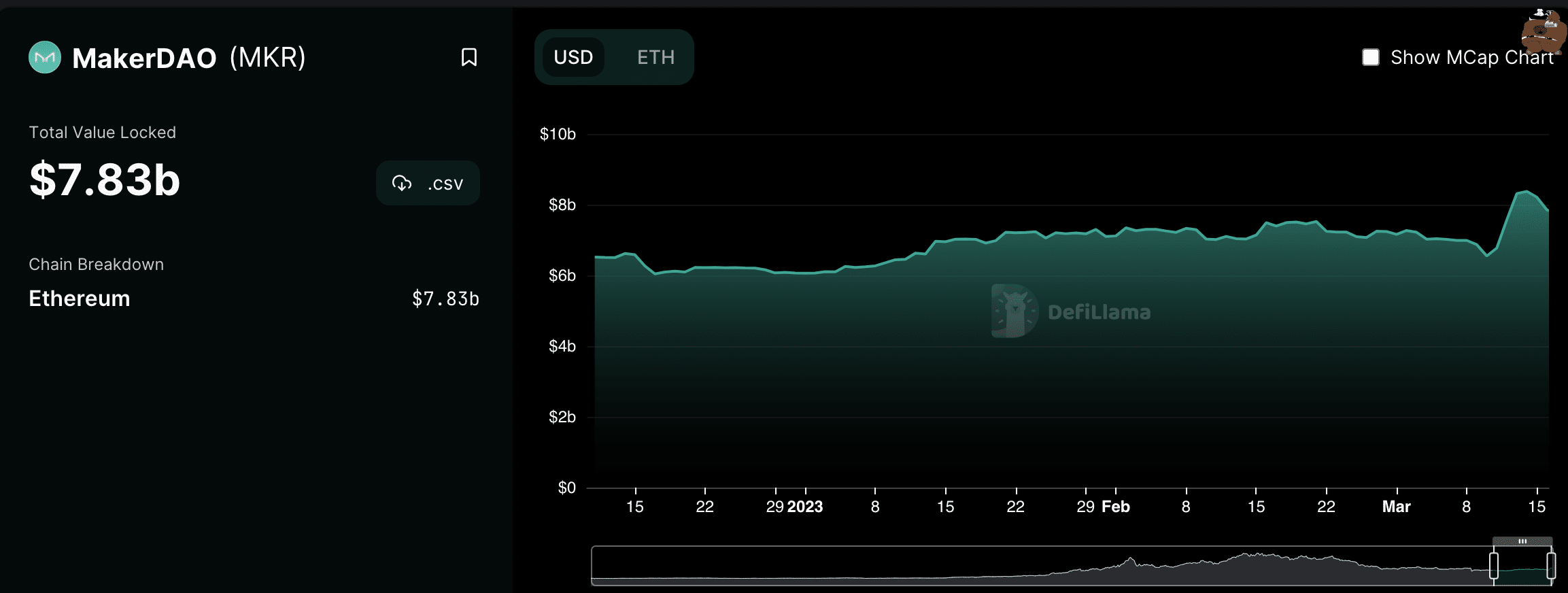

However, the number of unique users in the same period declined by 14% according to Messari’s data. This decline has affected the overall TVL generated by MakerDAO, leading to a decline over the past few days.

Read Maker’s [MKR] Price Prediction 2023-2024

MKR and DAI

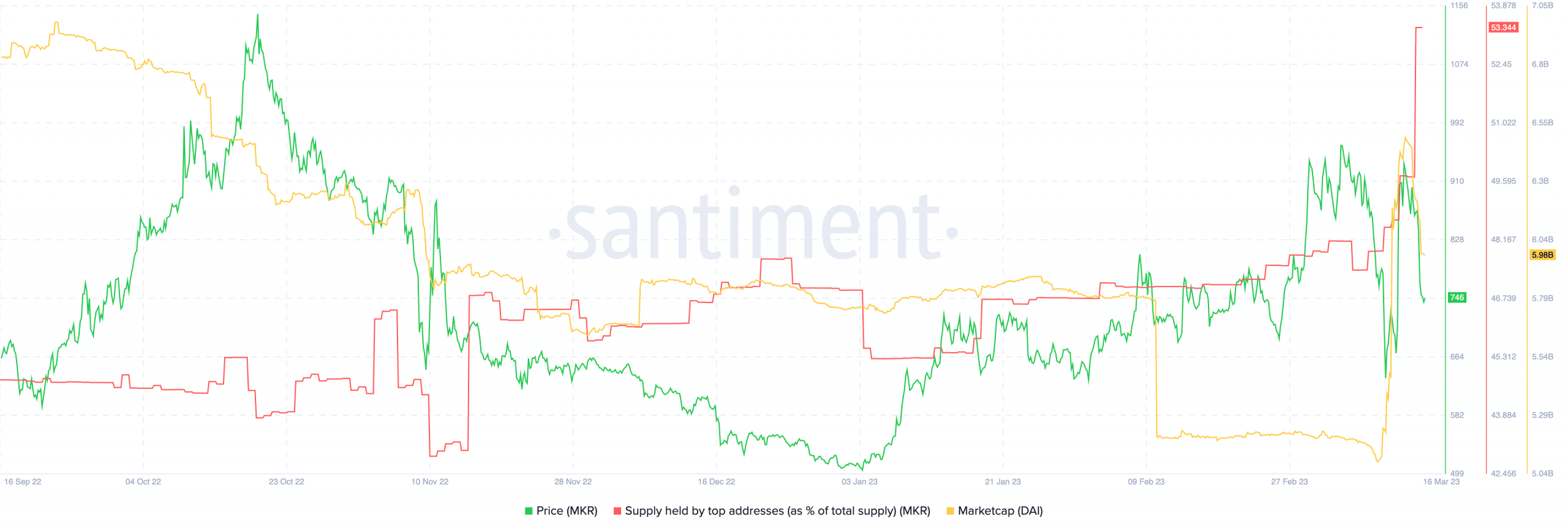

Along with a decline in TVL, MKR token’s prices declined.

However, whale interest in the token skyrocketed. This interest from whales could be due to the fact that the market cap of DAI increased materially over the last few days. This interest in both MKR and DAI indicated the potential for future profits and belief in the long-term viability of the protocol.

![Bitcoin [BTC] accumulation rises as ETF outflows cool - Is a breakout coming?](https://ambcrypto.com/wp-content/uploads/2025/03/Abdul_Bitcoin-400x240.webp)