MakerDAO plans to make a $100M move according to this new proposal

- MakerDAO proposes a $100M USDC move, with a yield of 2% annually.

- Unique users on MakerDAO decline and whales start to lose interest in the token.

MakerDAO, recently proposed to onboard $100 million worth of USDC into a iearnfinance on-chain vault. This move, according to the proposal, would give MakerDAO an estimated yield of 2% annually.

As per the proposal, one of the reasons for this decision was that Yearn Vault strategies are risk-adjusted and transparent at all times, providing a secure and reliable way for MakerDAO to earn a stable return on its assets.

Is your portfolio green? Check out the MKR Profit Calculator

Taking a look at the assets

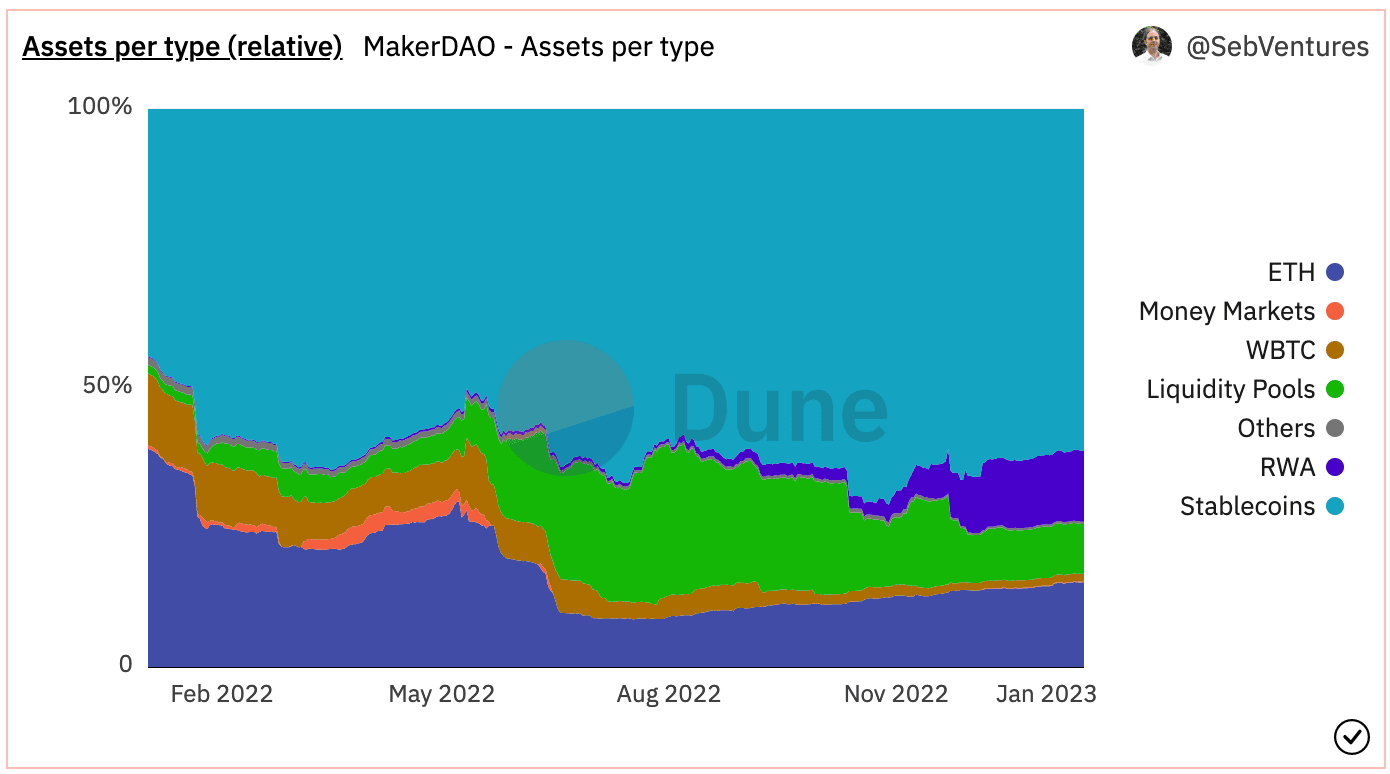

One of the key factors that make this proposal notable is the current asset distribution of MakerDAO. At press time, stablecoins make up a large portion of MakerDAO’s assets.

