Mapping Aave’s 2024 growth: Is $200 the next target in 2025?

- Aave broke out above the $161.21 level, and a successful retest of support positioned it for further upward momentum.

- Rising user engagement and stable liquidation levels indicated strong market sentiment and continued growth potential.

Aave [AAVE] has shown extraordinary growth in 2024, tripling its loan volume to $10B and increasing its Total Value Locked (TVL) by 26.7% to $15.96B.

Its revenue also skyrocketed by 1,628%, reaching an annualized total of $113.84M.

Despite these impressive numbers, Aave now faces critical market challenges. The question remains: can it maintain this momentum, or will external factors slow its rise?

Breaking resistance: Is Aave set to soar?

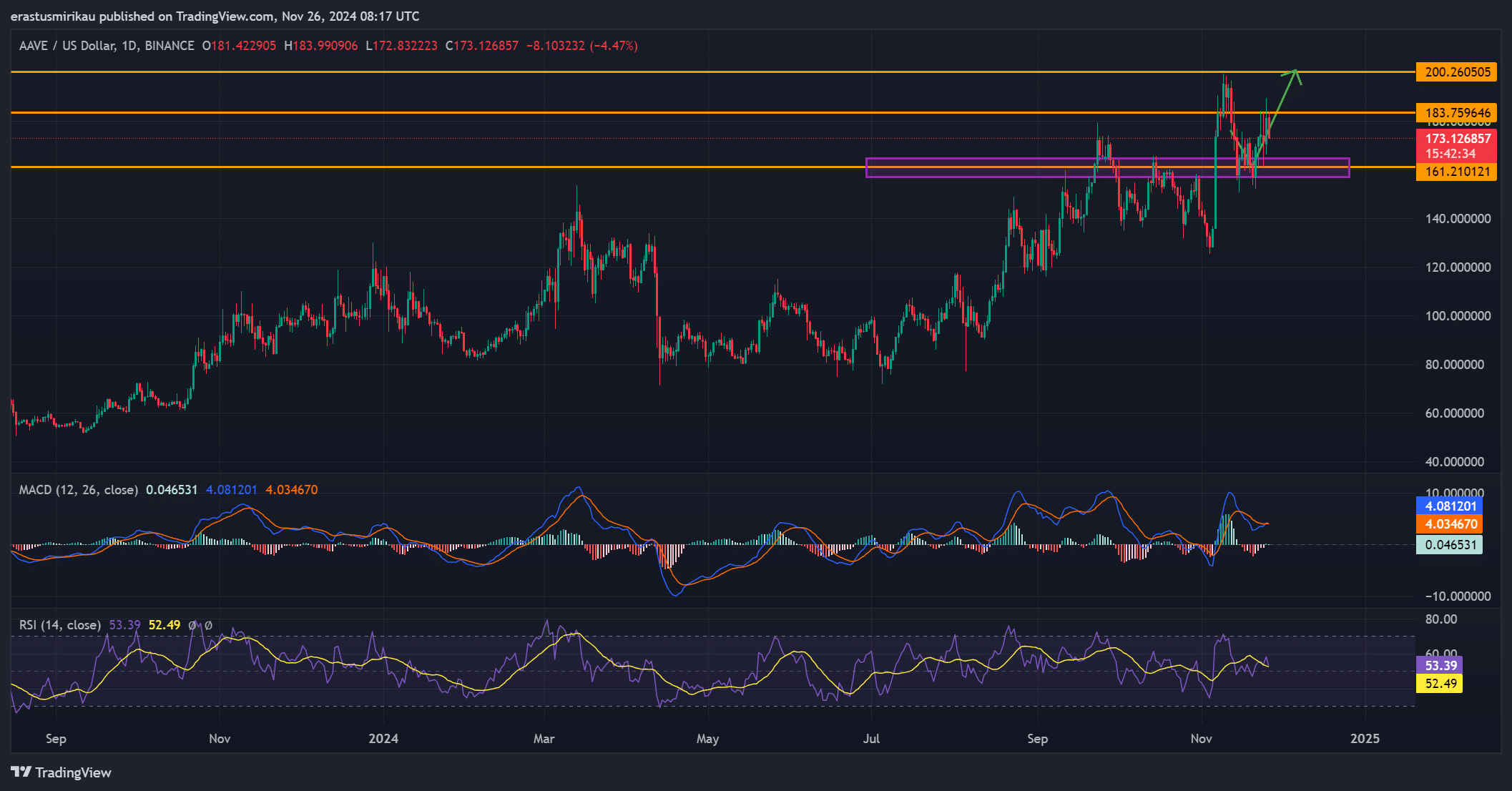

At press time, Aave was trading at $176.27, reflecting a modest 0.56% increase in the last 24 hours.

