Assessing the current status of MakerDAO for long-term MKR holders

- MakerDAO reported a profit of more than $2.8 million through its real-world assets.

- The revenue generated by the protocol grew, alongside an increasing interest in the MKR token.

MakerDAO [MKR], the protocol which was reigning atop the DeFi space in terms of TVL, lost its spot to Lido on 3 January. However, the protocol remained undeterred and continued to build and invest funds to grow the DAO.

Read MakerDAO’s [MKR] Price Prediction 2023-2024

According to recent data, MakerDAO reported a profit of more than $2.8 million from its recent investments.

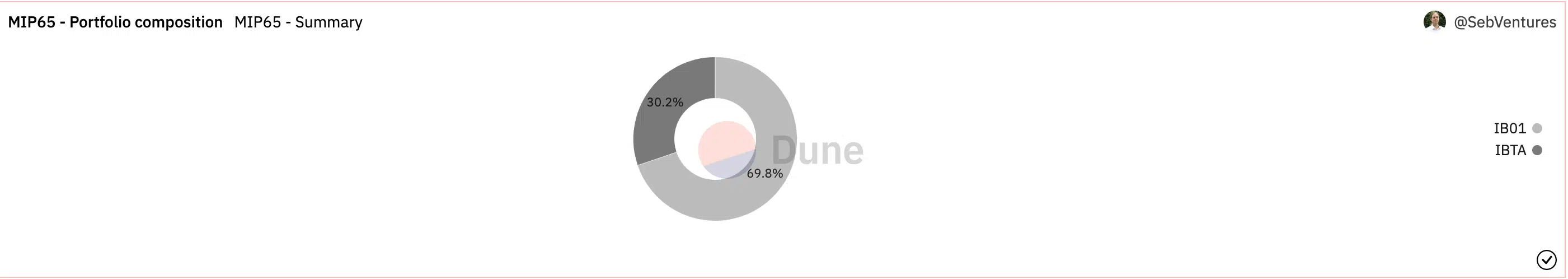

This is the current status of Monetalis Clydesdale's portfolio (MIP65), which deployed 500 million USDC of the PSM into short-term bonds:

• ~$349 million of IB01: iShares $ Treasury Bond 0-1 yr UCITS ETF

• ~$150.9 million of IBTA: iShares $ Treasury Bond 1-3 yr UCITS ETF pic.twitter.com/QNDxknxq5N

— Maker (@MakerDAO) January 4, 2023

Peeking inside the MakerDAO vault

MIP65, also known as Monetalis Clydesdale, is a vault on the protocol deploying MakerDAO capital to invest in short-term bonds and ETFs. MakerDAO has deployed around $500 million worth of USDC into various short-term bonds through the MIP65.

The vault has invested primarily in two commodities: IB01 and IBTA. IB01 is a tracker for one-year U.S. treasury bonds, and IBTA is a tracker for one – three-year U.S. treasury bonds. At the time of writing, most vault funds were deployed into IB01, which made up around 69.8% of the overall vault investments.

Along with the investments in these bonds, MakerDAO was observed to be allocating its resources to other real-world assets as well.

For instance, MakerDAO opened up a $100 million DAI loan to Huntington Valley Bank and also onboarded euro-dominated covered bonds over the last month.

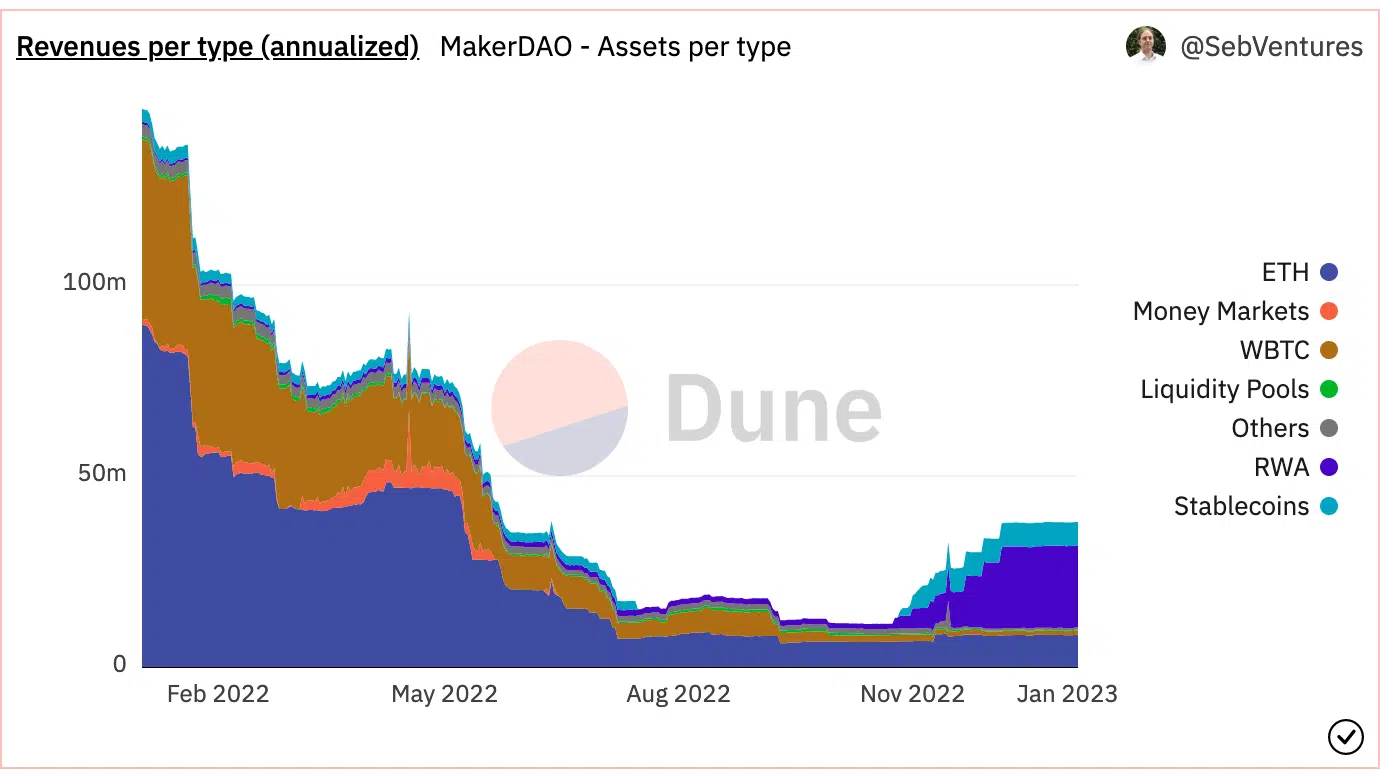

These investments proved to be fruitful, as the revenue generated by the protocol continued to increase over the past three months, based on data provided by Dune Analytics. Real-world assets contributed the most to the revenue. Other major sources of revenue for MakerDAO were their investments in Ethereum and Stablecoins.

However, the revenue collected through users on the protocol may decline in the near future. This is because the number of unique users on the protocol declined by 54.57%, according to data provided by Messari.

Are your holdings flashing green? Check the MKR profit calculator

Looking at the data

Even though the number of unique users on the protocol declined, the interest in the MKR token increased in the last week.

Based on data provided by Santiment, it was observed that the MKR’s volume grew from 14 million to 38.6 million in the last seven days. MKR’s price paralleled that growth, too. However, despite MKR’s growing prices, the MVRV ratio for the token remained negative.

This implied that the holders of the MKR token would have to wait for the price to rally even further if they wished to sell their holdings for a profit.