MakerDAO’s removal of ‘bad debt’ might be a good thing for users

- MakerDAO has liquidated a few of its vaults to reduce risk and exposure to bad debt

- Whales continue to show interest in the token, despite its TVL declining

After the FTX debacle, many in the crypto-community have put their faith in DEXs. It is against this background that MakerDAO announced that it will be liquidating multiple vaults to minimize risks.

Read MakerDAO’s [MKR] Price Prediction 2022-2023

No risky business

In a tweet, MakerDAO laid out its plan to liquidate USDC-A, USDP-A, and GUSD-A vaults. This will be only done to vaults whose collateralization ratio is less than 101%.

A vault with less than 101% collateralization ratio would be considered as “bad debt” for the protocol. Even though MakerDAO’s exposure to this type of bad debt is relatively low, the MakerDAO team has decided to reduce its exposure to be safe.

Along with the aforementioned vaults, other vaults with a collateralization ratio of less than 101% would also be liquidated. In fact, according to the Twitter thread, MakerDAO will face a 1.5 million DAI loss due to the liquidation event, which accounts for less than 2% of its current system surplus.

MakerDAO also stated that this DAI debt will not pose a major threat to MakerDAO’s protocol financial health.

MakerDAO’s sustained efforts to reduce risk exposure for their users may be one of the reasons why large investors and whales were observed to be showing interest in $MKR.

According to WhaleStats, for instance, MKR was one of the most-used smart contract tokens among the top-1000 ETH whales on 24 November.

In fact, at the time of writing, Ethereum whales were holding $43 million worth of $MKR tokens.

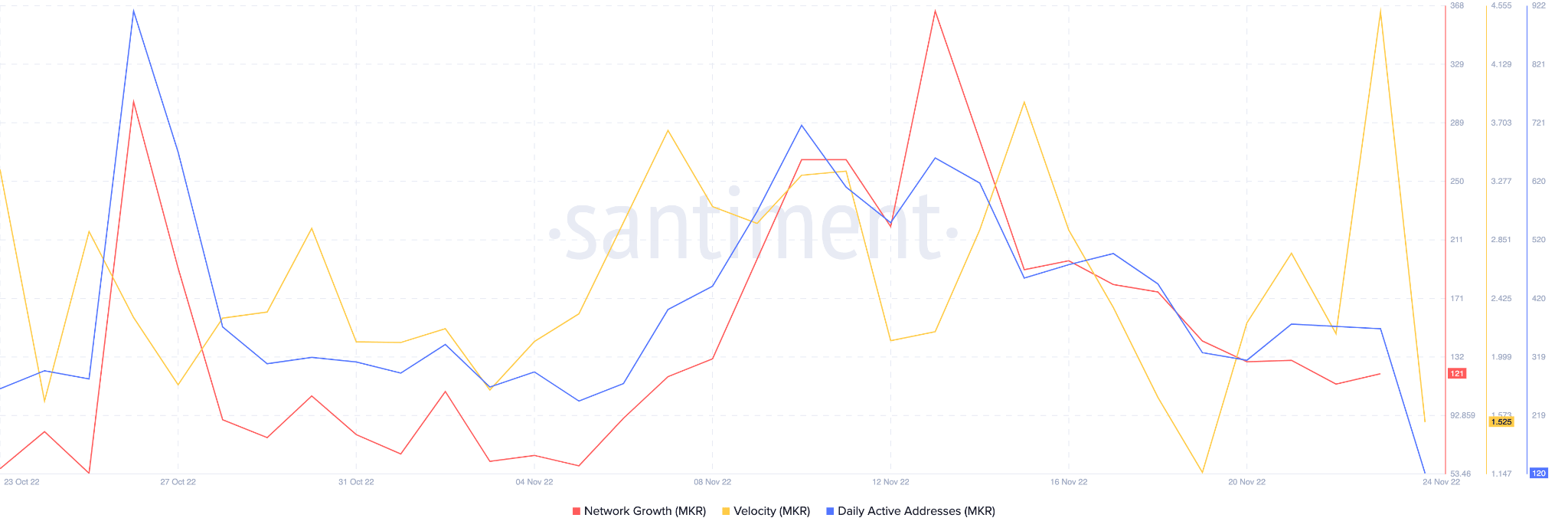

However, the activity on MakerDAO continued to decline. As can be evidenced, the number of daily active addresses depreciated significantly over the last few days. Another indicator of lack of activity is MKR’s declining velocity, which also declined during the same period. A decline in velocity indicates that the number of times MKR was exchanged among addresses decreased.

