MakerDAO taps into Chainlink to boost stability in DAI ecosystem

- MakerDAO to strengthen its DAI operations by boosting stability through Chainlink integration.

- MKR experiences limited sell pressure as uncertainty creeps back into the market.

Collaboration between blockchain networks or WEB 3 projects often yields interesting results. MakerDAO is the latest crypto project to walk down this road courtesy of its new collaboration with Chainlink.

Is your portfolio green? Check out the MakerDAO Profit Calculator

MakerDAO’s recently announced that it will incorporate Chainlink Automation into the Keeper Network. According to the announcement, the move seeks to boost the stability of the DAI stablecoin ecosystem through reliable automation.

The official statement also noted that this development will boost decentralization by increasing the number of third parties that perform essential tasks.

.@MakerDAO has onboarded #Chainlink Automation to its Keeper Network.

The addition of Chainlink's highly performant & reliable automation service helps further stabilize the DAI ecosystem by decentralizing key network verification & maintenance processes.https://t.co/ims0nDdyK1

— Chainlink (@chainlink) February 9, 2023

This development is timely considering the recent happenings in the broader market. The crypto market is facing pressure from regulators.

It might accelerate the rate of DeFi adoption in the next few months in a bid to avoid regulatory overreach. It is also not surprising that MakerDAO is working towards strengthening DAI since stablecoins have proved to be essential to the DeFi ecosystem.

Assessing MKR’s performance

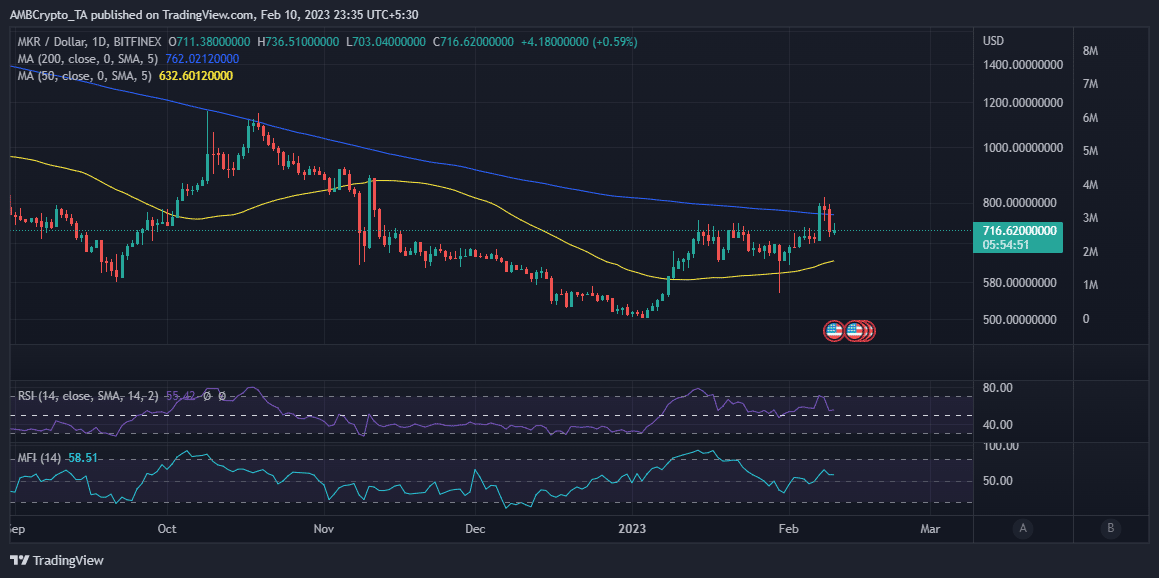

MKR’s upside from the current 12-month low peaked at 61% earlier this week. The price briefly managed to soar above its 200-day moving average for the first time since October last year.

However, this achievement was short-lived because the SEC-induced FUD triggered a sizable sell-off of roughly 12%.

While MKR has experienced a sizable pullback, the selling pressure dissipated in the last 24 hours. However, it may not be out of the woods yet but the current market conditions indicate that demand is recovering.