Based on data provided by Dune Analytics, stablecoins make up 70.7% of the overall number of assets being held by MakerDAO, with Ethereum making up 15% and real-world assets(RWA) making up 12% of the overall assets.

While RWA makes up a relatively small percentage of the overall assets, they have been a significant contributor to the overall revenue generated by MakerDAO. During press time, RWA was responsible for 56.9% of the overall revenue generated by MakerDAO.

In fact, real-world assets helped MakerDAO grow its revenue by 3.09% over the last month, despite a decline in the number of unique users. According to Messari, the number of unique users using the MakerDAO protocol declined by 23.16% over the last month.

Whales swim away

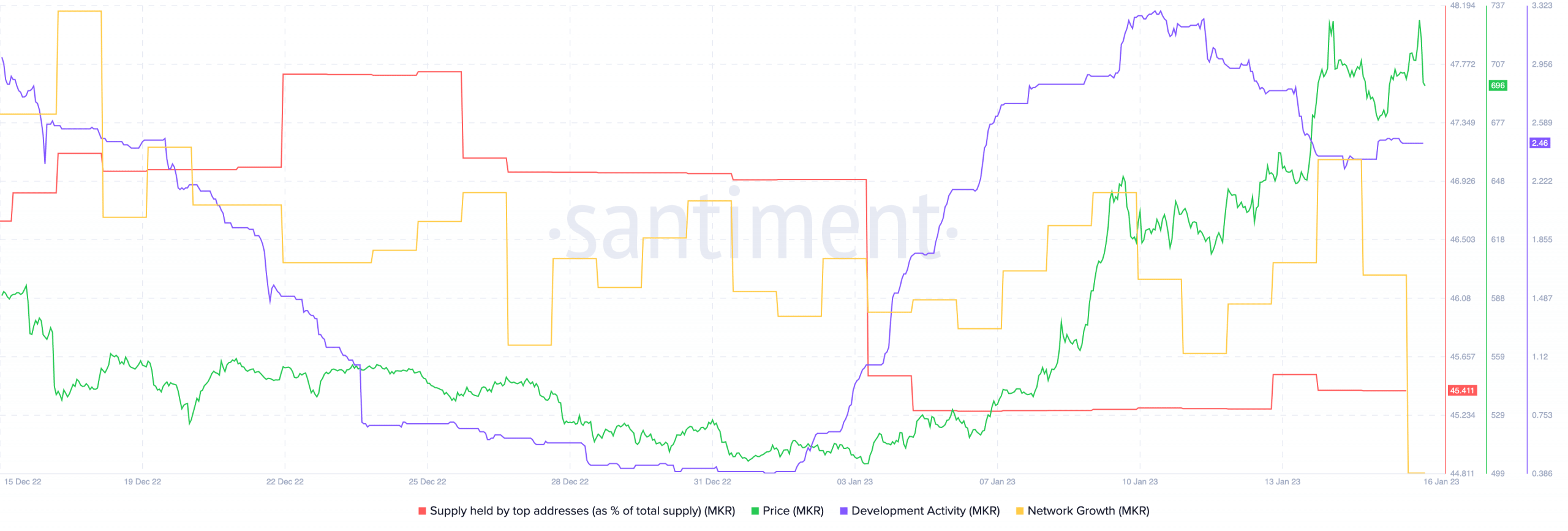

This decline in interest from users has also impacted the state of the MKR token. According to data provided by Santiment, the percentage of MKR being held by large addresses declined, suggesting that whales have started to lose interest in MKR despite its growing prices.

How many are 1,10,100 MKR worth today?

This decline in interest from users and whales, as well as a decline in network growth, could signal a potential decline in the overall interest in the MKR token. However, there are factors that suggest a change for MKR in the future.

For example, development activity on MKR witnessed a surge, suggesting that new updates and upgrades for MakerDAO could be on the way. This spike in development activity could potentially re-generate interest from whales and new addresses alike, and help to drive the growth of the MakerDAO protocol in the future.

While the future of MakerDAO and the MKR token remains uncertain, it is clear that the protocol is actively working to improve and adapt to the changing market conditions.