Recently, Aave broke through the key resistance at $161.21, which was a significant hurdle. After breaking this level, it successfully retested it as support, suggesting a solid foundation for further growth.

If Aave holds above $176, the next resistance point is $183.75, with $200 as the next major target.

The MACD showed a positive crossover, supporting this bullish outlook. Furthermore, the RSI stood at 52.49, indicating that Aave had plenty of room to grow before reaching overbought conditions.

Therefore, Aave is in a strong position to continue its upward trajectory.

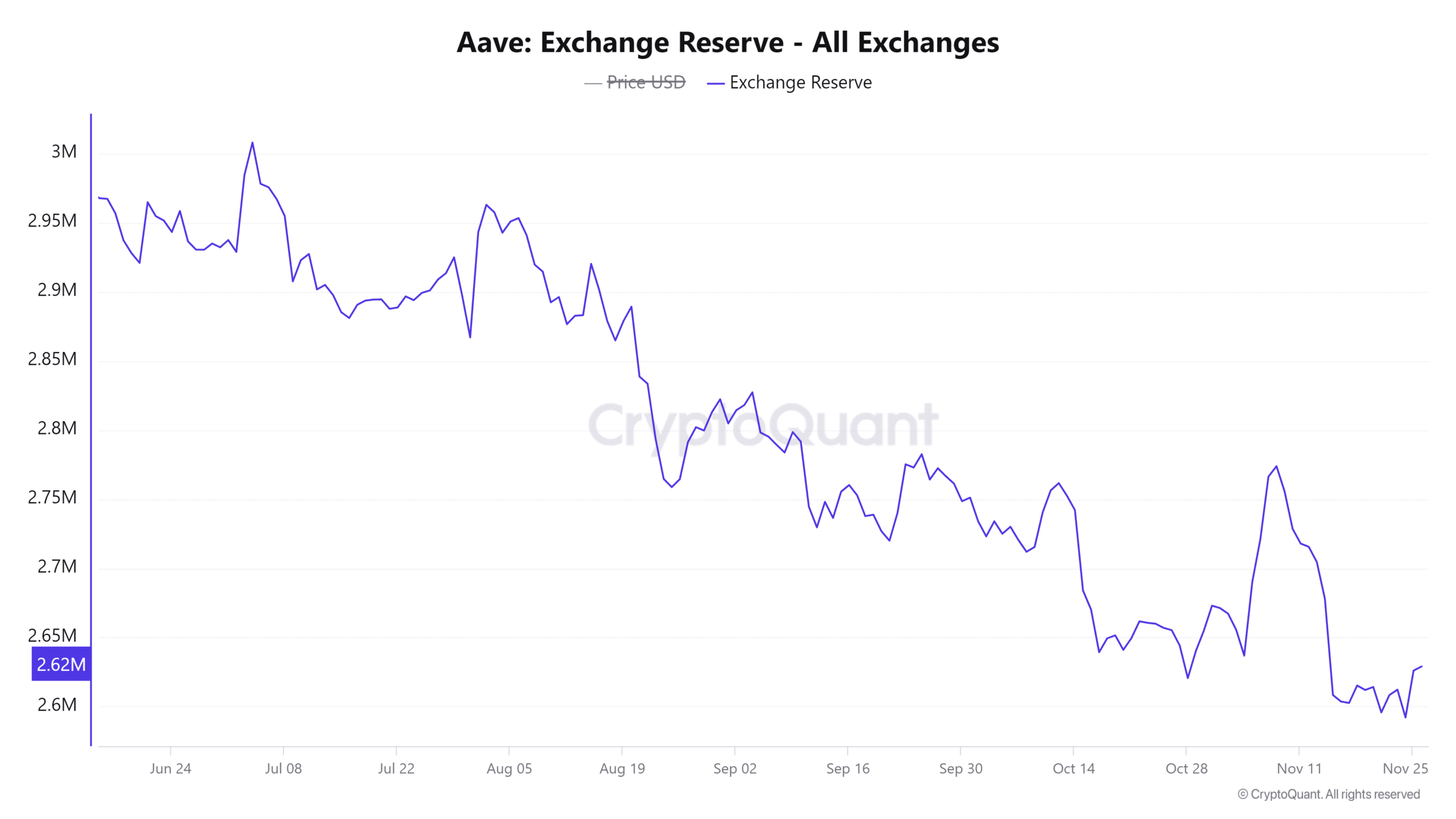

Increasing exchange reserve: A warning sign?

The exchange reserve has increased by 0.91%, bringing the total to 2.629M. This uptick pointed to a slight increase in selling pressure, as more tokens are being held on exchanges.

However, the increase is not large enough to immediately disrupt Aave’s bullish trend. Consequently, this will be a metric to monitor in the coming days.

If the trend continues, it could impact price action, but for now, it remains manageable.