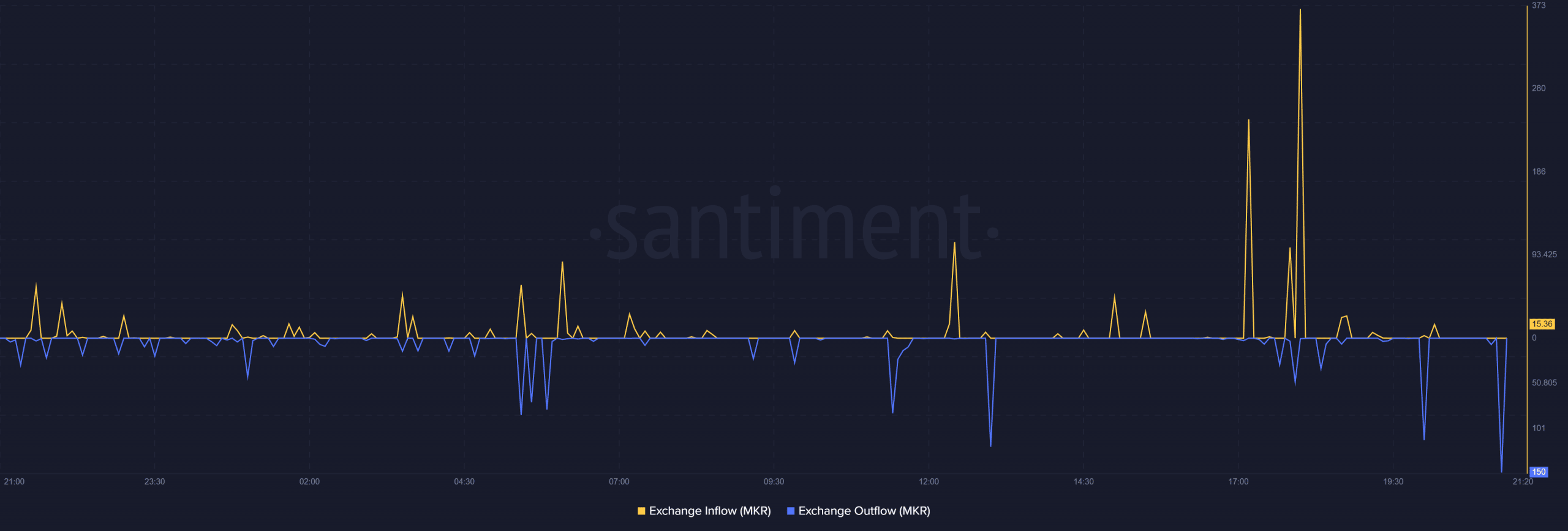

MKR’s latest exchange flow data reveals that the coin had a higher net exchange outflow than inflow in the last 24 hours at the time of writing.

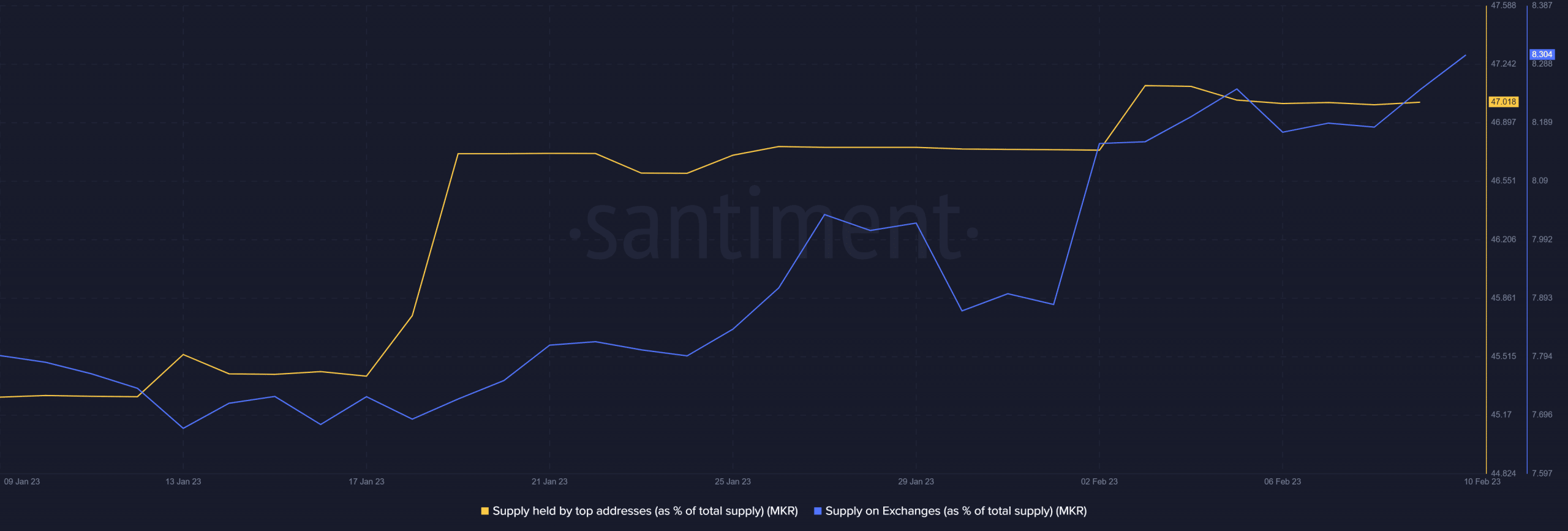

While demand is starting to creep back in, the supply of MKR held by top addresses has remained within its upper monthly range.

This means that whales have been holding on to their MKR and is a potential reason why the retracement this week quickly ran out of momentum.

How much are 1,10,100 MKRs worth today?

On the other hand, the supply on exchanges just reached a new monthly high. An expected outcome especially now that there is a lot of uncertainty this month.

Many investors might be anticipating a large market sell-off, hence keeping funds on exchanges for quick liquidation when the need arises.

In conclusion, MKR’s short-term outlook remains within the realm of uncertainty. However, some of the aforementioned developments highlight the positive long-term potential.