Mapping AAVE’s future: Price drop now, $179 later?

- Recent figures show a decrease in AAVE’s TVL, suggesting a brief faltering in investor confidence.

- However, there’s a strong demand zone just below current levels.

In the last week, Aave [AAVE] has seen some setbacks, with a 3.64% decrease in the past 24 hours and an 11.44% drop over seven days. Despite this, AMBCrypto reports that the downturn is likely short-lived.

While a drop from its press time price of $145.19 is expected, a significant recovery is also forecasted.

AAVE investors back out

At press time, AAVE’s Total Value Locked (TVL) dropped, indicating a reduction in investor trust and confidence in the asset.

TVL, which measures the total assets held in decentralized finance (DeFi) protocols, is essential for assessing the health and growth of the DeFi sector. It tracks the value staked, lent, or locked within these platforms.

With a 4.93% decline in AAVE’s TVL over the last week, bringing its value down to $82.71 billion, it’s clear that investors are pulling back.

However, analysis suggests this retreat is temporary, as the TVL’s position on the chart appears neutral, indicating stability may soon return.

Moreover, despite the withdrawal, trading volume has surged by 33.62% in the past 24 hours. This increase shows active selling but doesn’t point to a significant long-term downturn.

What’s next for AAVE?

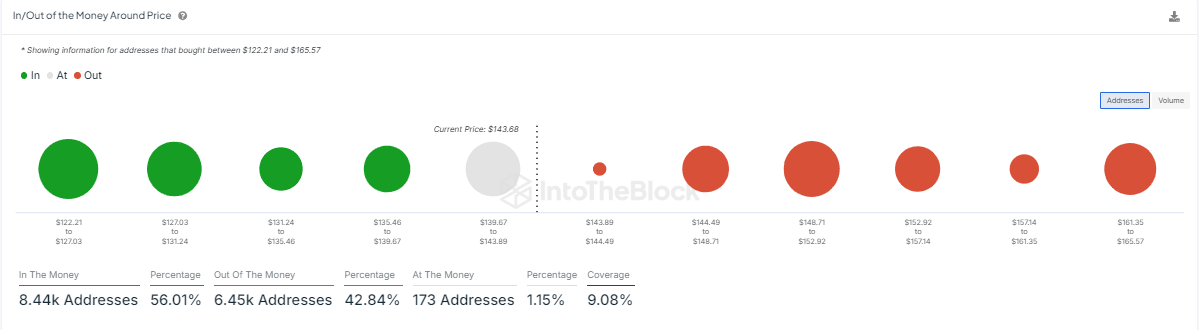

AMBCrypto, using IntoTheBlock’s “In and Out of Money Around Price (IOMAP)” data, identified that AAVE’s press time price of $145.19 was trading within a critical supply zone.

This zone, between $144.49 and $148.71, hosted a large liquidity cluster of 383.75k AAVE, which could drive the price further down due to increased selling pressure.

The analysis points to a key demand level between $135 and $128 on the daily chart, where the price might find support.

For a more targeted entry, IntoTheBlock pinpointed $134.31 as an ideal zone due to the substantial buy orders — 958.29k AAVE — present.

Should the price reach this level, it could trigger a rebound with potential targets at $154, $164, and $179. These are the key levels to watch for signs of a price recovery.

Market distributes AAVE

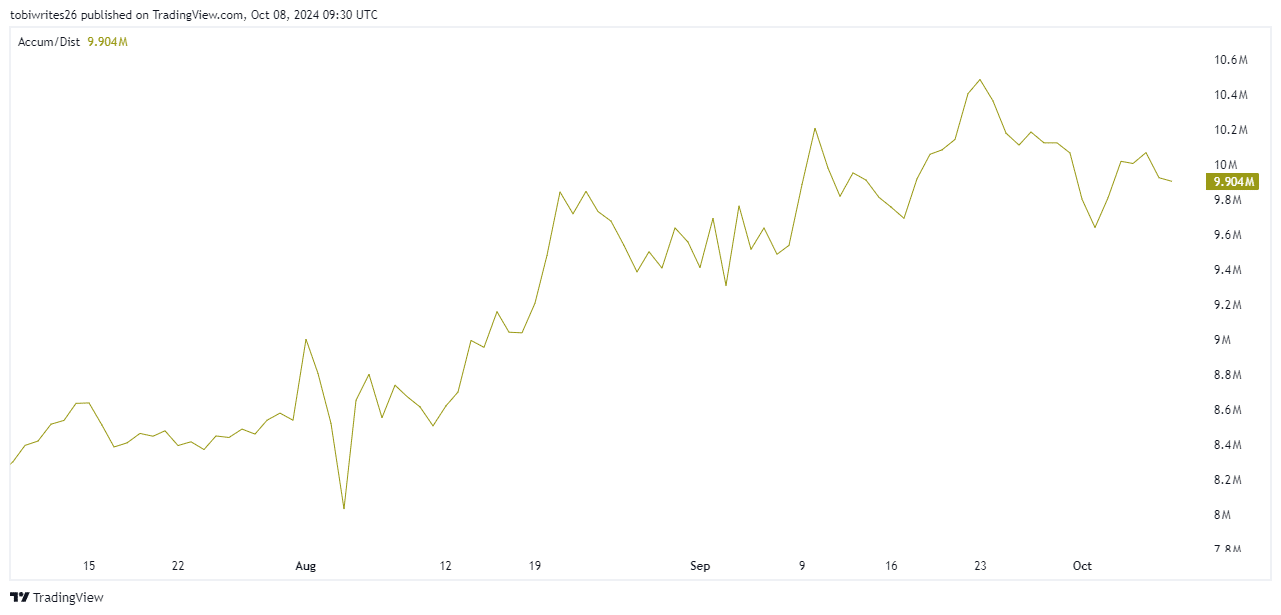

The expected decline in AAVE is evident with the use of accumulation and distribution technical indicators that track whether investors are buying or selling.

Read Aave’s [AAVE] Price Prediction 2024–2025

Currently, the indicator is slightly tilted downward, indicating there is ongoing distribution and mild selling activity.

If this trend continues, AAVE is likely to keep falling until it reaches the $134.31 level, where a rebound is expected.