Moreover, MakerDAO’s network growth fell as well, something that implied that the number of times new addresses transferred MKR for the first time had fallen.

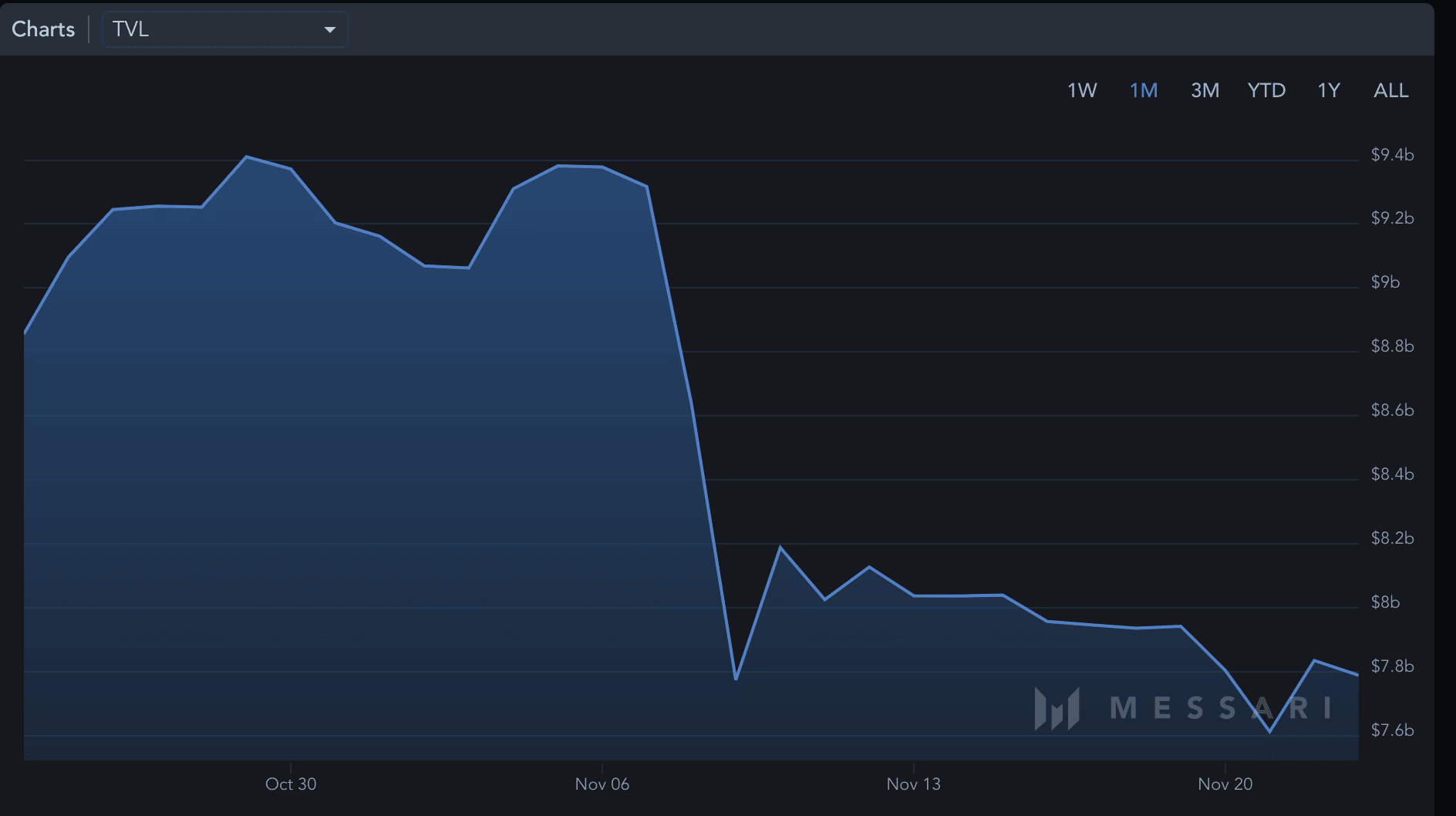

In the DeFI space, MakerDAO’s TVL fell massively.

However, the revenue generated by MakerDAO appreciated by 23.17% over the last 30 days. Also, the number of transactions increased by 200% over the same time period, according to data provided by Messari.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)