MANA’s network activity could bring forth a shorting opportunity here

Every once in a while, cryptocurrencies go through a phase where volumes contract and prices are restricted within a narrow range. Well, MANA has been stuck in this phase since June. As a consequence, it has struggled to exit its bottom range.

The altcoin has experienced very low whale and institutional activity during the contraction phase. This is often the case when cryptocurrency volumes shrink, and it is a key reason why price movements are quite limited.

Decentraland’s network

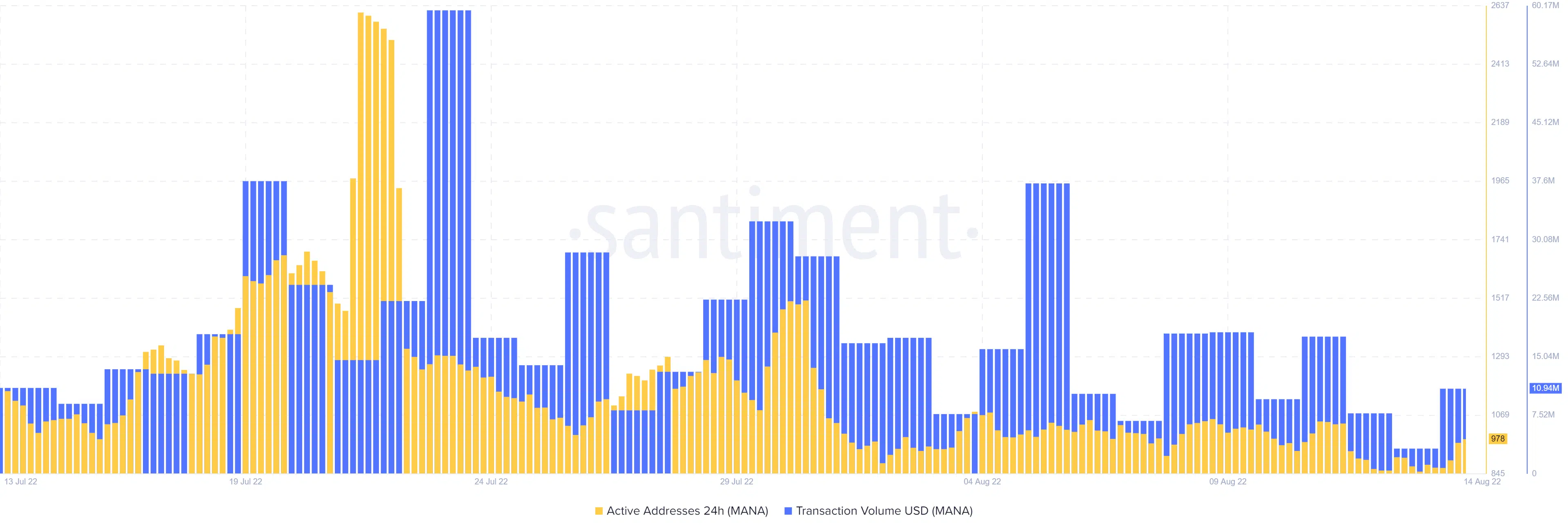

MANA’s muted performance was also exasperated by its native platform’s performance. Its transaction volumes dropped substantially in the last four weeks, peaking at 59.57 million on 27 July.

In contrast, it registered its lowest 4-week transaction volume at 3.24 million on 13 August.

The low network activity also reflected in the form of a drop in active addresses.

The latter peaked at 2,611 active addresses on 21 July and dropped to as low as 854 active addresses on 13 August.

Decentraland has been hard at work trying to boost engagement within its network.

The drop in network activity highlighted the need to boost its attractiveness as a metaverse project. Despite its shortfalls, Decentraland’s market cap is currently above $2 billion.