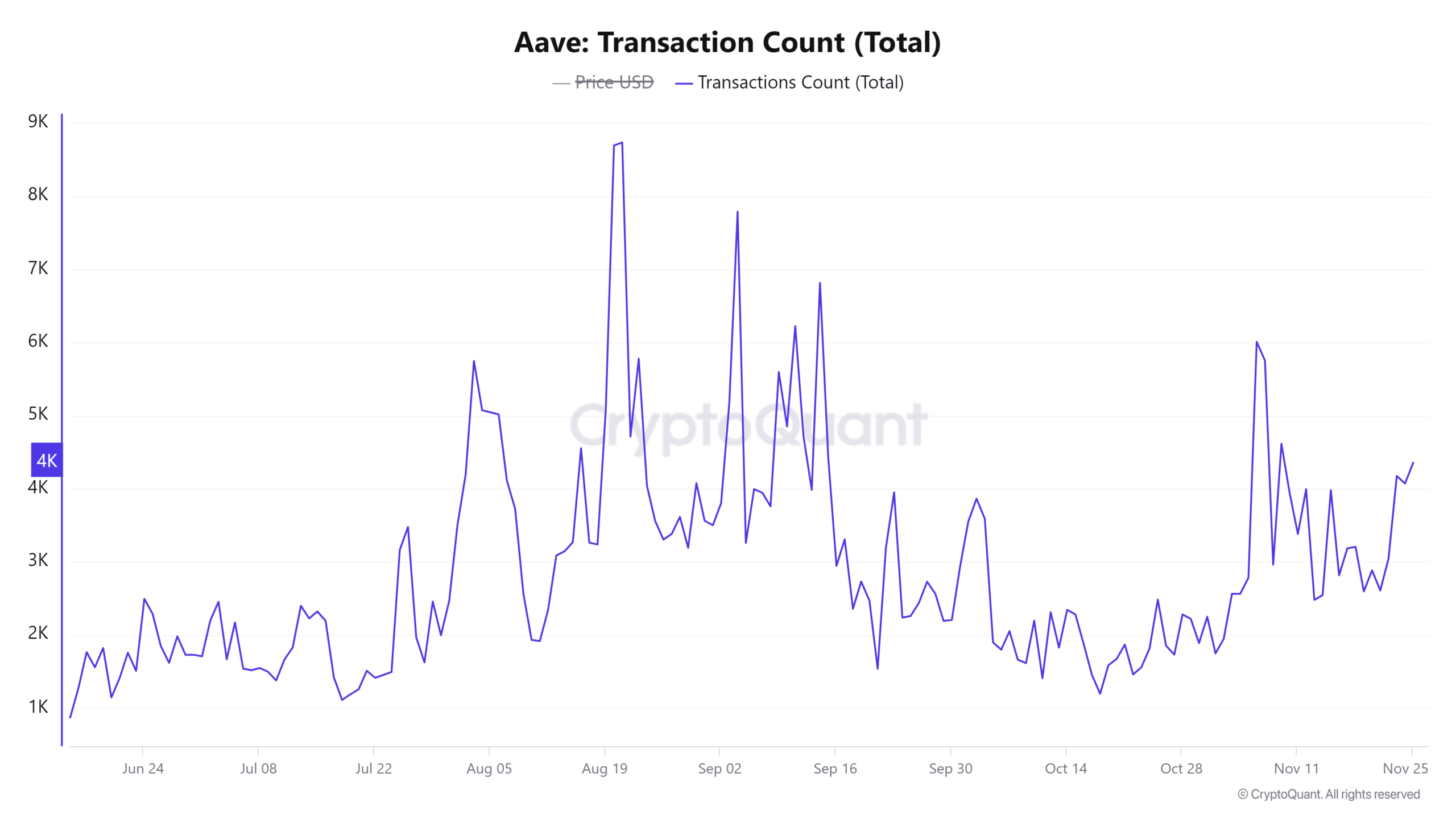

Active users and rising transactions

Active addresses have increased by 1.07%, and the total transaction count has risen by 1.03% to 4.117K transactions.

These hikes indicate that more users interacting with Aave, signaling rising platform adoption and greater activity.

Consequently, the growing user base strengthens the case for continued price appreciation.

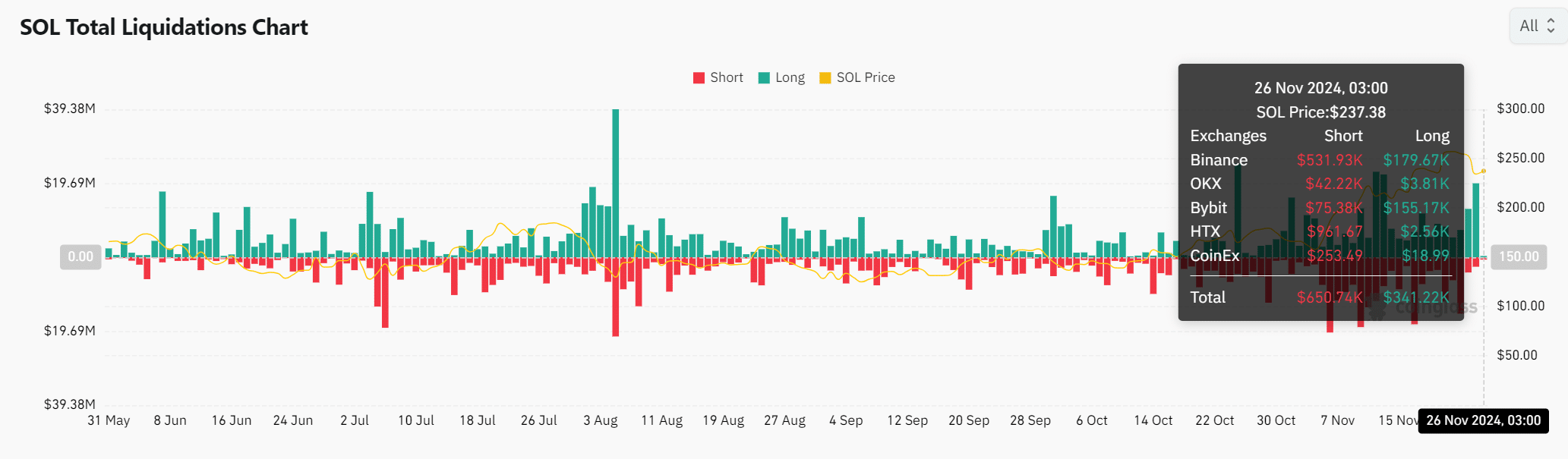

Stable liquidations: Is the market holding steady?

The total liquidations remain stable, with $650.74K in long liquidations and $341.22K in short liquidations over the last 24 hours. While these figures are within expected ranges, it’s important to monitor liquidation volumes.

If these numbers spike, it could indicate increased market volatility. However, for now, the market sentiment appears positive, suggesting that the bullish trend remains intact.

Can Aave reach $200?

The altcoin’s performance in 2024 has been impressive, and technical analysis highlighted that further gains are possible.

Read Aave’s [AAVE] Price Prediction 2024-25

The successful retest of $161.21 as support, coupled with strong indicators like the MACD and RSI, suggested it could break through $200 soon.

If it maintains support at $176 and continues its upward momentum, $200 is within reach.