Assessing MakerDAO’s [MKR] health following its displacement by Lido

- MakerDAO had a system surplus at press time, indicating that the total debt owed was not more than the value of the collateral in the system

- Its displacement by Lido might be temporary due to its slipping grip on the ETH staking market

Leading decentralized finance protocol (DeFi) MakerDao [MKR] provided users with an overview of its current state in 2023. The DeFi protocol took to Twitter on 2 January to highlighted the amount of DAI tokens it had in circulation and its total value locked (TVL).

The tweet also highlighted MakerDAO’s collateralization ratio and the number of DAI tokens it held as System Surplus until the tweet went live.

How 2023 started

• 5.7 billion DAI in circulation.

• $7.2 billion of total value locked.

• 141% collateralization ratio.

• 74.9 million DAI in the System Surplus.

Let's go! pic.twitter.com/VIDn06Kguy

— Maker (@MakerDAO) January 2, 2023

Read MakerDAO’s [MKR] Price Prediction 2023-2024

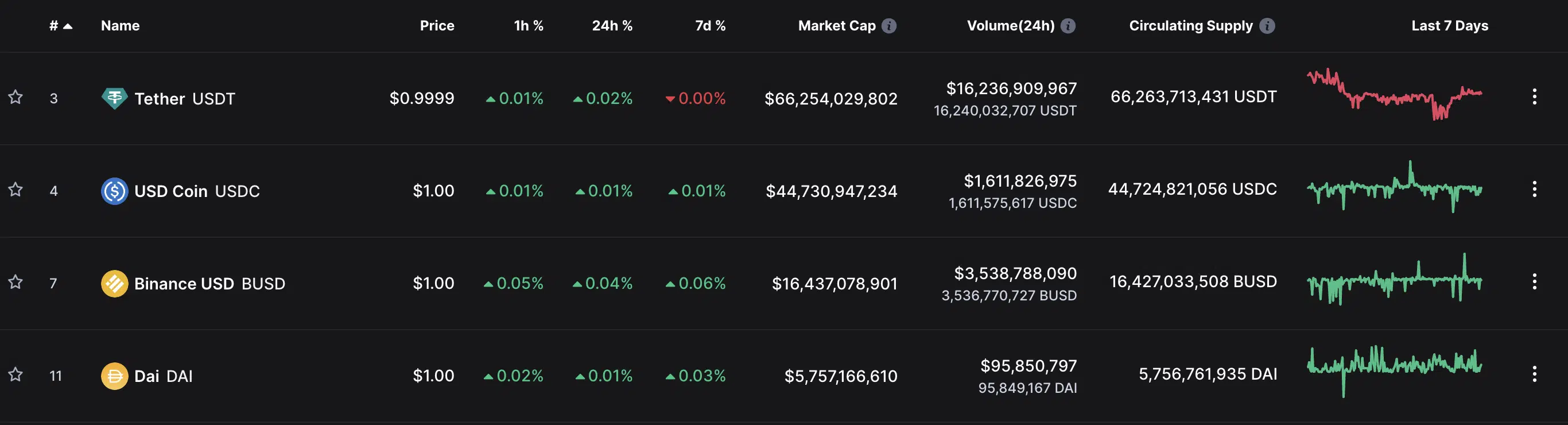

According to MakerDAO, the current circulating supply of its DAI stablecoin was 5.7 billion. This put it four places behind other stablecoins, including Tether [USDT], USD Coin [USDC], and Binance USD [BUSD], data from CoinMarketCap revealed.

MakerDAO also confirmed that its current collateralization ratio stood at 141%. Collateralization ratio refers to the amount of collateral that a borrower has pledged to secure a loan.

In the context of MakerDAO, the collateralization ratio represents the value of the collateral (usually ETH, BAT, and USDC) relative to the value of the debt (DAI).

This means that the value of the collateral must be at least 141% of the value of the debt. This high collateralization requirement is in place to protect the system’s stability and ensure that borrowers have sufficient collateral to cover their debts.

Further, MakerDAO stated that it held 74.9 million DAI in its System Surplus until the time of the tweet. The system surplus is an important measure of the overall health and stability of the MakerDAO system.

A surplus indicates that the system is able to withstand shocks or declines in the value of the collateral as it measures the difference between the value of the collateral in the system and the total debt owed.

MakerDAO dethroned by Lido, but for how long?

During the intraday trading session on 2 January, the TVL of leading liquid ETH staking platform Lido Finance exceeded that of MakerDAO. Thus, Lido managed to displace Maker as the DeFi protocol with the highest TVL.

Till the time of press, MakerDAO’s TVL was spotted at $5.92 billion, in second place behind Lido’s $5.97 billion.

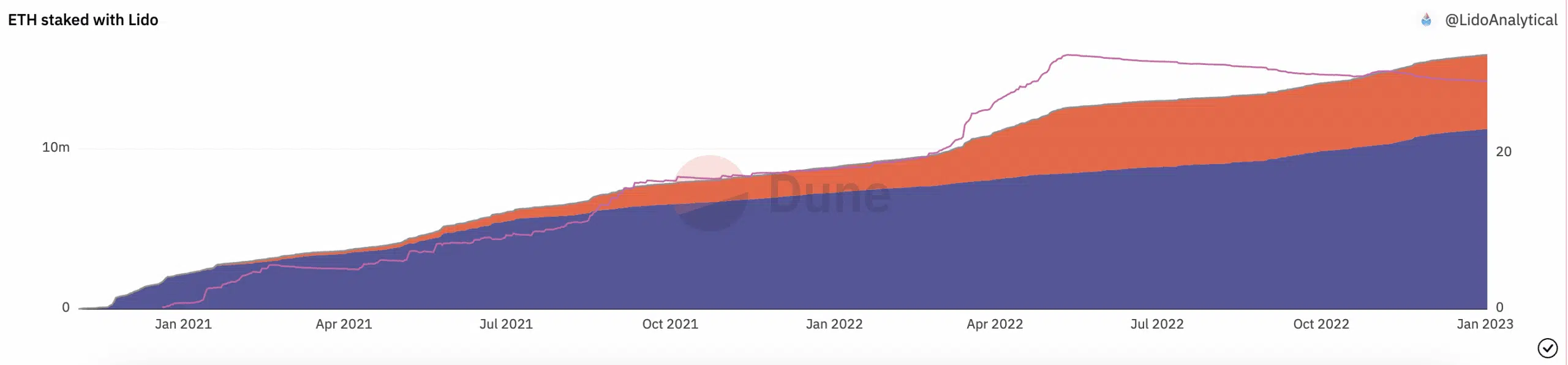

According to data from Dune Analytics, as more options for staking Ether become available, Lido Finance’s position as a leader in the market may be at risk.

Lido’s market share in the ETH staking ecosystem decreased slightly at the start of the 2023 trading year. This was pegged at 29% at press time and had been consistently declining since May 2022.

Are your MKR holdings flashing green? Check the profit calculator

With a persistent decline in Lido’s share of the ETH staking market, a corresponding fall in its TVL as the year progresses might lead to MakerDAO’s return to its initial spot.