MakerDAO’s governance changes could have this impact on the protocol

- MakerDAO is attempting to make new changes to the protocol through its governance

- Earnings generated by the protocol have increased while overall interest in the token declined

Despite losing its dominance in terms of TVL to Lido, MakerDAO has continued to focus on its protocol and has continued to make changes to it. The protocol has been very active in terms of engaging with its community as well and has suggested new ways to improve its network through its governance.

Read MakerDAO’s Price Prediction 2023-2024

Beefing up the security

In a recent tweet, MakerDAO announced a few proposals that would be voted on over the next few weeks. One of the major proposals stated is related to increasing the time limit of the GSM (Governance Security Module)’s Pause Delay Raise.

A new Executive Vote is live on the Maker Governance portal!

MKR holders and delegates are ready to use their MKR voting power to enact the following changes to the Maker Protocol if they support them: pic.twitter.com/aHCB7nlNd3

— Maker (@MakerDAO) April 5, 2023

The Governance Security Module (GSM) Pause Delay feature establishes a mandatory waiting period after an executive vote passes before modifications to the Maker Protocol become effective. After an executive spell gets approval, the GSM Pause Delay must elapse before the updates included in that spell can impact the Maker Protocol. The Maker Protocol incorporates just one GSM Pause Delay, which applies to all parameter modifications.

The main purpose of this parameter is to safeguard users of the Maker Protocol against a governance attack by unscrupulous MKR Holders. In case a fraudulent proposal is approved via governance, individuals who hold DAI or utilize vaults will have an opportunity to dispose of their DAI or shut down their vaults. This, before the modifications take effect in the Maker Protocol.

However, a longer GSM Pause Delay gives non-malicious MKR Holders and users of the protocol more time to become aware of and react to a governance attack on the Maker Protocol. It also gives users additional time to opt-out in the event of non-malicious but disagreeable changes to the protocol. For example – A hike in liquidation ratios that might cause the liquidation of a user’s vault.

Realistic or not, here’s MKR market cap in BTC’s terms

Apart from the GSM, other changes are related to the distribution of DAI across various sectors of the protocol.

State of MKR

Proposed changes could improve the protocol, but not necessarily the performance of the MKR token.

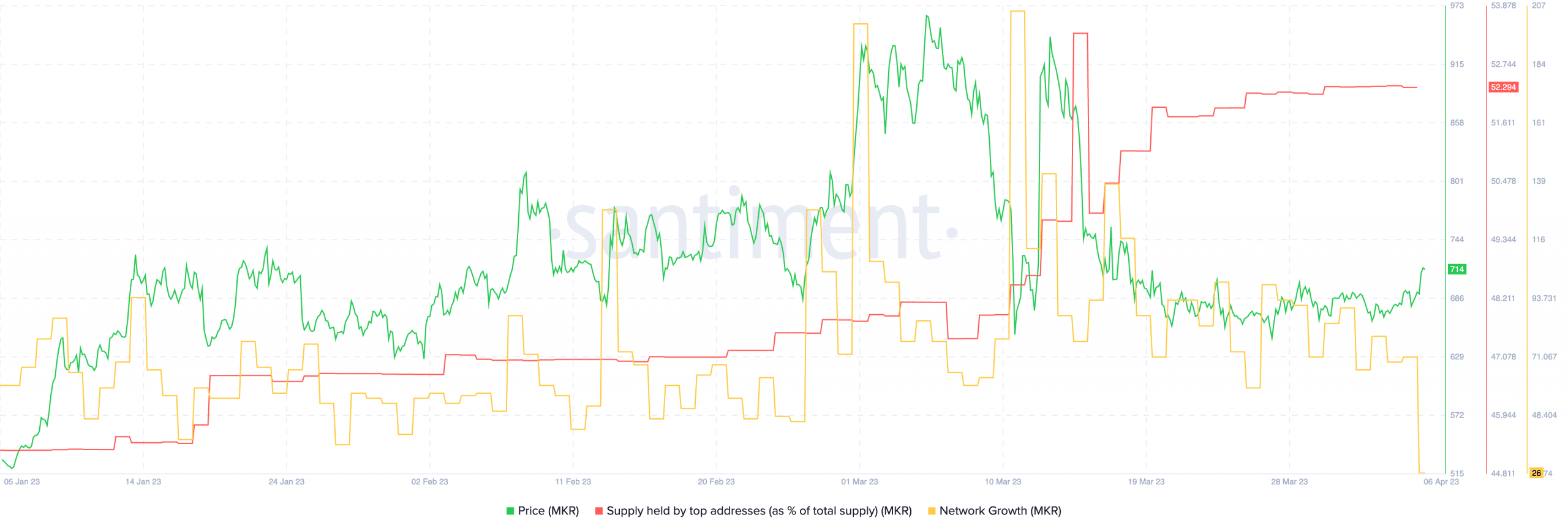

Over the last few weeks, whale interest in MKR has increased, making holders more vulnerable to attacks and sell-offs. Coupled with that, the network growth of MKR has also fallen, implying that new addresses weren’t as interested in the token at press time.