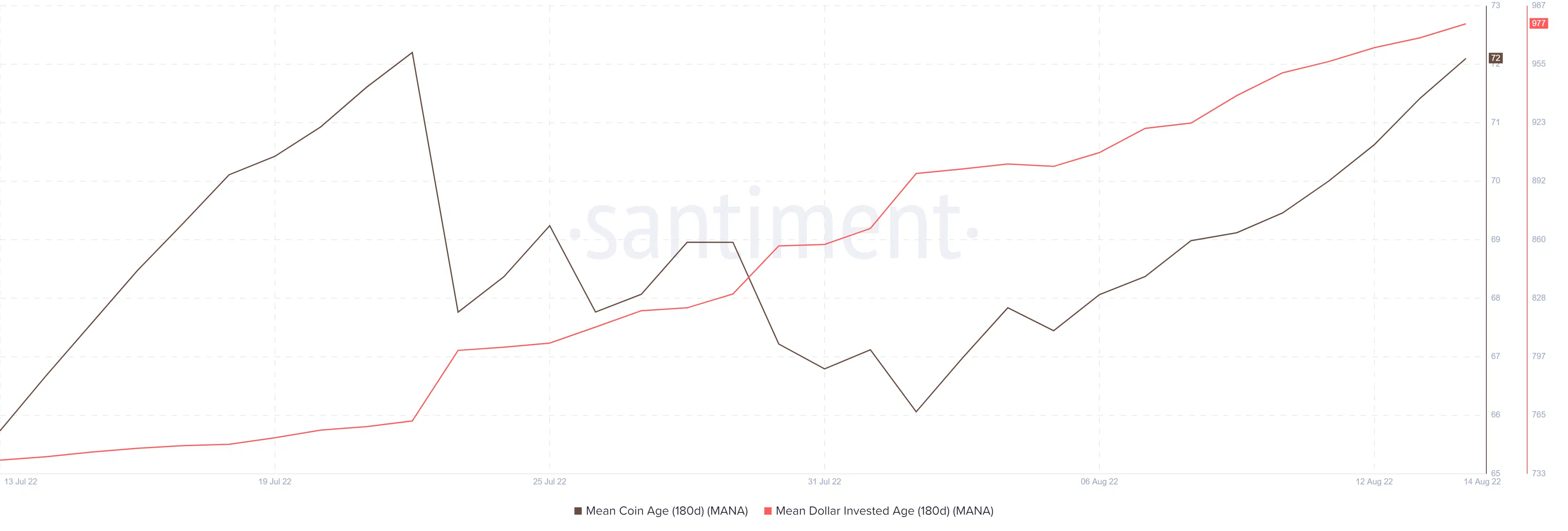

Quite a number of MANA investors are still holding on to their coins. The 180-day mean dollar invested age achieved steady growth in the last four weeks, peaking at 977.23.

There was some profit taking towards the end of June, leading to a drop in the 180-day mean coin age. However, its recovery to its press time level at 72.25 confirms that retail investors have been accumulating, and HODLing.

Why are these observations important?

It is normal for a cryptocurrency to have low volumes when network growth and organic demand are negatively affected.

That may explain the low whales and institutional demand in the last four weeks. However, most of the top coins by market cap have already experienced substantial upside, and no longer have maximum growth potential.

This means MANA will soon end up on the radar of whales and institutions looking for the next best opportunity.

Well, the token is still relatively closer to its bottom than most top coins courtesy of its limited upside.

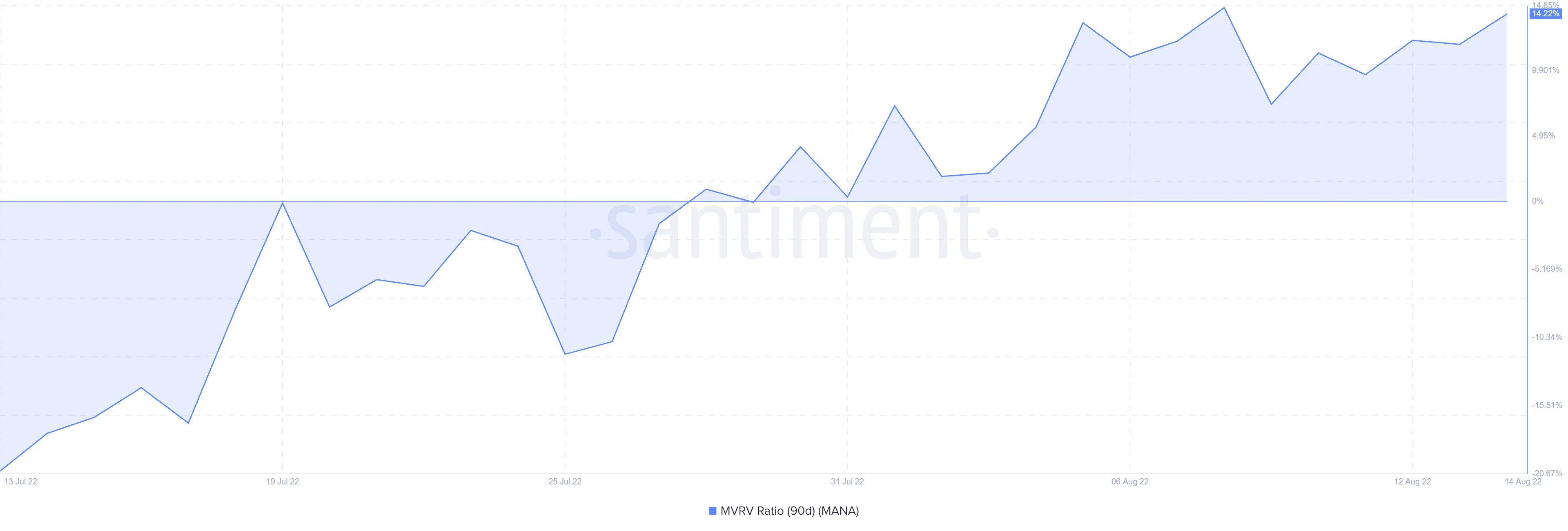

This means it has a higher growth potential to tap into. Its 90-day MVRV ratio, at press time, was at 14.22% which means some MANA holders who bought at the bottom are already in profit.

However, the numbers are still low compared to some of the best-performing top cryptocurrencies in the last month.

MANA’s heavily discounted price is still a healthy opportunity for long-term holders since metaverse development is still in its early stages.